Bitcoin Flash Crash Causes $710 Million In Crypto Long Liquidations

Data shows that the cryptocurrency derivatives market has suffered massive liquidations in the past 24 hours following the Bitcoin flash crash.

Bitcoin Witnesses Big Volatility in Last Day

BTC has shown some wild price action over the past day, seeing highs of $103,500 and lows of $90,500 within a narrow window. Especially when it reaches the latter level, its movements are so violent that it can be described as “earth-shaking”. flash crash.

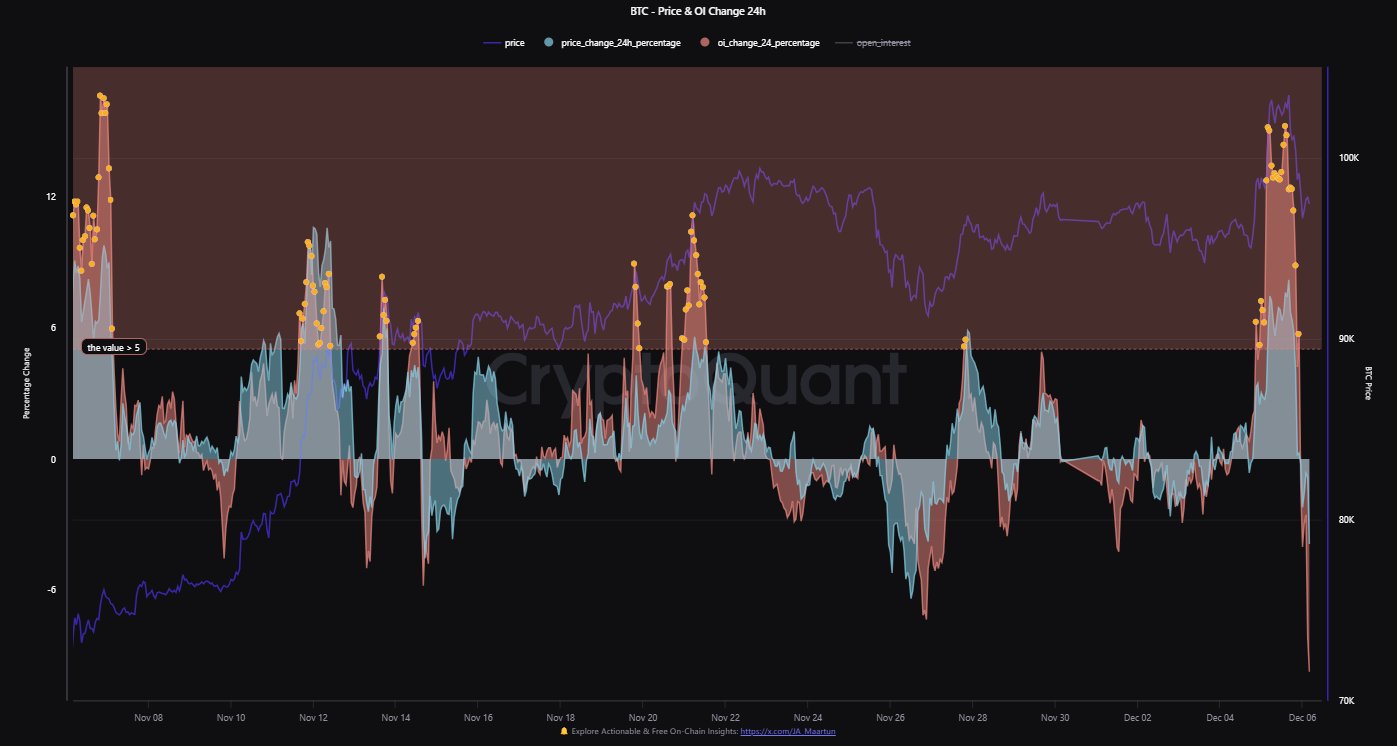

The chart below shows the asset’s recent trajectory.

As you can see from the chart, the sharp red candle only lasted a short time as the cryptocurrency quickly rebounded back to higher levels. Following the recovery, the coin is trading around $98,000, which means it is still down around 5% since the top.

As is customary, other top digital assets have followed BTC in bearish price action, but assets like Ethereum (ETH) and Solana (SOL) have proven to be more resilient as their prices have fallen just 2% over the past day.

The latest market volatility means chaos on the derivatives front in the cryptocurrency space.

Cryptocurrency bulls just witnessed a liquidation crunch

According to data coin glassthe cryptocurrency derivatives market took a massive hit liquidation Because asset prices across the industry have experienced dramatic fluctuations.

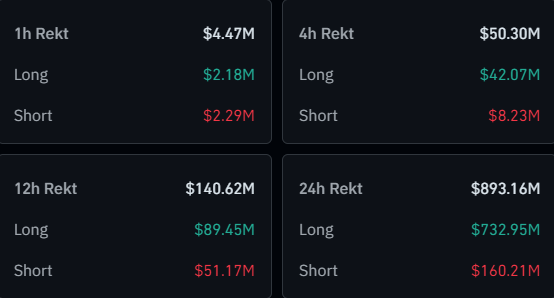

As the table above shows, a whopping $893 million worth of cryptocurrency derivatives positions were liquidated in the past 24 hours. When a contract suffers a certain level of loss and the exchange forcibly closes the contract, the contract is called “liquidation.”

Nearly $733 million of the liquidation involved long contracts, accounting for 82% of the total. This sharp dominance by the bulls is naturally a result of the net bearish action experienced by Bitcoin and other currencies.

Large-scale liquidation events like the recent one are often referred to as “squeeze”. Because bulls accounted for the majority of this squeeze, it’s called a bull squeeze.

The bull squeeze the derivatives industry just suffered may be the obvious conclusion to the red-hot market conditions that preceded it. As CryptoQuant community analyst Maartunn noted in X postalopen interest surged as Bitcoin surged.

Generally speaking, whenever derivatives positions explode during a rise, it means the rise is leverage-driven. This type of price movement can settle in an unstable manner.

In the most recent Bitcoin run, open interest increased by over 15%, which is considered a very impressive number. When the price reversed, all those leveraged longs got caught in the squeeze, which only provided further fuel for the collapse, explaining its particularly violent nature.