$44 Billion Bitcoin Liquidation Possible?

Stocks in Strategy (NASDAQ:MSTR) fell more than 55% from their November 24 high to $543, to around $250. As the software intelligence company now owns about 499,096 bitcoins (at current price of $44 billion) market participants are wondering whether the company will face forced liquidation of its massive Bitcoin Treasury.

On Tuesday, analysts from Kobeissi’s letter (@KobeissileTter) got X Wire Analyze this situation. They have to say: “MicroStrategy, MSTR, fell to -55%, and many are asking about “forced liquidation”. The company now holds $44 billion worth of Bitcoin, can it be forced to sell it? Is liquidation even possible?”

Forced Bitcoin clearance?

According to Kobeissi letter, Microstrategy’s Bitcoin Holding a total of approximately 499,096 BTCCurrently worth $43.7 billion. The company’s average cost base is about $66,350 per bitcoin. This naturally raises concerns about if Bitcoin’s price is significantly lower than Microstrategy’s average entry point.

“Let’s first point out that this is not the first time that liquidation is mentioned. MSTR has been buying Bitcoin for years and has been in multiple bear markets since then. This includes 2022 Bear market When Bitcoin dropped from $70K to about $15,000. Is this different this time? ” the analyst wrote.

Related Readings

Crucially, MicroStrategy’s operations rely on raising funds (usually through convertible notes) to buy more Bitcoin. The Kobeissi letter noted that MicroStrategy’s total debt is currently about $8.2 billion, with its $43.4 billion Bitcoin holdings and a leverage of about 19%. The majority of these debts are held in mature convertible notes around 2028.

“If a company undergoes a ‘basic change’, the only way to ‘forced liquidation’ occurs. If the notes are redeemed in advance, this may require MSTR to clear the Bitcoin holdings,” said Kobeissi Letter’s expert.

“Basic changes” may include a company bankruptcy, or a vote by shareholders to dissolve the company, which is what Kobeissi letter emphasizes remoteness under the current structure. Michael SealerMicroStrategy’s executive chairman and well-known Bitcoin advocate holds 46.8% of the company’s voting rights, meaning he can effectively prevent decisions from leading to liquidation.

Related Readings

Despite a sharp decline in stock prices, Kobeissi’s letter stated that it is “extremely impossible” to directly force liquidation. The structure of convertible notes and MicroStrategy’s ability to raise funds give the company significant flexibility. Even so, if Bitcoin is to experience a lasting and severe price decline (below current levels), Microstrategy could face challenges in debt and raising new capital:

“But what if these convertible bonds start in 2027? To do that, Bitcoin needs to drop more than 50% from its current level and stay there.”

Michael Saylor repeatedly deleted the liquidation scene. According to Kobeissi’s letter, “Michael Saylor was recently asked about liquidation. His answer is that even if Bitcoin drops to $1, they still won’t be liquidated. They will “buy only all Bitcoins.” While this sounds good in theory, convertible notes holders can’t forget.”

MicroStrategy’s business model – facilitating funds to buy Bitcoin, which may make prices higher, and then issue new stocks at a premium – depends on investor confidence. If the stock continues to shake, or if the Bitcoin dive is well below the average entry price of MicroStrategy, the company’s ability to attract capital may be rigorously tested: “We are now witnessing MicroStrategy’s first ‘bear market’ as it’s in the process of Gained popularity in 2024. Become: Will investors continue to buy dipping sauce here? Michael Saylor said “Bitcoin is being sold. ”

However, with Saylor’s voting ability and long-term convertible notes, forcing liquidation seems extremely unlikely in the short term.

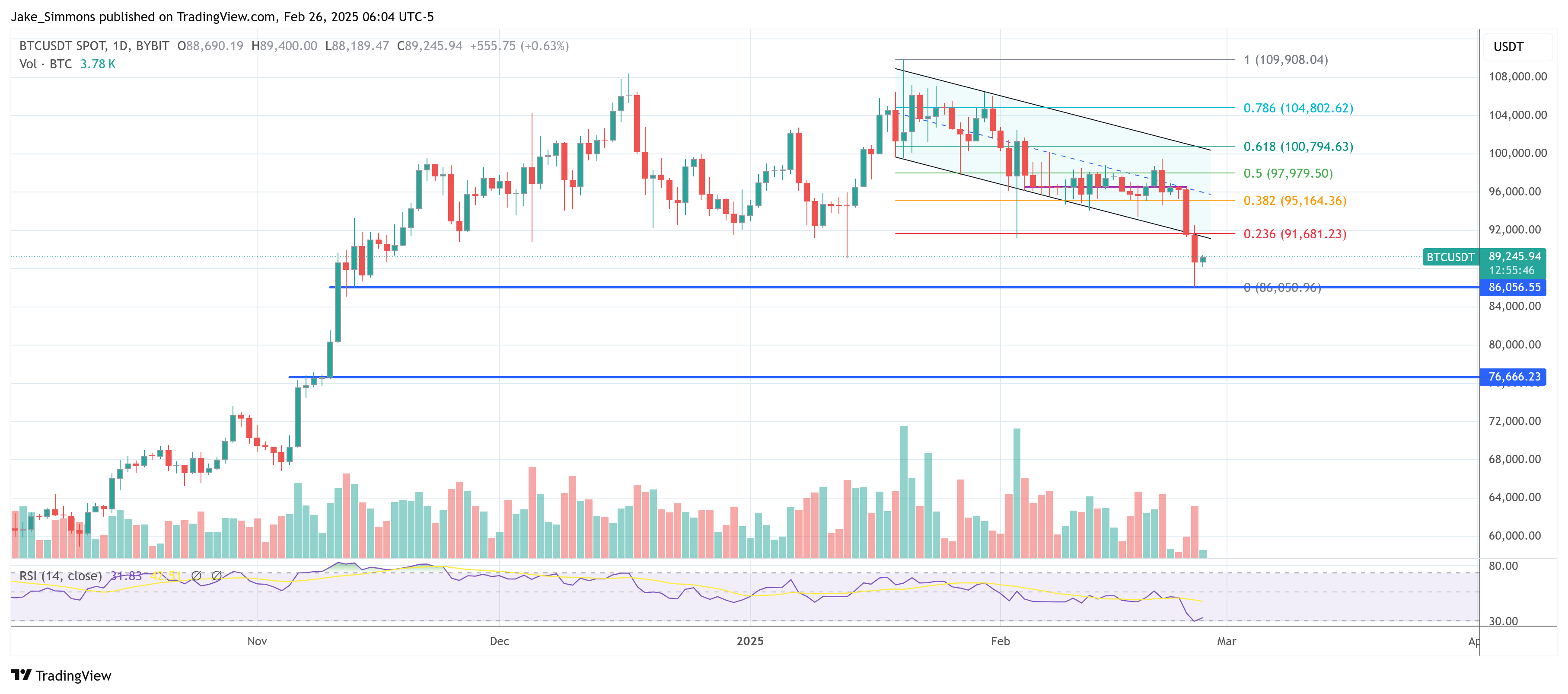

At press time, BTC was trading at $89,245.

Featured Images created with dall.e, Charts for TradingView.com