US inflation unexpectedly increases

BBC News Business Reporter

Getty Images

Getty ImagesU.S. inflation rose more than expected last month With higher eggs and energy prices help drive the cost of living for Americans.

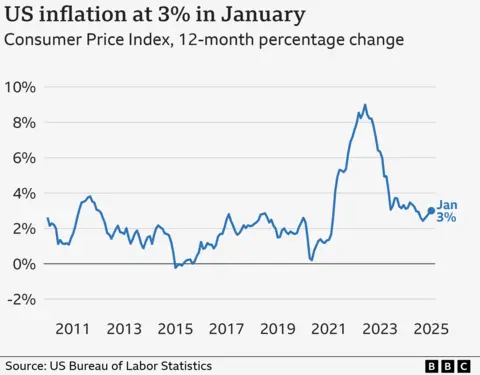

Inflation rose to 3% in January, with a maximum rate of six months, higher than economists’ expectations of 2.9%.

U.S. central bank rises in a few weeks Decide the interest ratethere is great uncertainty about where the economy might be.

This poses a challenge to U.S. President Donald Trump, who made inflation at the heart of his campaign last year, has proposed policies such as higher tariffs on imports, with economists saying risks Increase the price.

Ryan Sweet, chief U.S. economist at Oxford Economics, said the latest report could put pressure on Trump to rethink the plans, which would tax goods entering the country.

“Tariffs can still be used as a tool for bargaining, getting some discounts from other countries, but the political vision of putting some upward pressure on consumer prices through tariffs is not a good thing for the Trump administration,” he wrote.

The price increase last month was widespread, affecting auto insurance, air tickets, medicine and other basics.

Grocery prices rose 0.5% this month, compared with 0.3% in December, as egg prices soared more than 15% due to shortages caused by the avian flu outbreak.

The Labor Department said this marks the biggest monthly growth in nearly a decade.

In contrast, clothing prices fell, while rents and other related costs rose by 4.4% last year, marking the smallest 12-month increase since January 2022.

Core inflation deprived food and energy, and analysts saw it as a core inflation that better measures potential trends, which was 0.4% this month, the fastest since March.

“It’s not a good number,” said Brian Coulton, chief economist at Fitch Ratings.

“It illustrates how (the Fed) can do the work of lower inflation, just as new inflation risks (from tariffs on interest rates and squeezing labor supply growth) are beginning to emerge.”

The Fed has sharply raised interest rates from 2022, hoping higher borrowing costs will lower the economy and alleviate pressure to drive prices.

It has lowered rates since September, saying it wants to avoid further cooling.

However, signs of sustained inflation continuing to exceed the 2% target in recent months have prompted it to keep interest rates unchanged in January.

Fed Chairman Jerome Powell told Congress this week that the bank is not in a hurry to lower interest rates further.

He noted that it is unclear how Trump’s tariff plans will shape the Fed’s policies, as these measures may prompt an economic slowdown while prices rise.

On Wednesday, Trump called on the Fed to lower interest rates in order to “fight” with tariffs.

But some analysts said after the report that they no longer expect any tax rates to be lowered this year.

Wall Street stocks have been lowered most of the time, while interest rates on U.S. government debt have increased because investors dare to bet that borrowing costs will last longer.

Meanwhile, former Fed board member Randy Kroszner questioned whether Trump’s price changes to the course will rise.

“When President Trump last took office, he did raise tariffs on steel and aluminum, with little impact on overall prices,” Kroszner said in an interview with BBC News.

“So it’s not clear whether this time will be bigger. I mean, if it does lead to a global trade war, then they will have a bigger impact. But trade is a relatively small part of the U.S. economy . This is one of the reasons President Trump chose to focus on it.”