Ethereum Must Reclaim $2,050 To Start A Recovery Rally – Insights

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

The price of football for the Lions and players is a bit soft. Every arcu lorem, super kids or ullamcorper football hatred.

Ethereum (ETH) is now trading below the crucial $2,000, trying to find momentum after sales pressure and merger days. The wider crypto market remains under severe bearish control, with ETH losing more than 57% of its value, making it increasingly difficult for the Bulls to recover.

Related Readings

Now, as Ethereum is now below its multi-year support level, the region could become strong resistance, complicating any potential rebound. The market is in a highly volatile phase and traders are paying close attention to signs of strength or further downside risks.

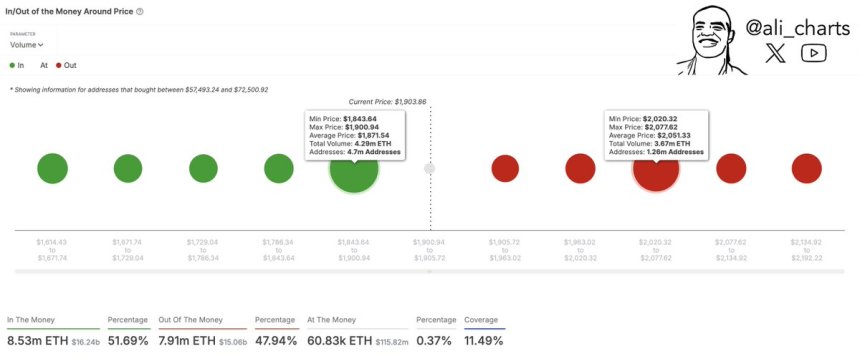

On-chain data highlights two key price levels of Ethereum’s direct trajectory. $1,870 is currently its key support; at the same time, $2,050 is now its most challenging resistance, and it is the main obstacle that ETH must recycle to confirm a trend reversal.

at present, Ethereum is still fragileuncertainty drives price action. ETH may see further declines if the Bulls are not defending their current support, but successful resistance can re-confidence in the market. The next few days are crucial to determining the short-term direction of ETH.

Ethereum faces critical testing as the Bulls struggle to recoup $2,000

Ethereum is at a critical turning point, with its lowest level since October 2023 approaching its lowest level as the bear maintains control. After weeks of sales pressure and uncertainty, the Bulls must recover $2,000 as soon as possible to prevent further shortcomings and restore market confidence.

Related Readings

The broader macroeconomic landscape remains uncertain, with fear of the trade war and global financial instability hit hard both in crypto and in the U.S. stock market. These factors lay the foundation for potential deeper corrections and put investors on the edge. However, some analysts believe that market recovery can still take place in the coming months, especially if Ethereum can recover key resistance levels.

Top analyst Ali Martinez Shared chain metricsdetermine $1,870 as Ethereum’s strongest support level. This means that if ETH breaks through this area, it may drop further. On the bright side, $2,050 is now Ethereum’s most challenging resistance and a key obstacle that the Bulls must overcome.

If Ethereum successfully recovers $2,050, it will mark a strong trend reversal, potentially laying the foundation for a strong recovery rally. The next few trading sessions will be crucial as ETH must maintain its position or risk adversely, while investors closely monitor price action.

Bulls must hold above $1,900

Ethereum at present Trading price is $1,920the following Critical $2,000 combined days. although Try to push higher,bull Try to regain the lost groundleave Eth In a vulnerable position.

To confirm the recovery, ETH must exceed $2,000’s score and push up the 200-unit average (MA) and exponential moving average (EMA) over 4 hours to about $2,400. The successful retraction of these levels will indicate repurchase momentum, potentially laying the foundation for strong gatherings towards higher resistance areas.

But if Ethereum fails to recover these levels, sales pressure could intensify, pushing ETH to around $1,750 in lower demand areas. A breakdown below this level will put more pressure on the bulls, which may lead to further disadvantages and prolong bearish sentiment.

Related Readings

As market conditions remain fragile, the short-term direction of ETH remains uncertain. The Bulls must step in as soon as possible to defend the critical level, or Ethereum risk losing further stance, making it more difficult to recover quickly. The next few days will be crucial as ETH traders pay attention to responding to broader market trends, pay attention to breakouts or further downward movements.

Featured images from DALL-E, charts from TradingView