Bitcoin Indicator Signals Short-Term Holders Have Been Taking Profits – Is The Next Rally Near?

After a turbulent week, Bitcoin traded below $100,000. Last Sunday, cryptocurrencies faced extreme sales pressure, down more than 9% in less than 24 hours. Despite Bitcoin’s slight recovery on Monday, sales pressure remains, putting the market in a state of uncertainty.

Related Readings

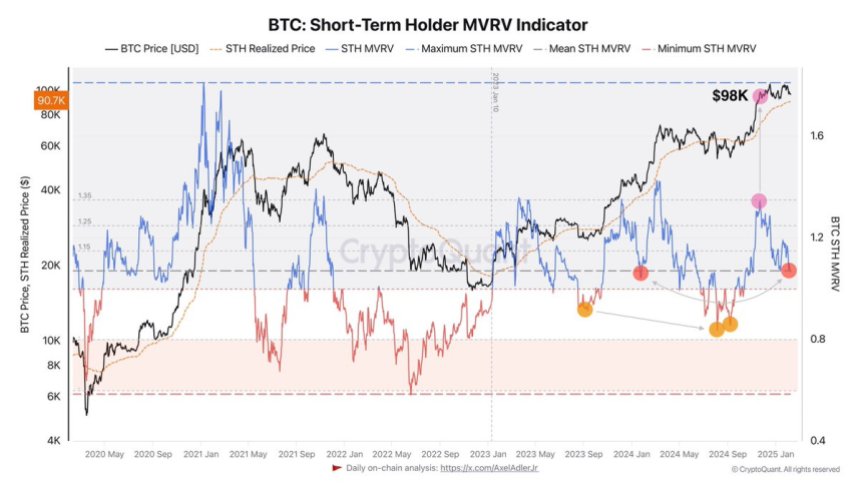

Key metrics shared by Axel Adler on X shed light on the current state of Bitcoin’s price action. According to Adler, the Bitcoin Short-term Holder (STH) MVRV metric has dropped from $98K with a value of 1.35, the average. This decline suggests that short-term holders have been actively profiting during this period of rising volatility.

STH MVRV is a key indicator for evaluating market sentiment in short-term participants. Historically, values above 1.30–1.35 indicate an overheated market that often leads to sell-offs. The indicator’s recent decline suggests that some short-term holders have withdrawn from their positions, possibly marking the end of the local overheating phase.

As Bitcoin Mergers Below $100kmarket participants closely monitor key support and resistance levels, hoping to identify the next major move in this unpredictable market environment. For now, profit and volatility dominate the narrative.

Short-term holders withdraw from their posts, Bitcoin faces ongoing sales pressure

Bitcoin has been struggling to cope with the increased volatility and sales pressure since early February, a trend that negatively impacts altcoins and meme coins, leading to bearish price action across the market. Analysts are increasingly asking for corrections as bulls show signs of fatigue, and price movements indicate a possible drop in further prices.

Key insights from CryptoQuant, shared Axel Adler on Xrevealing important changes in market dynamics. The Bitcoin Short-term Holder (STH) MVRV indicator is a key tool for measuring short-term holder behavior and has dropped from $98K and 1.35 to the average. The decline shows that short-term holders have been profiting due to recent market volatility.

Historically, STH MVRV is above 1.30–1.35, an overheated market, usually before a large sell-off. The current decline in the indicator shows that a number of short-term holders have withdrawn from positions, easing market pressure. Returning to average usually marks the end of the local overheating phase.

Related Readings

If demand remains strong, Bitcoin may enter a merger or side trading phase during this profit period. However, a decline below 1.0 below STH MVRV will mark the formation of a local bottom, which may lay the stage for future gatherings. With this uncertain period of market navigation, monitoring these key indicators is crucial to anticipate the next move of Bitcoin.

Prices are difficult to find directions below $100,000

After several days of lateral movement, Bitcoin trades for $96,700 after a few days of lateral movement. Prices cannot establish a clear direction, and the Bulls lost control after failing to hold a $100,000 mark last Tuesday. This lack of motivation puts the uncertainty atmosphere in the market to the edge of traders as Bitcoin hovers around key support levels.

The short-term outlook for Bitcoin is unclear, as neither the bull nor the bear decides to take decisive control. If Bitcoin fails to exceed the critical support level of $95,000, it may be more deeply reduced to the 90k demand zone. Such a move would indicate increased sales pressure, which could further weaken sentiment and expand the current phase of integration.

Related Readings

On the other hand, recovering the $100,000 level is crucial for the Bulls to regain control and raise prices. However, without a strong push, Bitcoin’s price action may remain unstable and uncertain. Market participants are closely watching any signs of breakout or breakdown as the next step may define the trajectory of Bitcoin in the next few weeks. At present, caution remains a common sentiment.

Featured images from DALL-E, charts from TradingView