Long-Term Dogecoin Holders Are In “Denial” – On-Chain Metrics Expose Weakness

After two weeks of sales pressure, Dogecoin (Doge) traded at key demand levels at key demand levels, while the Bears drove Doge by more than 30%. The wider cryptocurrency market faces extended corrections that began in mid-January, but the meme coins were most affected. As a market leader in the meme coin industry, Dogecoin suffered a huge volatility, testing lower support levels as investor sentiment remains bearish.

Related Readings

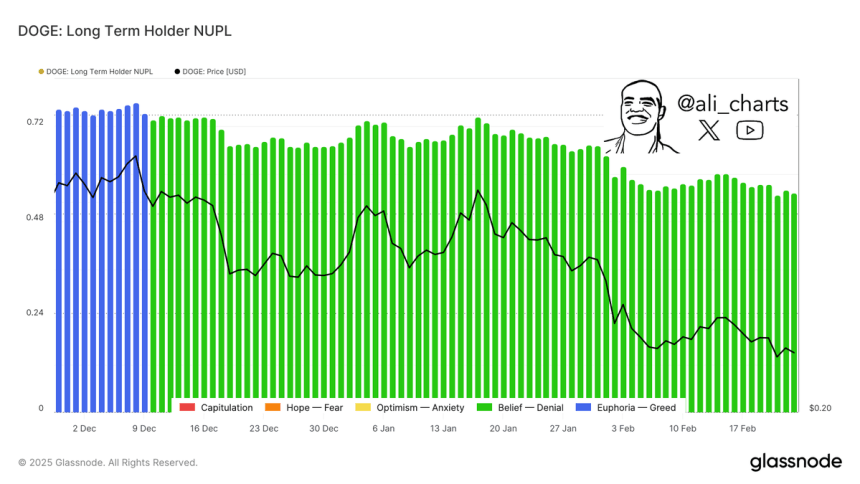

GlassNode’s chain metrics show that long-term Dogecoin holders are in a “deny” state, indicating that uncertainty among those who hold Doge for a long time is growing. Doge’s long-term holders’ net unrealized profit/loss (NUPL) indicator is on a downward trend, which means many long-term holders see a decrease in unrealized profits and even fall into losses. This trend suggests that holders who once had confidence in Dogecoin’s long-term potential are now facing market skepticism and may consider sales if conditions do not improve.

Just like in key support for the nearby Dooge industry, the next few days will be crucial to determine whether the Bulls can regain control and push back the recovery or sales pressure will continue to force Doge into deeper correction areas. Bitcoin and the entire market New lows are being set, and this week is crucial for the Bulls to defend key demand at these levels.

Dogecoin crash: Can the Bulls regain control?

Dogecoin experienced a huge sell-off, falling from its December high to $0.48 and to its most recent $0.19. This sharp decline caused panic across the market, and sentiment worsened further as many analysts began calling for the beginning of a bear market. Sluggish investors have weakened investor confidence, while meme coins (once the hottest sector in the market) are facing the toughest corrections.

Despite the continued decline, the linked data suggests that not all hopes have lost Doge’s hope. Share by crypto analyst Ali Martinez Glass Festival indicators Long-term Dogecoin holders are in “deny” according to Doge’s long-term holders’ net unrealized profit/loss (NUPL) indicator.

These data show that despite the downturn, many long-term investors are still sticking to their jobs but are beginning to get tired of the long-term downtrend. Historically, this “rejection phase” can precede the final surrender or a strong rebound if the bulls regain control.

Related Readings

The upcoming week is crucial to determine whether Dogecoin can rebound from current levels or sellers continue to dominate. If Doge manages to have a critical level of support and restore momentum, you may see a relief rally. However, if sales pressure persists, prices may continue to trend downward, further extending the correction.

Dogecoin price struggles after 19% drop

Dogecoin’s trading has fallen by 19% since Monday, and its decline trajectory continues to decline due to weak markets. The meme coin industry has been one of the biggest hits to be hit in recent weeks, as sales pressure remains dominant, so it strives to seek strong support.

Now, the Bulls are facing critical testing, as it is crucial to maintain current levels to avoid further shortcomings. To start the recovery rally, Doge needs to recoup $0.24 Mark, a key resistance level that can mark the beginning of an uptrend. However, market sentiment remains cautious, and price action shows that Doge can enter a phase of integration below this level before any meaningful recovery begins.

Related Readings

If Dogecoin fails to hold prices above $0.21, the bear may continue to push prices down, possibly revisiting previous support levels. But if buyers step in and stabilize, it may build momentum for driving higher prices in the future. In the short term, traders should pay close attention to whether the Bulls can defend current demand levels and return to key resistance levels to confirm a potential reversal of price action.

Featured images from DALL-E, charts from TradingView