CryptoQuant CEO Warns Not To Short XRP Due To Insider Whales

XRP has experienced an extraordinary surge in recent weeks, with its price soaring by 380% in the past 23 days. In the past four days alone, the price has increased by 75%, reaching a peak of $2.87 on December 2. This rapid rise appears to be driven by heavy buying activity by large investors, commonly known as “whales.”

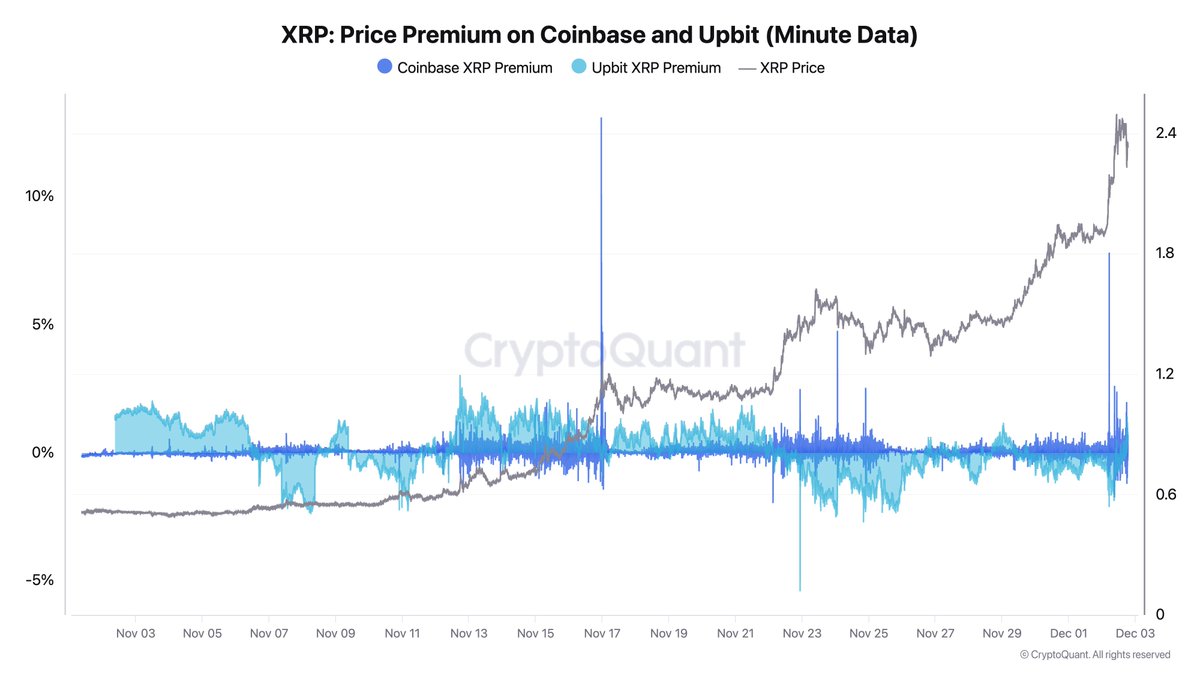

Ki Young Ju, CEO of on-chain analytics company CryptoQuant, Highlight These whales primarily operate through the US exchange Coinbase. On December 2, he noted that “Coinbase whales are driving XRP higher,” noting Coinbase’s minute-by-minute price high quality Gains during the surge ranged from 3% to 13%.

In contrast, Upbit, a South Korean exchange with more XRP investors than Binance, did not show a significant premium, suggesting that buying pressure came primarily from the United States.

Ki Young Ju hinted on his alt-X account (@kate_young_ju) that there may be insider activity affecting market dynamics, saying, “Someone knows something.”

Related reading

Today, he warn Traders object to shorting XRP. “Shorting XRP right now seems risky to me. Depositing $25B in XRP before the pump might look like market manipulation, but it could also just be front-running. This insider whale might know something very bullish about XRP ,For example Spot ETF Approval,” he speculated.

He further shared a chart “XRP: Retail Activity (Spot and Futures) on Surge in Trading Frequency” which shows that XRP’s retail trading activity has surpassed its 2021 highs and is approaching January 2018 levels, At that time XRP reached an all-time high. All-time high $3.92.

Related reading

After looking at the one-year cumulative volume delta (CVD) of taker buy/sell volume, he said: “The one-year cumulative volume delta of XRP taker buy/sell volume shows historic Rally. Whales are actively taking advantage of market orders, driving overwhelming demand.”

Is XRP about to rally 700% against BTC?

From a technical analysis perspective, crypto analyst Jacob Canfield emphasized the importance of examining the XRP/BTC pairing. he notes XRP is currently in a key resistance zone on the BTC pair chart (XRPBTC), with the USDT pair just reaching $2.75 levels, a resistance point since December 2019.

Canfield said a breakout here could signal a possible 240% return to key resistance areas in 2017, 2018 and 2019. Bitcoin,” he commented, acknowledging that “XRP had the strongest two monthly candles we have seen in 5 years. “

Considering the shorter time frames of the XRP/USD currency pair, Canfield Highlights Use support and resistance levels to identify new entry points on these time frames. “In a bull market, you need to use low time frame support/resistance to find new entry points. 5 minutes/15 minutes are best. Take XRP for example – $2.20 is a clear S/R failure. Maximum green candle The Bottom = The Bottom of a Pulse is usually the best place to re-enter the trade.”

At press time, XRP was trading at $2.63.

Featured image created using DALL.E, chart from TradingView.com