Ethereum Exchange Balances Drop To 9-Year Low – Time For A Major Price Move?

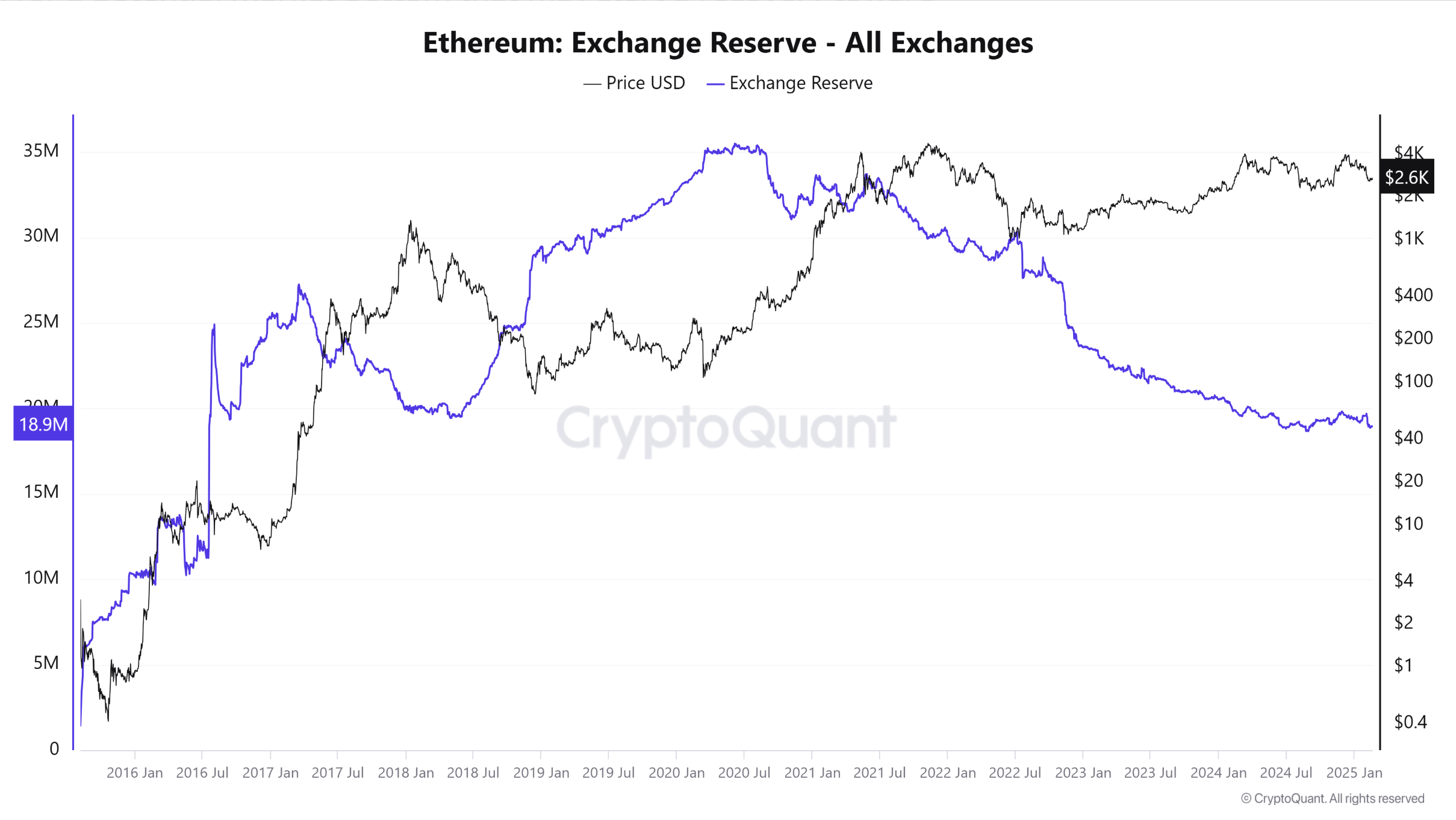

According to recent statements data From crypto sources, Ethereum (ETH) reserves for centralized cryptocurrency exchanges have fallen to nine-year lows. Experts believe this growing supply of ETH could indicate an upcoming “supply shock” that could exacerbate major rally in cryptocurrencies.

Ethereum reserves at 9-year lows

Ethereum is the second largest cryptocurrency in market capitalization, continuing to trade in the mid-term range of $2,000, at $2,721 at the time of writing. Unlike Bitcoin (BTC), ETH’s 2024 was relatively quiet, struggling to surpass its all-time high (ATH) recorded in November 2021.

Related Readings

This bland price action has caused investors to ease confidence in ETH. However, the digital asset has recently managed to defend a critical $2,380-2,460 demand zone, reigniting bullish hopes that it could break through the resistance level above $3,000.

More notably, centralized exchanges continue to decline in ETH reserves, which could lead to supply shocks – demand for assets exceeds their liquid supply. If this is achieved, ETH may appreciate rapidly.

For beginners, supply shocks in the crypto industry occur when demand for underlying digital assets exceeds their current supply. As a result, in this case, the underlying asset (ETH) may reflect huge price appreciation in a short period of time.

As of now, ETH’s ETH reserves for centralized crypto exchanges have dropped to 18.95 million, the last level that appeared in July 2016. Especially ETH was trading at $14 at the time.

Recent analyze Crypto Buddha, an experienced crypto analyst, proposed that ETH could be on the verge of a major price shift. Analysts highlighted how ETH breaks through diagonal resistance levels, indicating a potential bullish breakthrough.

Furthermore, Bitcoin (BTC) exhibits similar price behavior. A successful BTC breakthrough could trigger a wider crypto market rally, thus achieving huge gains on a variety of digital assets. The Encryption Buddha pointed out:

BitcoinThe price action follows a similar pattern with a triangle fusion, raising the question of whether it can successfully break through. Ethereum. Bitcoin has been solidified for 10 days due to its sub-$91,000. The market is at a critical moment, and it is time to choose the direction.

Do ETH investors finally have time?

Unlike competitors like Solana (Sol), Sui and XRP, all of which have been noticeable price appreciation over the past year, ETH has been working hard to capitalize on the bullish momentum. Bearish sentiment around ETH has been at an unprecedented level.

Related Readings

However, analysts are confident that ETH may surprise the market soon. The latest analysis of crypto titans emphasize The ETH may soon enter its “most annoying gathering”, resulting in a significant price appreciation.

That is, concerns about the Ethereum Foundation sell A large amount of ETH continues to bother holders. At press time, ETH was trading at $2,721, down 4.7% in the past 24 hours.

Featured images from Unsplash, charts from CryptoQuant and TradingView.com