Bitcoin to $500,000? Standard Chartered Exec Predicts Massive Surge By 2028

In recent customers notesGeoff Kendrick, head of digital assets research at Standard Charter, predicts that Bitcoin (BTC) could soar to $500,000 by the end of 2028. The executive attributes the potentially extraordinary price increase in BTC to two major factors.

Factors driving BTC prices

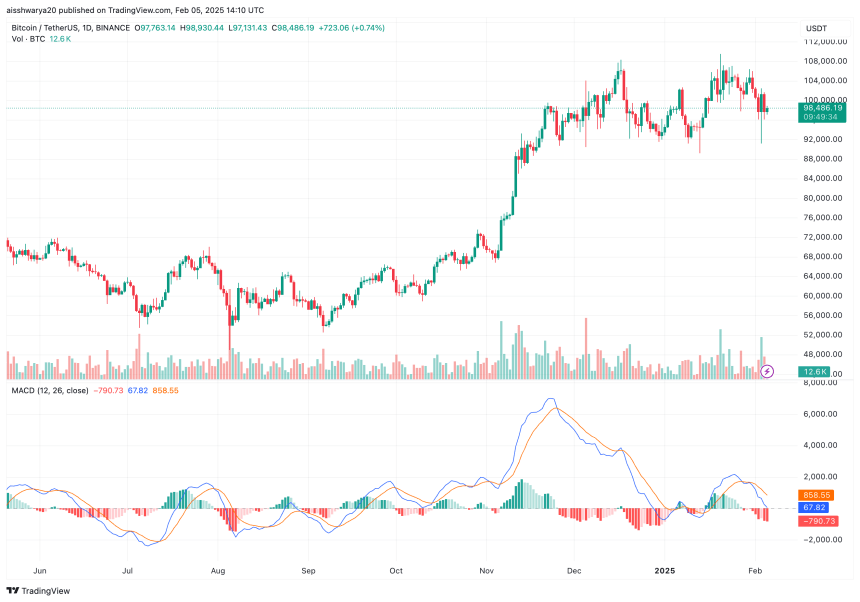

While 2024 is a landmark year for the world’s largest cryptocurrency – seeing it reach multiple historical peaks (ATHs) and surpassing $100,000 for the first time – the price in 2025 is more modest. Since January 1, BTC has climbed from $94,000 to $98,486 as of February 5.

However, Kendrick believes that from the second half of 2025 to 2028, Bitcoin can enter another parabolic growth phase. He predicts that BTC will reach $200,000 by the end of 2025, by the end of 2026, by the end of 2026, by the end of 2027, by the end of 2027, and by the end of 2028, it will end up at $500,000.

Kendrick attributes this ambitious price trajectory to two key factors: improved investor access and reduced volatility. In January 2024, the U.S. approval of spot Bitcoin exchange trade funds (ETFs) in the U.S. significantly simplified investors’ access to BTC.

Additionally, as Bitcoin’s price and market capitalization grow, its volatility has been declining. The larger market capitalization makes it difficult for any single trader or entity to manipulate the price of BTC.

Kendrick expects this trend to continue as the ETF market matures and supports financial infrastructure within the crypto market. Kendrick added:

So far, ETFs have attracted a net inflow of $39 billion, supporting the theory of releasing pent-up demand through increased access. Donald Trump ordered the government to assess potential National digital asset inventory It is equally important because this can encourage other central banks to consider Bitcoin investment.

If Trump’s administration moves towards building national digital asset reserves, then Bitcoin’s volatility could drop further. This may attract traditional venture investors who have traditionally hesitated due to the price fluctuations of BTC.

Bitcoin price forecast has a bullish background

Over the past few days, BTC faced Increase Volatility briefly fell to $91,000 amid concerns over U.S. trade tariffs on Mexico, Canada and China. However, analysts are confident in Bitcoin’s long-term bullish outlook.

Related reading

For example, experienced crypto trader Alex Becker statement BTC’s $150,000 price target is too conservative. Similarly, a Report According to CryptoQuant, BTC could reach between $145,000 and $249,000 according to the Trump administration.

Re-link data suggestion That Bitcoin “whale” – the investor who controls crypto wallets with a large number of BTC holdings – is positioned for a bullish price trajectory, demonstrating confidence in BTC’s long-term growth under the Trump regime. At press time, BTC was trading at $98,486, down 1.3% in the past 24 hours.

Featured images from Unsplash, charts from TradingView.com