TRUMP Token Takedown—Did Insiders Plan the Crash?

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

The price of football for the Lions and players is a bit soft. Every arcu lorem, super kids or ullamcorper football hatred.

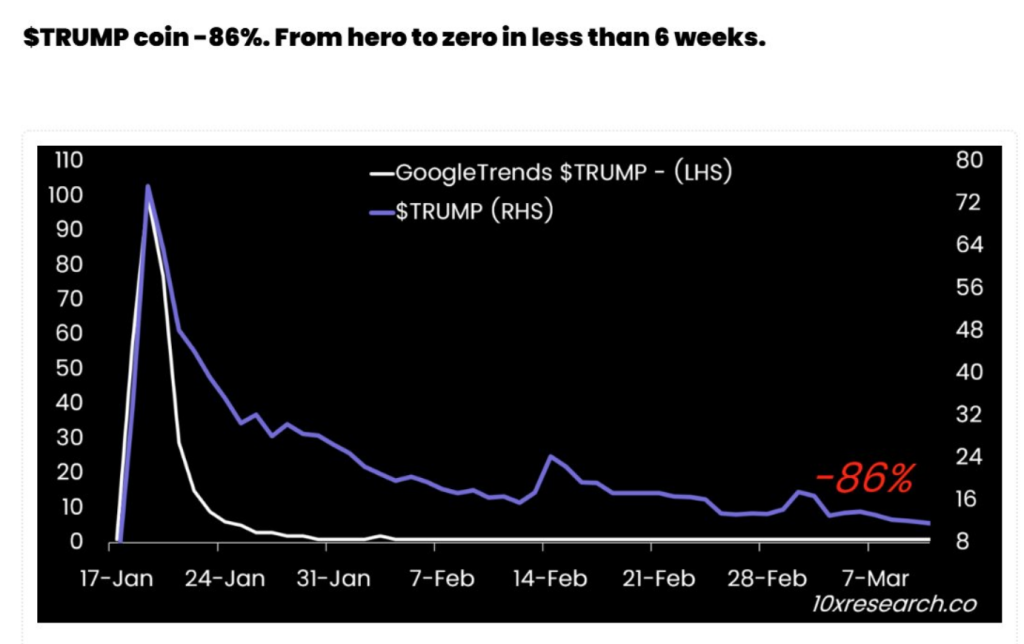

Official Trump tokens, designed to honor the second president of U.S. President Donald Trump, took immediate blows when they were launched. The token soared from less than $10 on January 18 to a high of $74.59 on January 20, and then quickly surrendered some gains in a few hours.

Although the tokens remained competitive for the days after the president’s inauguration, the transactions above were over $30 but quickly disappeared under pressure. trump card It fell below $20 on February 2 and is now trading at $10.

Related Readings

Observers say the broader crypto market and Trump’s tokens are collapsing. But Trump’s collapse is not without controversy – 10 times research reveals “internal play” before the coin drops heavily. While most traders lost billions of dollars in crashes, a large number of early investors made a lot of profits.

Early investors cash out before large-scale exchange listing

according to 10 times studymost early investors cashed out before the big exchange listed coins because they were worth more than $60 and briefly reached $70. Everyone welcomed the rapid price increase of coins, and early investors won the best seats in the house. After a rapid rise, Trump suffered a huge decline. Starting at a low price of $20, it trades for $10, with the retail industry and small merchants causing losses.

this $Trump Garbage ground: When hype gradually disappears, reality hits

👇1-4) An obvious example is $Trump Coins, insiders and people who have early access at Washington crypto dances can buy them in public, while communications is eager to list the tokens as it soared by $60. short… pic.twitter.com/pvzlcvbl0m

– 10x Research (@10x_research) March 11, 2025

The losses associated with the fall in Trump’s price are reminiscent of previous bearish cycles, including the 2021 NFTS boom and bust. With the Trump token, that value dropped significantly in a week. By looking at the bigger picture, Trump’s tokens have accounted for more than 80% since their peak in January last year. Data on the chain suggests that early investors quickly liquidated their positions, retail and small businessmen used as pawns.

Solana Chain takes a hit

The Solana ecosystem is one of the biggest losers in token crashes. In addition to Trump, some other Solana-based tokens are under sales pressure, including Raydium’s Ray token, which fell 60% last month.

Even Solana’s local token, sol, Reduced by more than 40% During the same period. The decline in the value of SOL-based tokens suggests that interest in meme coins or speculative tokens is declining.

The pump also saw dramatic changes

Another leading meme coin platform pump. It also witnessed a dramatic Decline of network activity. Over the past year, the platform has processed 8.4 million meme coins, reaching its peak before Trump’s inauguration.

Related Readings

From Christmas to early January, up to 1.7 million meme tokens were released on Pump.Fun. However, the daily launch dropped on pump.fun. In addition, participation rates have also declined on the platform, reflecting a decline in interest rates in the asset class.

Featured images from Newsweek, Charts from TradingView