Ethereum Breaks Below Parallel Channel – Is ETH Collapsing To $1,250?

Ethereum has experienced a huge decline, with its lowest levels since late November 2023. The entire market was hit by extreme volatility, uncertainty and positive price volatility, while ETH lost more than 20% of its value in just a few hours. Investors are concerned that this correction will expand further as Ethereum strives to restore critical demand levels.

Related Readings

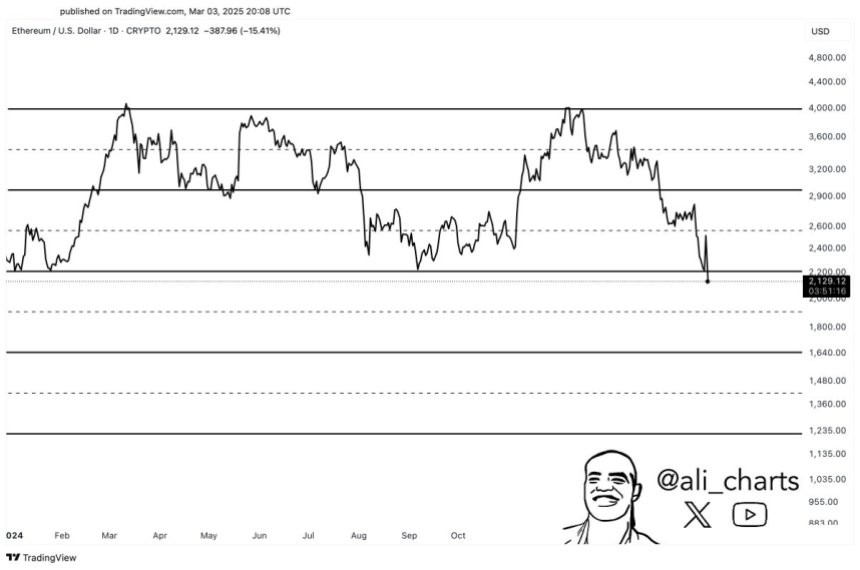

Analysts are closely monitoring Ethereum’s price action as the next few days can identify the short-term outlook for the second-largest cryptocurrency. Top analyst Ali Martinez shared a technical analysis on X, which shows that Ethereum is on the verge of breaking from a parallel channel. If you push it up to a score below $2,000, you can set ETH to a deeper correction before making any recovery attempts.

Ethereum’s Weaknesses This has raised concerns about the wider crypto market, as AltCoins has also taken a huge blow in the latest sell-off. Sentiment remains bearish, and traders are waiting to confirm whether ETH will recover power or continue to decline towards lower demand zones. The next few trading sessions are crucial to determine whether Ethereum can maintain critical support or inevitable drawbacks.

Ethereum faces more downside risks

Ethereum’s price action is incredible as the broader crypto market is difficult to find stability. Despite the brief rally and sharp declines, ETH has not identified a clear trend, leaving investors uncertain about its future direction. The asset is trapped in a long-term downtrend, always setting new lows and strengthening the sense of bearishness in the market.

Currently, Ethereum trades at bear market prices and shows little signs of sustainable recycling. As the market structure weakens, many investors expect ETH to drop further. Analyst Martinez stressed One on development, noting that Ethereum appears to be crashing from a parallel channel containing several months of prices. ETH may move towards a sharp shift of $1,250, which will indicate a deeper market collapse.

A drop to $1,250 will not only enhance Ethereum’s bearish outlook, but it can also be a key signal for a wider market segment. This situation could lead to panic sale, lowering other major assets and confirming an extended bear market. Despite occasional price volatility, Ethereum is still at a critical moment, with the Bulls working hard to regain key support levels. Unless ETH can retract lost stances and build a strong support base, the risk of further disadvantages remains high.

Related Readings

As Ethereum fails to show strength in market volatility, investors remain cautious and expect lower prices until any meaningful recovery can be made. The coming days are crucial to determine whether ETH can be stable or Martinez’s $1,250 target will become a reality, confirming the bearish outlook for the entire cryptocurrency market.

Key requirements level for ETH testing

Ethereum traded at $2,090 after its weak price, down 30% since February 24. This significant decline has led investors to question whether ETH can maintain its long-term bullish structure or a more in-depth correction is about to be made.

Currently, Ethereum is at a critical level of support and any bullish hope must be maintained. A breakdown below this level may confirm the situation in the bear market, pushing ETH toward lower price levels as sales pressures intensify. The uncertainty of Ethereum price action has made traders cautious, as any further weakness can accelerate the decline.

However, if ETH can recover the resistance level of $2500, it is still possible to recover. Such a move would indicate re-buy momentum and could trigger a strong recovery and potentially reverse the recent bearish trend. If Ethereum manages to put $2,500 in support, this will show reconfidence in the asset and lay the foundation for higher target goals.

Related Readings

Currently, everyone’s eyes are focused on Ethereum’s ability to defend $2,090. The days that follow are crucial to determine whether ETH can stabilize or the market moves towards a longer bearish phase.

Featured images from DALL-E, charts from TradingView