Bitcoin Uptrend Soon? Dollar Index Breakdown Sparks Optimism Among BTC Bulls

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

The price of football for the Lions and players is a bit soft. Every arcu lorem, super kids or ullamcorper football hatred.

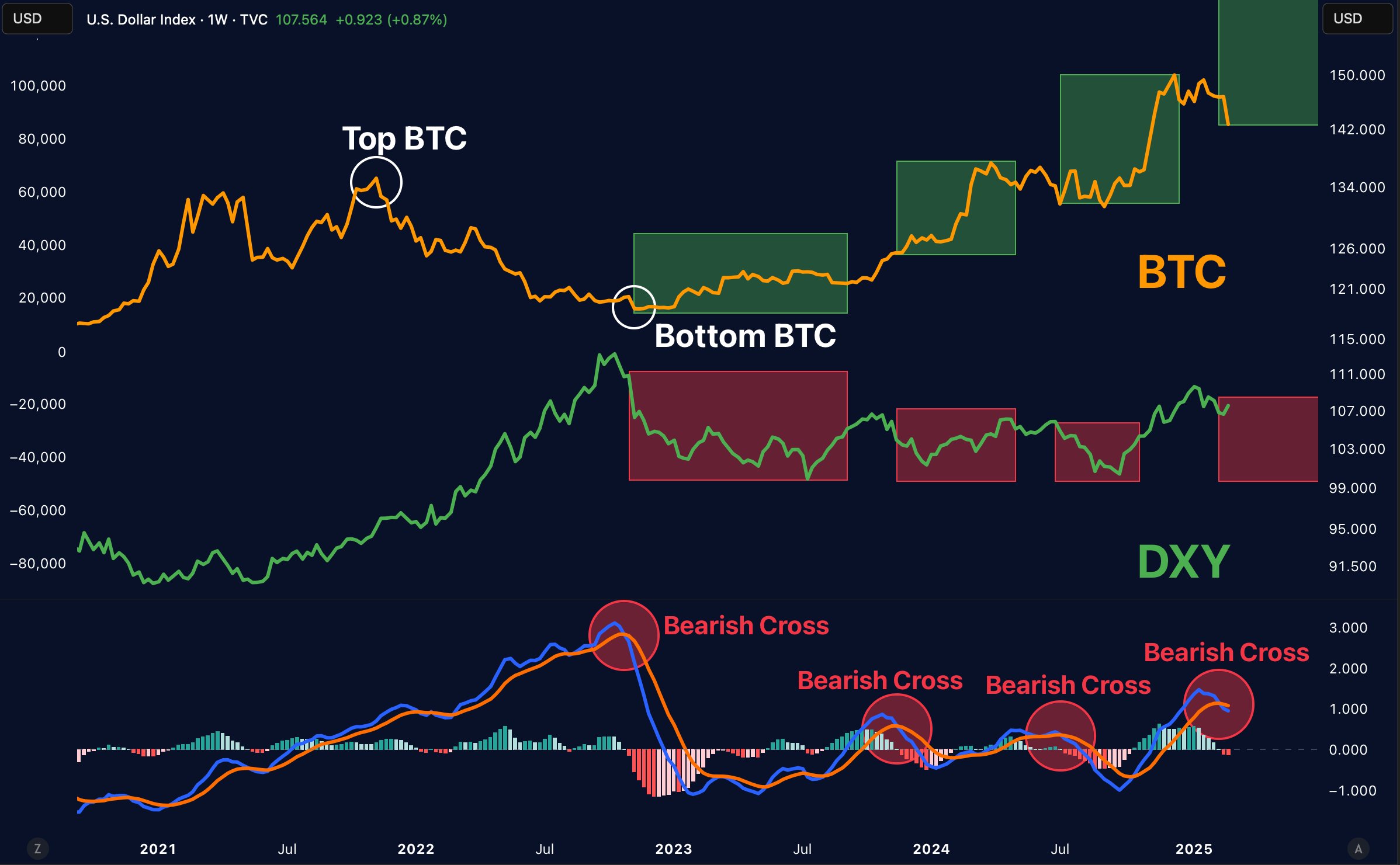

The US dollar index (DXY) is Experience One of the biggest weekly declines since 2013 has exacerbated optimism about potential gatherings in risky boarding assets, including Bitcoin (BTC). The last time DXY saw such a sharp callback was during the peak of the FTX fiasco in November 2022, which coincided with the bottom of Bitcoin.

