330,000 Ethereum Withdrawn From Exchanges In 72 Hours – Supply Squeeze Incoming?

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

The price of football for the Lions and players is a bit soft. Every arcu lorem, super kids or ullamcorper football hatred.

With the overall cryptocurrency market trending downward, Ethereum has faced huge sales pressure and volatility over the past month, pushing ETH to a critical level of demand. As uncertainty dominated the market, traders remain cautious as Ethereum struggled to regain lost stance.

Related Readings

Analysts are expected to have more volatility after U.S. President Donald Trump’s executive order, which builds strategic bitcoin reserves. While the announcement is expected to boost market sentiment, it introduces more uncertainty that leaves investors uncertain about its long-term impact on the cryptocurrency space.

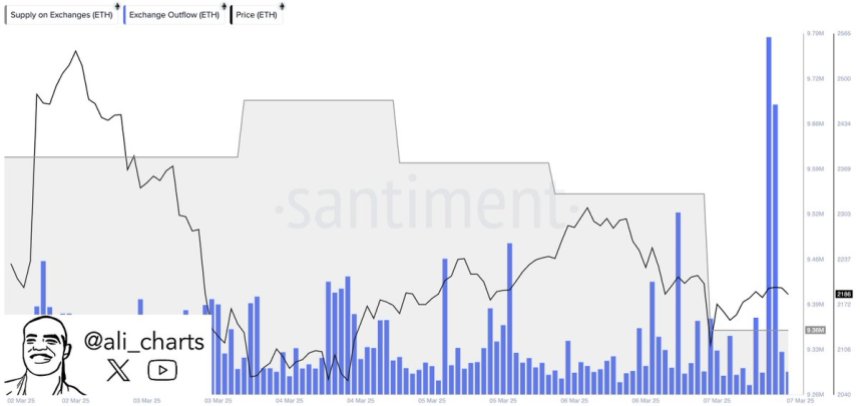

Despite the continued decline, the chain chain data in Santiment suggests a bullish signal – 330,000 Ethereum has been withdrawn from the exchange in the past 72 hours. Such a large outflow often indicates that investors are transferring ETH into private wallets, indicating reduced sales pressure and possible long-term accumulation.

As Ethereum hovers at key support levels, the next few days are about determining whether or not Ethical stability Or face further disadvantages. Ethereum may see a strong recovery if market sentiment improves and exchange outflows continue. However, if sales pressure persists, the other leg is still possible, keeping traders highly alert.

Ethereum faces major tests

Ethereum has lost more than 50% of its value since late December, triggering fear and panic sales across the market. Once the main force at the Crypto rally, ETH is now working to regain momentum, causing investors to question whether the long-awaited Altseason will be achieved this year. Many analysts speculate that as Ethereum and most altcoins continue to work hard, they cannot regain the background or establish a clear recovery trend, so they won’t.

Despite bearish sentiment, there is hope for a rebound, as chain data suggests a potential bullish catalyst. Shared by Ali Martinez Data shows that 330,000 Ethereum has been withdrawn from the exchange in the past 72 hours. This important outflow could indicate that investors are transferring ETH to private wallets, alleviating immediate sales pressure and potentially laying the foundation for supply compression.

When the available supply on the exchange is reduced, supply compression occurs, which makes it more difficult for sellers to drive price reductions. If Ethereum continues to maintain critical demand areas and increase purchasing pressure, the reduced exchange supply could promote a strong recovery at higher price levels.

Related Readings

Currently, traders are paying attention to whether ETH can stabilize and recover key resistance levels. If the Bulls recover power, Ethereum may start to recover from trends in the coming weeks. However, if sales pressure persists, another downward movement remains a possibility to put the market on the edge. The next few days will be crucial to determine the short-term direction of Ethereum and whether the recent exchange withdrawal marks a turning point for ETH.