$1 Billion Liquidated in 24 Hours as Bitcoin Drops Below $83,000

The cryptocurrency market has experienced a sharp decline, with Bitcoin’s price falling below $83,000. This decline has resulted in a wave of liquidation over the past 24 hours, totaling $1 billion as leveraged traders are experiencing huge losses Market correction.

According to Coinglass, a total of 305,170 traders were liquidated during this period, reflecting the impact of the latest price decline in Bitcoin on investor positions.

Detailed description of total liquidation

Most liquidation comes from long positions where traders bet on Bitcoin prices rise. With the market changing, forced selling occurred, accelerating the downward momentum.

data From the paint, long liquidation accounts for more than 80% of the total, reaching US$833.24 million, while short liquidation is Significantly lower $170.8 million.

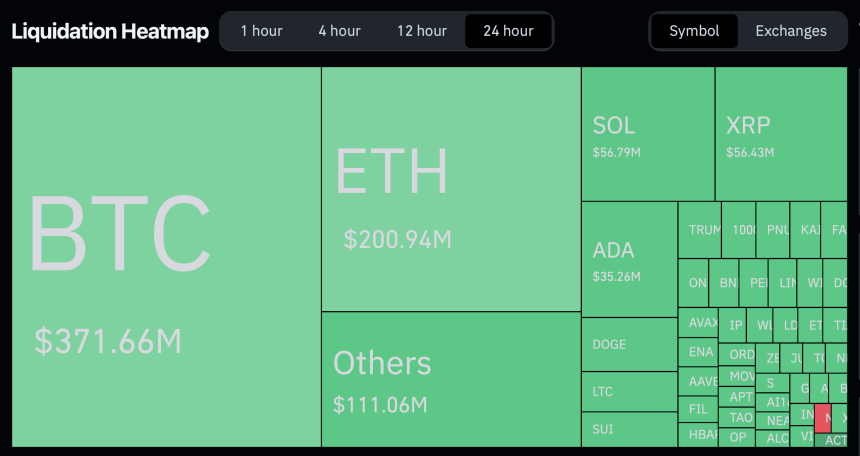

Among the affected cryptocurrency exchanges, Bybit and Binance have the highest clearing volumes, at $411.54 million and $241.54 million, respectively. Bitcoin itself accounts for the largest share of total liquidation, contributing $371.6 million.

Ethereum (ETH) is the second most affected cryptocurrency, with clearing tickets of $200 million, while other crypto assets collectively claim to be more than $100 million. The largest liquidation order occurred on Bitfinex, where its $13.4 million BTC position was forced to close.

High-definition calculations show that many traders are caught off guard by the price drop in Bitcoin. Long position Lead the liquidationwhich shows that market sentiment is basically optimistic before the downturn.

Market prospects: Can Bitcoin recover quickly?

Despite the decline, some analysts remain optimistic about Bitcoin’s long-term trajectory. Crypto Analyst Javon Marks Famous Despite the recent decline, indicators still indicate that Bitcoin may be preparing for a larger bullish rally.

Signs are still pointing to the huge bullish rally of Bitcoin.$ btc

– Hawan

Tags (@javontm1) March 4, 2025

Meanwhile, Rektcapital Point out The decline in Bitcoin has resulted in a CME gap between $84,650 and $93,300, which could lead to Price reversal In the short term.

In addition, the CEO of Ki Young Ju of chain data provider CryptoQuant recently revealed that “the market may remain slow until US sentiment improves.”

According to JU, there is no significant chain activity, and The key indicator is neutral This shows that the bull cycle is still very complete.

#bitcoin The market may remain slow until US sentiment improves.

There was no obvious chain activity, and the key indicator was neutral, indicating that the bovine cycle was still intact. The fundamentals are still strong, and more mining rigs are coming soon.

If the cycle ends… https://t.co/fswl26d0gx pic.twitter.com/bywdwezhsq

-Ki Young Ju (@ki_young_ju) March 4, 2025

Feature images created with DALL-E, charts for TradingView