Will Bitcoin see an upward trend?

BTC has dropped nearly 10% over the past two weeks, mainly due to hawkish stances from the U.S. Federal Reserve and concerns over U.S. trade tariffs on Canada, Mexico and China.

Related Readings

DXY has fallen more than 3% since March 3, falling from 107 to 103 at the time of writing. This decline has sparked hope for cryptocurrency investors. Historical data supports this prospect.

In addition to the $15,000 BTC bottom in November 2022, DXY experienced two other sharp drops – during the Covid crash in March 2020 and back to the 2015 bear market, when the Prime Minister’s cryptocurrency traded for $250.

In these three occasions, DXY fell by more than -4 standard deviations, BTC formed the bottom, and subsequent trend reversal brought digital assets back to its optimistic momentum. Crypto analyst Merlijn traders share their thoughts on the DXY-BTC relationship.

Analysts noted in X’s post that BTC gathers whenever the DXY moving average convergence difference (MACD) becomes bearish. Analysts explained this using the following chart.

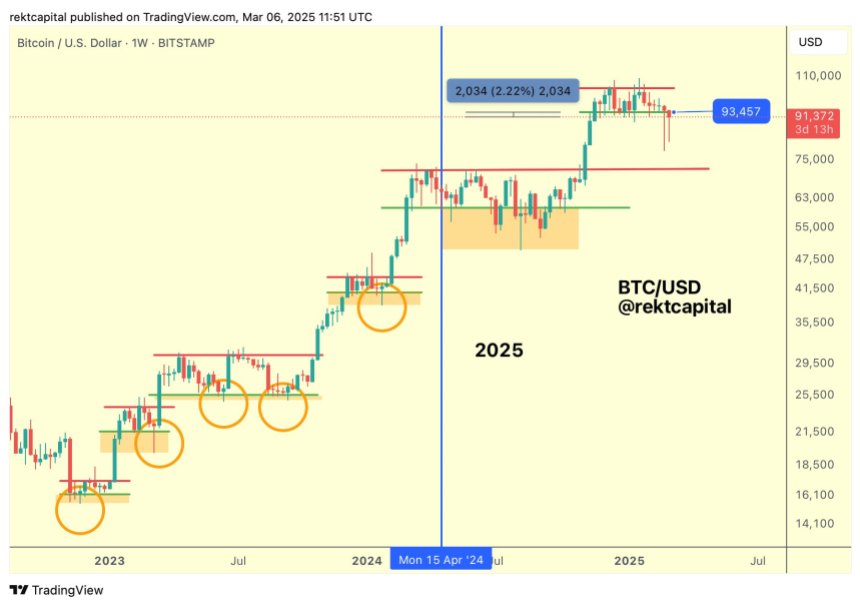

Crypto analyst Rekt Capital has a similar view. Analyst emphasize BTC may have formed higher lows after another downside bias, which sees cryptocurrency beat The February 28 low was $78,258.

Clearing $90,000 resistance is important

Another cryptocurrency trader, Daan Crypto Trader, hinted that if BTC continues to consolidate near-range lows, BTC may target new all-time highs (ATHs) at about $120,000. The trader explained:

We see this in every merger, in this cycle it breaks lower, doesn’t see continuation, regains the range and moves higher from there. Let’s see what’s going on. The $90K level is still key.

Related Readings

Recent analyze The view that support BTC from encryption may have formed the bottom. Additionally, recently experienced crypto analyst Ali Martinez Highlight BTC has encountered over-levels since August 2024, which may indicate a trend reversal in the near term.

In other words, so is BTC face The bearish bias fills the new Chicago Mercantile Exchange (CME) gap, which could reduce the hope of a quick recovery in prices. At press time, BTC was trading at $86,870, down 3.3% in the past 24 hours.

Featured images from Unsplash, charts from X and TradingView.com