As Bitcoin Sell Pressure Fades, Could A Local Bottom Be Forming? Analyst Explains

According to x postal Authored by crypto analyst Ali Martinez, Bitcoin (BTC) has witnessed a drop in sell-side pressure, suggesting that the lowest point in the local market may soon form the major cryptocurrency.

Local bottom of Bitcoin on the horizon?

Bitcoin continues to trade at a lower level of $100,000 in psychological sense, hovering at $98,650 as it writes. However, the cryptocurrency with the highest market capitalization is witnessing a significant drop in seller pressure.

Related Readings

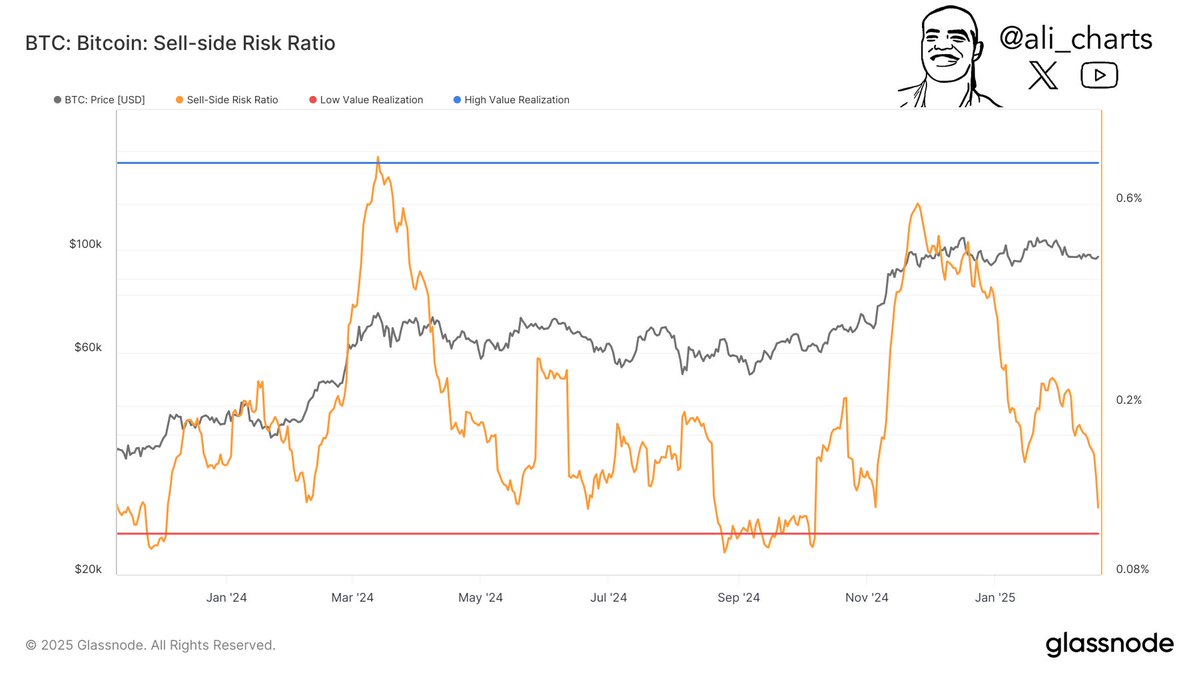

Martinez shared the following Bitcoin seller risk ratio chart from the glass node of the crypto-analytics platform, highlighting the sharp decline of the metric since mid-January 2025. This decline suggests that BTC may form a local price lowest point, which may lead to a new accumulation phase.

For those unfamiliar, a drop in sell-side risk ratios often indicate that investors are sticking to their BTC rather than selling, indicating an early stage of the accumulation phase where prices may stabilize or begin to rise.

Martinez’s analysis is consistent with the broader theory of cryptocurrency market cycles, suggesting that the bottom of the market is often the cumulative phase. In turn, this stage paves the way for potential price increases.

However, BTC must remain above the critical support level to confirm this prospect. Crypto Analyst Rekt Capital Weighing In Bitcoin’s price action, the importance of closing more than $97,000 per week was emphasized to keep it back higher.

The analyst shared a weekly chart of Bitcoin and noted that the overall bullish pattern remains intact despite BTC seeing multiple wicks on multiple wicks below its symmetrical triangle structure. However, failure to close over $97,000 in the weekly time frame may add further disadvantages.

Similarly, analyst Daan Crypto trades shared bullish views, pointing out that BTC has recently achieved a “stable breakthrough” from its downward channel structure. Analyst additional:

Just see the continuation that goes into the weekend right away to get a good foundation for next week. $98K is the key in the short term.

Is BTC the new all-time high?

Martinez gear Relocations of over $108,000 are likely to reach new all-time highest levels (ATH). Analyst Kevin, e.g. predict A brief squeeze could push BTC to $111,000.

Related Readings

Similarly, Rekt Capital’s recent analysis Highlights BTC shows early signs of bullish differences, which could break down bearish price momentum for digital assets. At press time, BTC was trading at $98,650, up 0.1% over the past 24 hours.

Featured images from Unsplash, charts from X and TradingView.com