Ethereum Whales Have Bought Over 600,000 ETH In The Past Week – Time For A Price Upswing?

Ethereum has been working to regain momentum, keying $2,800 since last Thursday. The Bulls are in trouble as prices are still stuck at key supply levels, which has left investors worried about the short-term future of Ethereum. Many bullish years expecting the second-largest cryptocurrency to bullish years are now questioning their outlook, as huge sales pressure last week allowed ETH to drive ETH from $3,150 to $2,150 in less than two days.

Related Readings

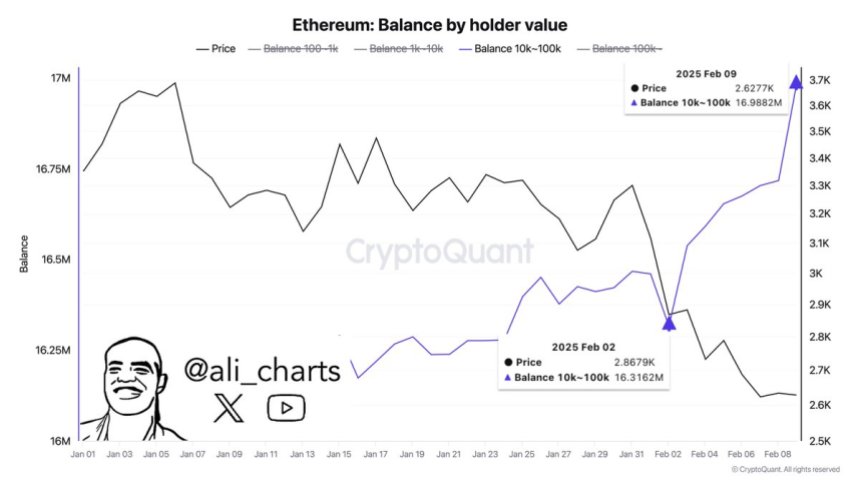

Recent price action has expanded the fear and uncertainty among retail investors, and many continue to sell in amid market turmoil. However, Chain World metrics tell a different story, which shows the growing confidence of larger players. Key data shared by top crypto analyst Ali Martinez shows that whales have accumulated more than 600,000 Ethereum over the past week, even as retail investors remain cautious. This difference emphasizes the key trends in the market – retail investors appear scared and responsive, while big players quietly buy ETH at discounted prices.

As the market struggles to deal with indecision and volatility, Whale accumulation It can lay the foundation for a major shift in momentum. If the Bulls manage to recoup the $2,800 and $3,000 levels, Ethereum may begin to resume rally. For now, everyone’s attention is focused on whether the difference will lead to a turning point in ETH price action.

Ethereum Investor Difference: Retail Fear and Whale Trust

Ethereum remains in a challenging position after a dramatic sell-off last week, with prices falling from $3,150 to $2,150 in less than 48 hours. Despite the $2,700 range being restored, ETH is still struggling to obtain key supply levels, keeping many investors cautious. Prices are still trapped under key resistance at $2,800 and the Bulls need to push up more than $3,000 to change the bearish trend and restore market confidence.

Key indicators Uncertainty shared by crypto analyst Ali Martinez reveals promising trends. Whales have accumulated over 600,000 Ethereum over the past week, indicating a strong buying activity for large players.

This accumulation trend is in stark contrast to the cautious behavior of retail investors, which continue to be sold in a situation of fear and uncertainty. The difference between whale accumulation and retail sales suggests that even if short-term price action remains unstable, large investors remain optimistic about Ethereum’s long-term outlook.

Related Readings

This whale activity brings hope to investors who think there is still a possibility of Ethereum surge. The breakthrough above $3,000, which coincides with the 200-day moving average, may mark a significant turning point in ETH, thus triggering rally toward higher price levels. Until then, ETH was still in a critical stage when navigating between bearish pressure and recovery potential.

ETH price action: key levels of recovery

Ethereum is currently trading at $2,620, trying to recover $2,700 that is fighting critical supply levels. The Bulls are under pressure to break through resistance at $2,800 and $3,000, as retractions of these levels will represent a reversal of the daily downtrend that has been ongoing since late December. The $3,000 mark has special significance because it aligns with the 200-day moving average, a widely observed indicator that represents long-term strength when prices rise.

The push for success over $3,000 could spark strong rally, with Ethereum quickly targeting higher price levels. Such a move will restore confidence in the market and indicate a potential bullish trend for ETH, which has been working to restore its foothold after last week’s dramatic sell-off.

Related Readings

However, if Ethereum fails to surpass the $2,600 mark, the outlook will be bearish. Failures below this level may open the door to further declines, and ETH may test lower demand areas in the coming days. The market is still at a critical moment, and Ethereum’s ability to retract and hold critical levels will determine its short-term direction as investors closely monitor the next step of action.

Featured images from DALL-E, charts from TradingView