How Close Is Bitcoin To A Bear Market? This Historical Level May Contain Hints

Bitcoin’s chain-level level has historically been the boundary of a bear market. This is the current distance from the asset price to this line.

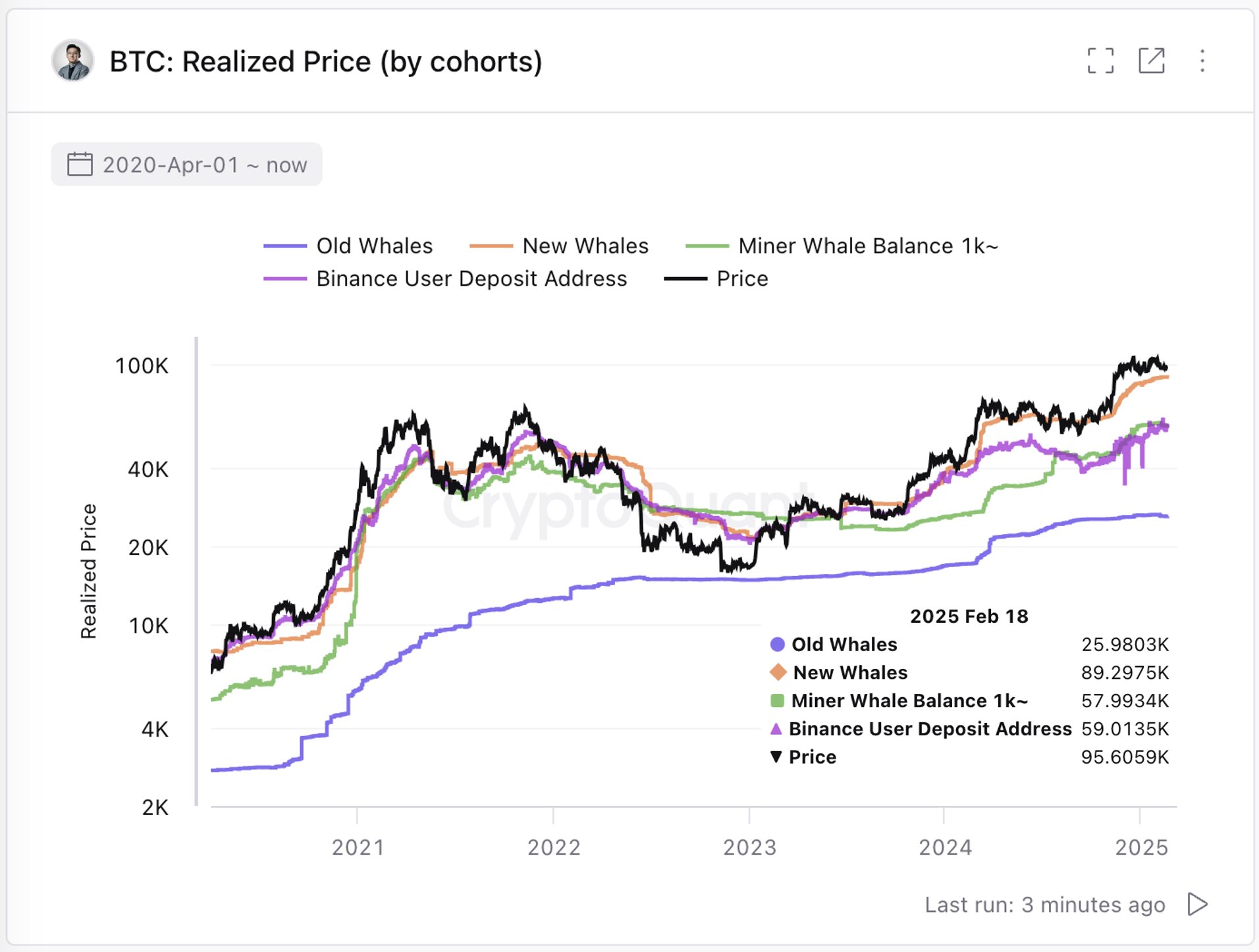

Bitcoin now exceeds the price of all major queues

In the new postal On X, CryptoQuant founder and CEO Ki Young Ju discusses the price realized currently represents some important Bitcoin investor groups.

this”Achieved price“Here is a chain indicator that tracks the cost basis of ordinary investors on the BTC network. When the spot price is above this metric, it means that the holder is in a profit overall, and under the indicator it indicates the loss Dominate.

Related Readings

Now, here is a chart of Young JU Shared metrics that show its trend toward its value to four Bitcoin counterparts:

As can be seen in the picture above, Bitcoin now exceeds the realized price of all these groups, so their members will sit on some unrealized gains.

Historically, the average cost basis of these queues has some significance for cryptocurrencies. From the chart, it is obvious that whenever it exceeds the realized price, the price usually follows a bullish trajectory New whale (orange color).

New whales, also known as short-term holder whales, refer to BTC investors who have purchased coins in the past 155 days and have held more than 1,000 BTC. Currently, the implementation price of the queue is currently $89,300, meaning that if the bearish trajectory continues, BTC may be retested in the near future.

However, a potential decline at this level does not immediately indicate a shift to a bear market. This simply means there is a lack of motivation behind Bitcoin. Miner whales (green) may have to avoid BTC to avoid falling into trouble to avoid bankruptcy levels.

Miner whale refers to wallet of Mining companies That’s More than 1,000 BTC. The crypto founder explained that in the last few cycles, the BTC plunge caused a bear market.

Currently, the realization price of miner whales is $58,000. Starting with current prices, Bitcoin has to go through a nearly 40% reduction before it can be retested. If this level does act as a bear market boundary again in this cycle, BTC can be considered at the moment on safe distances.

Related Readings

Although the asset tends to see the cost base of three populations over the course of a cycle and below interruption, it never went bankrupt under the realization price of the fourth group, old whales or long-term holders whales.

The average acquisition level for whales that have been firmly holding Bitcoin for more than 155 days is currently $26,000.

BTC price

Yesterday, Bitcoin witnessed a game at the $94,000 level, but the coin seems to have found a rebound as its price recovers now to $96,200.

Featured images from dall-e, charts from cryptoquant.com, tradingview.com