Solana Sweeps Lows But Recovers – Can Bulls Reclaim $185 by Friday?

Solana has experienced enormous sales pressure and is now trading at its lowest level since November 2024 and has removed all proceeds from the post-election rally. Solana, once a leader in the Altcoin market, is now at serious risk as Meme Coin Euphoria fueled its rise, which has turned into a bloody mud, raising concerns about its long-term sustainability.

Related Readings

The speculative madness around meme coins initially drove a lot of trading volume and liquidity to the Sorana ecosystem. However, with the gradual disappearance of hype and major sell-offs, the impact now has a great impact on Saul’s price action. Analysts believe that the rapid cycle of speculation and liquidation makes Solana vulnerable to further adverse effects.

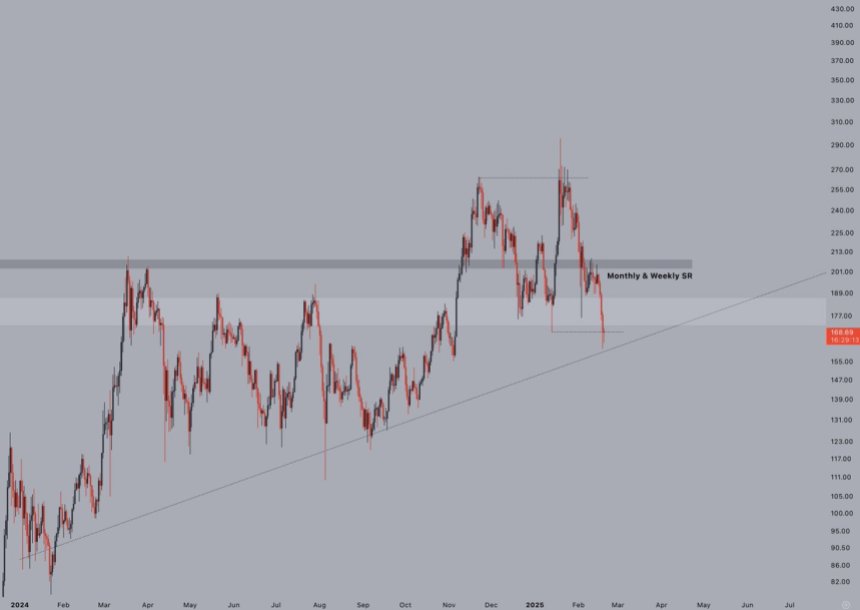

Crypto analyst Jelle analyzed an analysis on X, showing Thor takes out the nearest low But managed to surpass the previous lows, which indicated a potential relief move. Jelle stressed that this could be a critical moment for SOL, as the key level of recovery could inspire strong recovery. But as the market waits for a bounce or further downside, the days ahead will be crucial. Investors are paying close attention to Solana’s price action as it treads on the edge of major actions.

Solana tests key demand levels

Solana has been facing enormous sales pressure since reaching its all-time high in late January, and its prices are now working to recover amid the sluggish recession of the alternative token market. Negative sentiment continues to dominate as it has become a responsibility to exacerbate liquidity and investor confidence, which is the meme coin fanaticism.

Related Readings

The rapid rise and fall of speculative meme coins on Solana’s network creates an unstable trading environment, and traders are reluctant to reinvest in the ecosystem. This shift has led to a drop in the volume of diversified trading (DEX), further exacerbating Solana’s efforts to maintain bullish momentum. The fundamentals of the network are still strong, but price action shows that investors are becoming increasingly cautious.

Jelle’s analysis of X Revealed that Sol took out the nearest low but managed to surpass the previous low. Although this marks a potential mitigation action, it does not confirm a full recovery. Jelle hopes to see a strong rebound from here – ideally, Sol recovered $185 before Friday’s business ended.

Traders and investors are closing 3 days and weekly candles to determine Solana’s next big move. Successfully recovering the $185 level can restore confidence and restore the price to $200. However, as Solana remains vulnerable to wider market developments and ongoing volatility in the meme coin industry, failure to do so could lead to further downward pressure.

Sol Price Trys to Recall Key Levels

Solana (Sol) is currently trading at $173, holding the crucial $170 support level. The Bulls must defend this price to maintain short-term momentum and prevent deeper corrections. Pushing above $185 is crucial for recovery, as this level is consistent with the 200-day moving average, a key indicator of long-term strength. Retrieving this level will indicate a transition in momentum and open the door to move stronger upward movement towards higher resistance levels.

But if Sol fails to surpass the $185 mark in the coming days, sales pressures could intensify, leading to another economic downturn. As long as the price remains below this critical threshold, the bear can remain in control, and a rejection rate of $185 may trigger an adverse aspect that may revisit support for $160 or less.

Related Readings

The next few days will be crucial for Solana as traders pay attention to confirming reversals or continuing bearish trends. A breakout above $185 can provide the momentum required for SOL to resume its bullish trajectory, and failure to recover from that level could result in further losses. Market sentiment remains fragile and investors closely monitor price action for any signs of sustainable recycling.

Featured images from DALL-E, charts from TradingView