What Key Holders Did Next

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

The price of football for the Lions and players is a bit soft. Every arcu lorem, super kids or ullamcorper football hatred.

In cryptocurrencies, wild price fluctuations are normal when policies and new regulations are announced. After U.S. President Donald Trump announces plans for the plan Strategic encryption protected area These include Ethereum, Solana, Ada, Ripple’s XRP, and of course Bitcoin.

Related Readings

The crypto response is straightforward, with Ethereum being one of the highest assets to soar and fall in a few days. On March 2, ETH traded at $2,191, then rose to $2,542 on March 3, before falling below $2,300 at the close of the day, and settled again at $2,050 the next day.

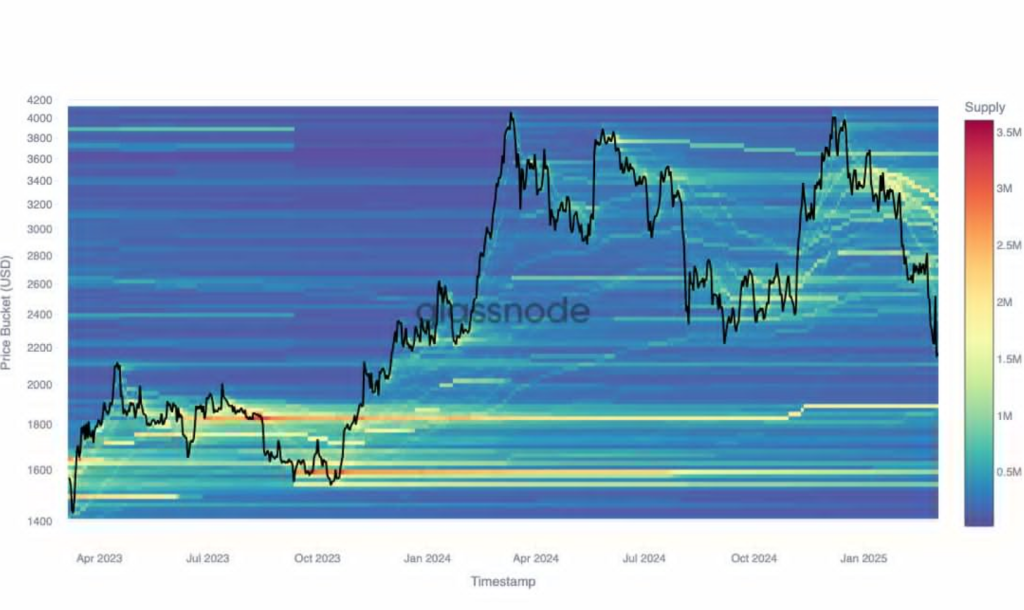

according to Glass nodeRecent crypto price changes reveal some key strategies for ETH holders.

A series of activities among ETH holders

Glass Festival data shows that in recent crypto price fluctuations, ETH holders and investors moved and adjusted their holdings in the case of holdings. Based on its three-month analysis, ether Holders who received the token for $3,500 adjusted their holdings in February.

#Ethereum Investors actively manage their exposure during this fluctuation period. After the gathering reaches $2.5k, $eth Looking back to the last appearance of $20,500 in November 2023 – Cost Base Distribution (CBD) shows how capital rotates at the price level and who exploits the decline. 🧵👇 pic.twitter.com/vl6adghfro

– Glass Node (@GlassNode) March 5, 2025

These investors started their positions at a peak price of $2,500, and their positions remained in their positions when ETH revisited $2,050. According to the Glass Festival figures, these investors have 1.75 million ETH, with an average acquisition price of $3,200. This means their holdings are now down 10% from their entry.

GlassNode also shared that on March 1, investors bought 500K ETH at an average price of $2,200. However, when the price of ETH reached $2,500, the group quickly redistributed its holdings.

Ethereum’s recent price action shows that the new main price resistance is $2,800, and market traders have accumulated 800,000 tokens. So if ETH rebounds soon, crypto holders and investors are now paying attention to this level.

The accumulation of ETH whales continues to grow

Market analysts also highlighted the growing transaction activity and accumulation among crypto wallets. Crypto commentator Ted shared Encrypted whale Investors recently purchased 17,855 ETH, worth about $36 million, with an average price of $2,054.

Now, whales have ETH holdings of $2.5 billion. This deal validates current accumulation trends and shows that today’s prices are “buying opportunities.”

Is it time to buy ETH?

Currently, ETH is trading between $2,100 and $2,300, and its price is still below $3,500 on Monday. according to encryption Ethereum is likely to be in favor after analysts’ recent price volatility. Analysts added that Ethereum’s MVRV ratio fell below 1, meaning assets were undervalued.

Related Readings

This level usually sets the tone for the price increase in previous bull markets. He also noted that more and more ETH addresses are buying more tokens. These wallets hold ETH without being sold, which suggests that institutional participants are building their own shares.

Nevertheless, crypto analysts remain cautious about ETH, pointing out that macroeconomic conditions can still swing crypto prices. He then pointed out the possible impact of tariff measures and monetary strategies on ETH and Altcoin prices.

Featured image from Reuters, charts from TradingView