Bitcoin Presents A ‘Generational Opportunity’ As Global Turmoil Intensifies, Says Bitwise Executive

exist postal Jeff Park, head of Alpha Strategies at Bitwise, said on X released yesterday that Bitcoin (BTC) is currently raising “generational opportunities” amid the strengthening of global macroeconomic turmoil.

Parker notes such as trade tariffs proposed by U.S. President Donald Trump, concerns about U.S. debt ceilings, and growing magazine-based sentiment as key factors in current economic uncertainty.

Bitcoin is supreme amid global political and economic turmoil

2025 begins a foundation of instability, a sign of global economic and political instability caused by trade tariffs, U.S. debt ceiling issues, and broader efforts. These factors may seriously affect financial markets and geopolitical stability.

Related Readings

Later this year, uncertainty about the U.S. Tax Cuts and Employment Act (TCJA) coming to an end, which could lead to unprecedented shifts in tax policies and exacerbate economic unpredictability.

Parker also emphasized the “gold running risk”, referring to the extreme price fluctuations in gold during the gold medal’s distress. When writing, gold is trading $2,900 per ounce, up from around $2,585 in December 2024.

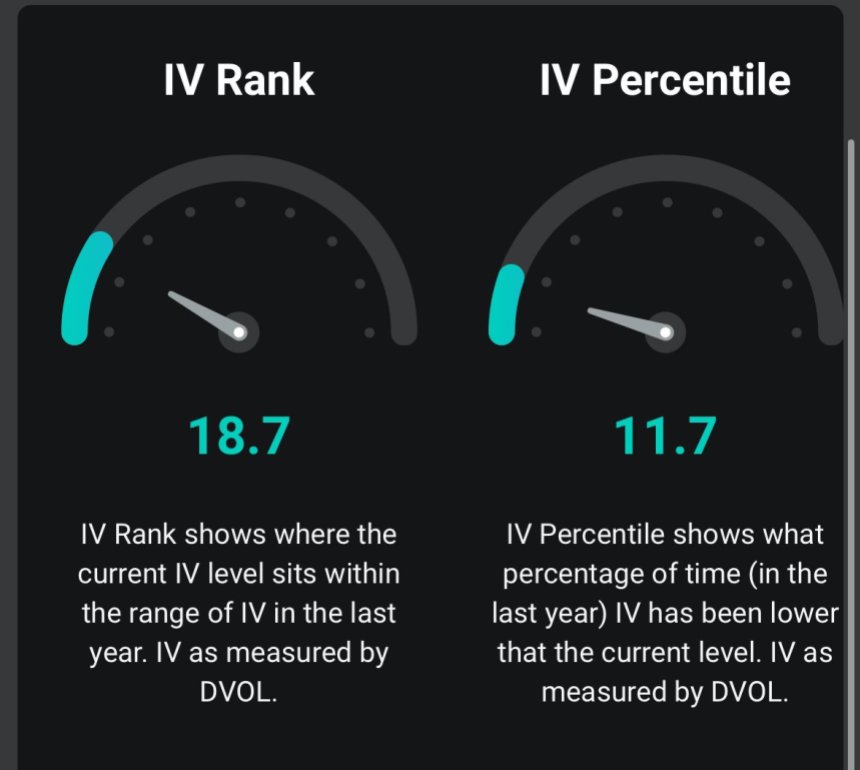

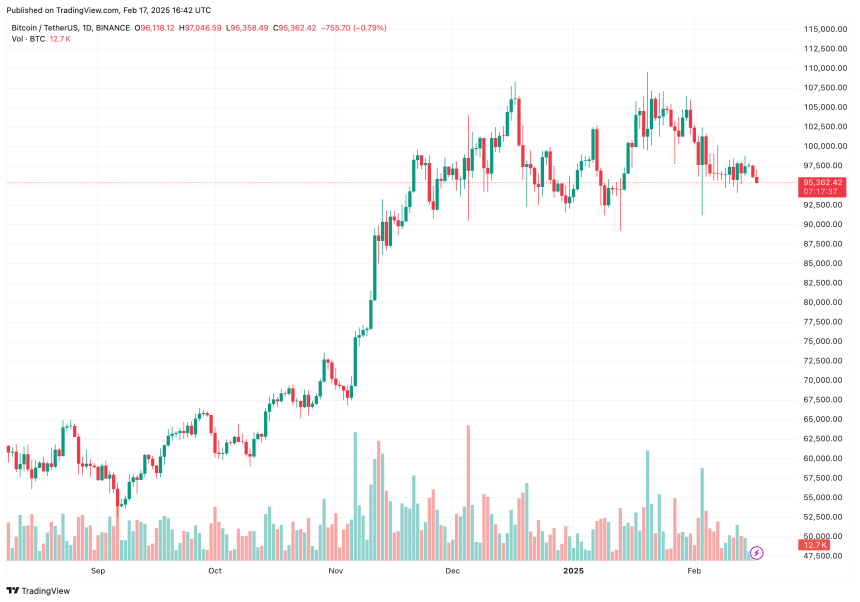

Despite these growing risks, Bitcoin remains resilient, with its price range ranging from $90,000 to $100,000. Park highlights the implied volatility (IV) percentile of BTC – a measure that reflects its current volatility compared to historical levels.

He noted that BTC’s IV percentile is at its lowest level in a year, strengthening his perception that Bitcoin brings “a chance for generations.” Echoing this sentiment, CEO Hunter Horsley Comment Many underestimate the “big leap that Bitcoin will become mainstream this year”.

Indeed, Bitcoin continues to gain mainstream traction and demonstrates resilience amid rising global economic uncertainty. For example, BTC remains largely Not affected The technology market sell-off caused by the release of China’s AI model DeepSeek.

Is it the season soon?

As Bitcoin strengthens its dominance, the altcoin market has been struggling, struggling with thin liquidity and mitigating retail benefits. A key indicator support This trend is Bitcoin Advantage (BTC.D), which measures BTC’s market value relative to the total cryptocurrency market.

Related Readings

The weekly BTC.D chart shows that the rebound of around 54% in December 2024 is strong. At the time of writing, BTC.D’s accounted for 60.65%, which has not been seen since March 2021.

That said, some analysts remain optimistic about potential Ethereum (ETH) Altseason later in 2025 Calm down For this year’s major upward action.

Analysts also pointed out Similarities Between ETH’s current price action and BTC’s behavior in its third market cycle, this means Ethereum may soon enter what he calls the “most annoying rally.” At press time, BTC was trading at $95,362, down 0.4% in the past 24 hours.

Featured images from Unsplash, charts from X.com and TradingView.com