On-Chain Metrics Reveal The Most Critical Resistance For Bitcoin – Can BTC Break $97.5K?

Bitcoin continues to trade on a tight range, holding above the $94K level while working to surpass the $100,000 mark. As BTC maintains key demand levels, the long-term outlook remains bullish, but short-term price action remains uncertain. Investors and analysts are watching the breakthrough closely, guessing that this period is calm before the storm.

Related Readings

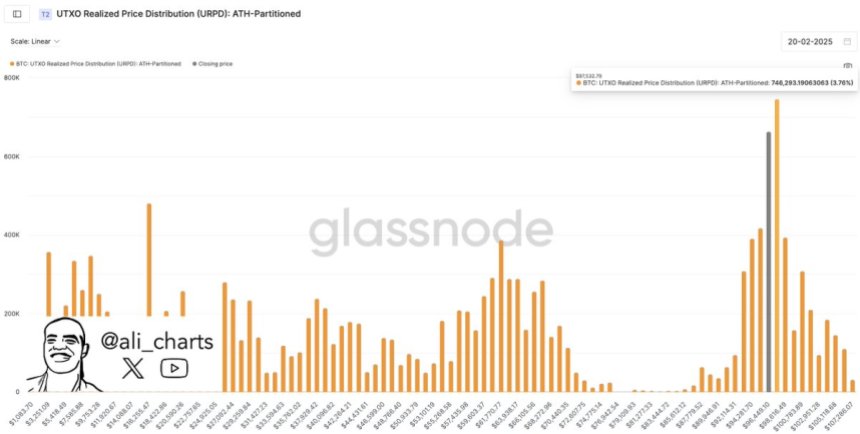

Although the Bulls have defended key support levels, they are unable to push BTC toward critical resistance, resulting in increasing frustration in the market. Analysts show that positive actions in either direction are imminent. GlassNode’s key indicators show that Bitcoin’s most critical resistance level is currently $97,533. This level has acted as a critical exclusion zone in recent weeks to prevent BTC from recovering momentum.

If Bitcoin manages to break Maintain a move beyond this resistanceit may mark the beginning of a new uptrend, with the potential to push prices to ATH and beyond. However, not doing so could lead to sideways trading and could even lead to another retest of the lower demand area. Bitcoin is still at a critical moment when market participants are waiting for confirmation, and can define its next big move.

Bitcoin prepares for positive moves

Bitcoin has been in a quiet merger below $100,000, creating an environment full of uncertainty and frustration. The price action remains, fluctuating between $94K and 100k without any clear direction. Analysts continue to speculate on the next move, and most agree that the inevitable positive breakthrough is inevitable. However, the main problem remains – will it be a bullish surge in price discovery or throw away people with lower levels of demand?

Top analyst Ali Martinez Shared glass section data on Xrevealing that Bitcoin’s most critical resistance level is currently $97,533. This level repeatedly acts as a barrier to prevent the bull from regaining control. Martinez believes that a sustained breakthrough beyond this level may further indicate upside potential, which may pave the way for a path towards a $100,000 psychological barrier.

Investor sentiment is mixed with some expecting Bitcoin to recover momentum and get past ATH, while others remain cautious due to long periods of consolidation and reduced volatility. Historically, the extended period of low volatility is usually before major price transfers, but the market still diverges in what directions BTC takes.

Currently, Bitcoin continues to trade on a tight range, and investors are eagerly awaiting confirmation of the next major trend.

Related Readings

BTC price action details

Bitcoin is trading at $97,300, trying to reclaim the moving average of keys that can define its short-term direction. The 4-hour 200 index’s moving average (EMA) is $98K and the $200 moving average (MA) of $200 as a key resistance level that the bulls must overcome to confirm the uptrend. If Bitcoin exceeds these levels and supports it, it could ignite large-scale rally to the new high.

However, uncertainty still dominates the market as BTC strives to maintain bullish momentum. Investors are paying close attention to whether prices can break through these resistance areas or whether other rejections will occur. An attempt to exceed the $98K-$100K range failed could lead to increased sales pressure, which reduces BTC’s lower demand zones to around $91,000.

Related Readings

Despite cautious sentiment, Bitcoin’s long-term structure remains bullish as it continues to remain at key support levels. As traders seek confirmation of a breakthrough or potential echo, the coming days will be crucial. If BTC manages to retract these key moving averages, confidence can return to the market, exacerbating further upward momentum. Until then, Bitcoin is still in a critical phase of consolidation, awaiting its next decisive move.

Featured images from DALL-E, charts from TradingView