Bitcoin’s ‘Ugly Start’ – Weekend Sell-Off Pushes Price Near $80K

Bitcoin hit again on March 10, retreating to below $82,000 and emitting tremors in the cryptocurrency market. After weeks of good returns, the latest loss of value for the world’s highest digital asset is. At present, traders are not sure whether this is just a temporary ic or the more important correction is the beginning.

The important level of monitoring

Arthur Hayes, chief investment officer of Maelstrom and co-founder of Bitmex, expects Bitcoin to face $78,000 resistance. He described Bitcoin’s frustrating performance as “Ugly Start” a Week.

Hayes suggests that if the price is Bitcoin It cannot be normal at this level.

An ugly start to the week. look like $ btc Will be retested for $78K. If it fails, the next one in the crosshair is $75K. $70-$75K has a lot of options, and if we get into that range, it would be violent. pic.twitter.com/q4cq0rthgj

— Arthur Hayes (@cryptohayes) March 9, 2025

Investors expressed concerns about the decline, especially those who have just joined the market. Market Analysis Company 10X Research describes DIP as a “classic correction.” The company also revealed that traders who bought coins in the past 12 weeks have created about 70% sales pressure. New investors’ panic sales could make volatility worse.

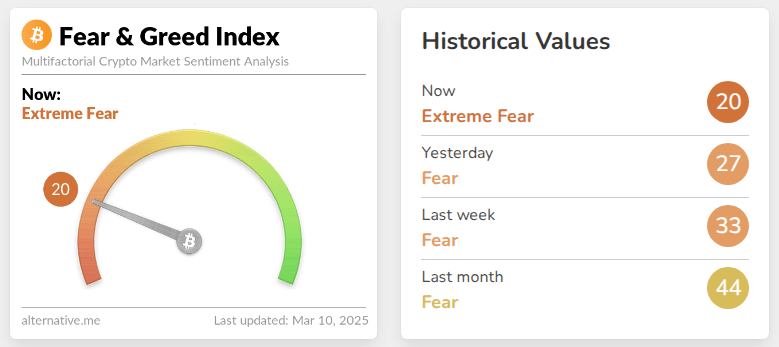

Status: Extreme fear

Emotions have changed dramatically. Bitcoin’s Fear and Greed Index hits a 20 reading and shows it has fallen into “Extreme fear.” This is in stark contrast to the optimism of the past few weeks. Such low ratings usually indicate that traders are nervous, which may lead to shorter price volatility.

Meanwhile, data suggest that most Bitcoin choices range between $70,000 and $75,000. As Bitcoin approaches these levels, traders can change their positions, which will create more volatility.

Upcoming inflation data may affect prices

Upcoming US inflation report It is possible to significantly affect Bitcoin’s subsequent actions. Investors are paying close attention to the U.S. Federal Reserve’s monetary policy, as any sign of a stricter or looser financial position could affect Bitcoin’s price pathways.

A surge in inflation that exceeds expectations may increase the likelihood of additional interest rates, which may put pressure on risky assets and Bitcoin. Instead, a decline in inflation may alleviate market volatility and promote stability.

The road ahead of cryptocurrencies

At the time of writing, traders focused on monitoring $78,000. Successful maintenance above this level may increase confidence, while breakthroughs may result in additional losses. As Bitcoin continues to grow as an asset, sharp moves like this become increasingly common.

Featured images by Gemini Imagen, charts by TradingView