Can Bitcoin Hold $97K? – 1-3 Month Holders’ Data Reveals Crucial BTC Demand

Bitcoin has been through a quiet weekend, with the price of around $96,500 for five consecutive days still in a standstill. This extended merger period highlights the current market’s sensational chart. The Bulls have been unable to recover control and push bitcoin to a critical $100,000, while the Bears have also worked hard to push prices to key demand levels.

Related Readings

The lack of direction has put investors and analysts on the signal of the next major action. Broader market sentiment remains cautious, with many questioning whether Bitcoin can resume bullish momentum or more in-depth corrections are coming.

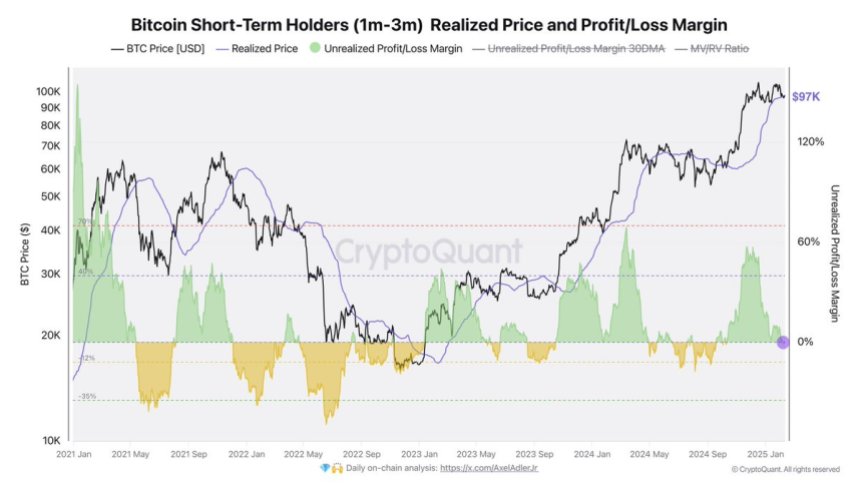

Crypto expert Axel Adler shares key metrics on X provide some insight into the current dynamics. According to Adler, the $97K level is a strong support area that represents the average purchase price Bitcoin short-term holders. This shows that despite the lack of upward momentum, a large percentage of market participants remain confident in Bitcoin’s ability to stay above this level.

Bitcoin demand remains strong as hesitation drives the market

Bitcoin has been navigating uncertainty and speculation for weeks or even months, leaving investors apart in the short term. The Bulls have been working hard to push the price above the key $100,000 mark, while the Bears are unable to break through the key support level. This impasse creates a market characterized by indecision, with volatility continuing to dominate price action.

The lack of obvious trends has caused frustration among investors, many of whom expect stronger rally earlier this year. Instead, Bitcoin has been integrating in scope, bounced between its all-time high of $109K and support levels of about $90,000. For now, the market seems to be in this stage, without an immediate catalyst explosion.

Top analyst Axel Adler offers Key insights into current dynamics. According to Adler, this $97K level is strong support because it represents the average purchase price for short-term holders who hold Bitcoin for one to three months. These data suggest that many market participants remain confident in Bitcoin’s ability to maintain that level, even if broader uncertainty is imminent.

If Bitcoin can maintain this support in the coming days, analysts expect a potential rally to return to a selling price of around $109,000. However, the inability to maintain this level may pave the way for further disadvantages, thereby testing areas with lower demand. Currently, the market is still on the edge, waiting for Bitcoin’s next decisive move.

Related Readings

BTC price action details: Key levels

Bitcoin is currently trading at $98,000 in the range between psychological resistance in the tightening range of the past week and a low of $94,500. This limited price action highlights the hesitation in the market, as bulls and bears are difficult to gain control.

In order for Bitcoin to confirm a short-term reversal and resume bullish momentum, the Bulls need to regain support at $98K and decisively exceed the $100,000 level. Breaking and staying above this critical resistance could be a move towards higher price levels, possibly targeting an all-time high of around $109K. Successfully recovering the $100,000 level will indicate increased strength and confidence in the market, which inspires investors’ optimism.

On the other hand, if the support level is not exceeded at $95K, the door can be opened to further be lower. A drop below $95K could put Bitcoin into a lower demand zone, while the $90K level serves as the next key support. Such a move can further fuel and expand the current integration phase.

Related Readings

As the market continues to consolidate, investors are closely monitoring these levels to understand clues to Bitcoin’s next move. With testing restrictions on bulls and bears, the coming days may determine the short-term direction of BTC prices.

Featured images from DALL-E, charts from TradingView