Bitcoin And S&P Decline Together, But Data Predicts A Turnaround

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

The price of football for the Lions and players is a bit soft. Every arcu lorem, super kids or ullamcorper football hatred.

Bitcoin is not the only one suffering. Investors are becoming increasingly concerned as flagship cryptocurrencies recently fell after the S&P 500 index. But if there are any signs of past performance, Bitcoin It may be experiencing a revival.

Related Readings

U.S. President Donald Trump served in his second term in November, but U.S. stocks have fallen about 10% since then. This is the worst start to the US presidency since the tough market in 2009. Although there are many reasons for this decline, uncertainty in economic strategies and concerns about inflation contributed.

In the past, when the S&P 500 and Bitcoin fell at the same time, it usually indicated impending volatility. The bear market in 2022 suffered continuous losses, which are both markets falling sharply at the same time. However, not all declines lead to long-term recessions. Some have led to a significant rebound, especially since the cryptocurrency halving cycle.

How did the market react to Trump’s second term?

The S&P 500 has fallen 9% since his return, the worst start to the presidency since 2009.

At that time, the recession drove the decline. This time, uncertainty is in the driver’s seat.

Let’s study the data 🧵👇 pic.twitter.com/a10f0qtweb

– cryptoquant.com (@cryptoquant_com) March 12, 2025

Bitcoin and stocks move together – Now

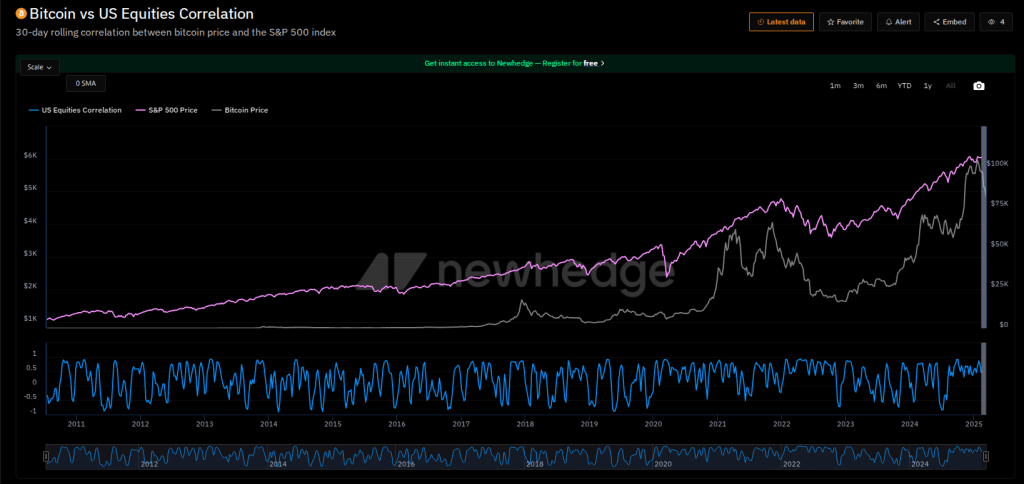

Bitcoin has long been called “digital gold”, but now it functions more like technology stocks. according to Crypto ResearchBitcoin’s price has tracked traditional markets, especially the S&P 500 S&P 500. This model is not new. During the 19th March 2020 pandemic, cryptocurrencies fell together with stocks and then recovered later in the year.

But intotheblock analysts found Bitcoin relation The S&P 500 index fell to essentially zero. This suggests that according to the long-term holder model, BTC began to migrate outside of regular finance.

If this decoupling continues, the movement of Bitcoin price may rely less on changes in the stock market.

Historical trends indicate recovery

According to CryptoQuant, previous data suggests that Bitcoin often rebounded after the correction is strong. For example, in 2018, Bitcoin lost about 80% of its value before it recovered in 2019. Similarly, Bitcoin hit a fresh high in 2021 after the collapse in 2020.

Another statistic to focus on is the Coinbase Premium Index, which measures the difference in Bitcoin prices between Coinbase and Binance. When the indicator becomes negative and returns to the positive area, it usually indicates an upcoming price rebound.

Related Readings

Caution and optimism among analysts

Meanwhile, market analysts remain split. Some warn that Bitcoin’s recession may indicate that overall stock market rise is Not sustainable. Sevens Report Research co-editor Tyler Richey said Bitcoin’s poor performance compared to its January peak could be a warning sign for stocks.

Featured images by Gemini Imagen, charts by TradingView