Bitcoin Struggles To Hold $100,000 As China Strikes Back With US Import Tariffs

Yesterday, Bitcoin (BTC) was relieved, because the United States delayed the 25 % of its proposal Mexico and Canada’s trade tariffs for one month. However, the United States imposed 10 % tariffs on China, prompting Beijing to take revenge. The upgrade reduces the price level of the BTC to the key $ 100,000.

Bitcoin suffers a trade war

After 24 hours of turmoil, around Mexico and Canada’s trade tariff uncertainty, BTC experienced a brief relief rally to $ 102,000. This is after the 30 -day delay of US President Donald Trump announced its 30 -day delay of tariffs on two North American countries.

Related reading

However, the implementation of China’s tariffs on China today has triggered a sharp decline, which has led BTC to exceed $ 100,000. In response, the Chinese Ministry of Finance announced a new countermeasure.

Starting from February 10, China will impose a 15 % tariff on coal and liquefied natural gas, as well as 10 % of tariffs on agricultural equipment, crude oil and certain vehicles.

In addition, Beijing also accused the United States of violation of the World Trade Organization (WTO) regulations with its unilateral tariff policy. The Ministry of Commerce of China also said that it will tighten the export control of key raw materials, including molybdenum, Inistium, BISMUTH, TELLURIUM, and TUNGSEN, and cited national security issues.

With the upgrading of trade tensions between the United States and China, analysts predict that the volatility of the cryptocurrency market will increase in the next few days. Michael van de Poppe, a well -known crypto strategist, shared his prospectThe

Bitcoin Rapid rebound, currently in this scope. I think we will see the new ATHS in February, and it is normal to correct it after such a strong rebound. With the volatility of the roof, as long as Bitcoin still exceeds $ 93,000, there may be a new ATH.

At the same time, cryptocurrency traders and investors Phoenix suggested that in a continuous trade war, BTC can establish a new scope of transaction. However, history shows that increasing tariffs may cause trouble for cryptocurrencies.

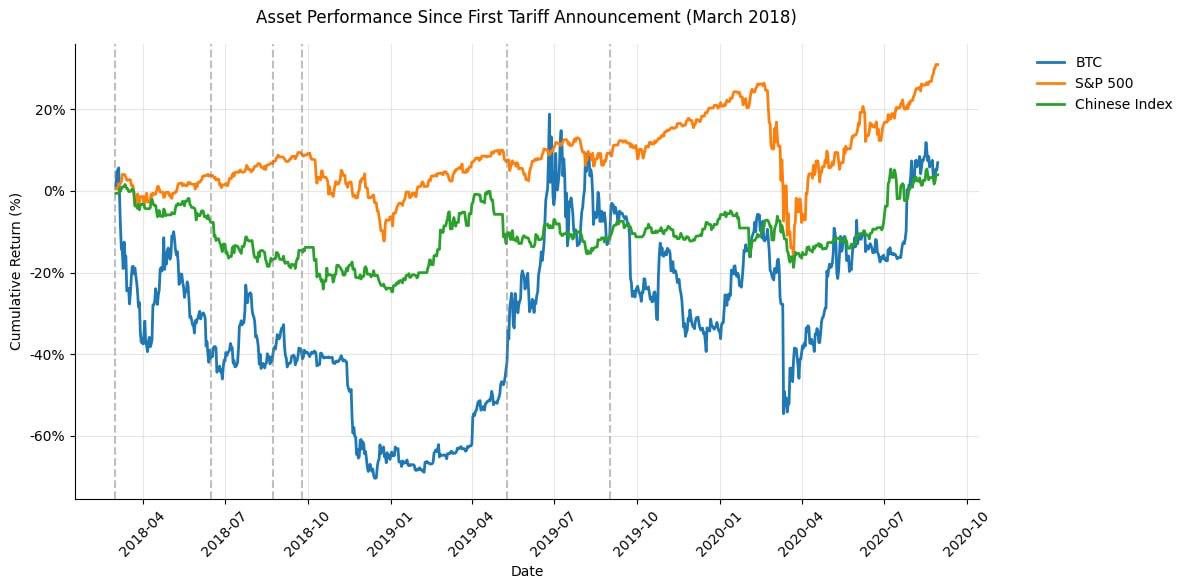

Web3 lovers MERTS.ETH tip When Trump launched a trade war with China for the first time in 2018, BTC fell 65 % in the X post in 2018. The effect is not limited to digital assets, because within a few weeks after the implementation of tariffs, the S & P 500 Index also dropped by 12 %.

What are the shortcomings of BTC?

As Bitcoin strives to hold a price level of $ 100,000, people are worried about the potential segment of the price. Crypto analyst Ali Martinez (Ali Martinez) tip Come out, if BTC cannot hold a support level of $ 97,190, there may be More pain For top digital assets.

Related reading

Analysts made another observation of BTC’s current appearance trading Use the flag pattern. At the time of release, the transaction price of BTC was $ 99,961, an increase of 1 % in the past 24 hours.

Charts from unsplash, charts of X and TradingView.com