Whales Are Manipulating ETH Price

The main fluctuations in the Ethereum market caused a wave of response from social media yesterday. One of the co -founders of Ethereum claimed that some large holders (or “whale”) deliberately reduced the price of assets.

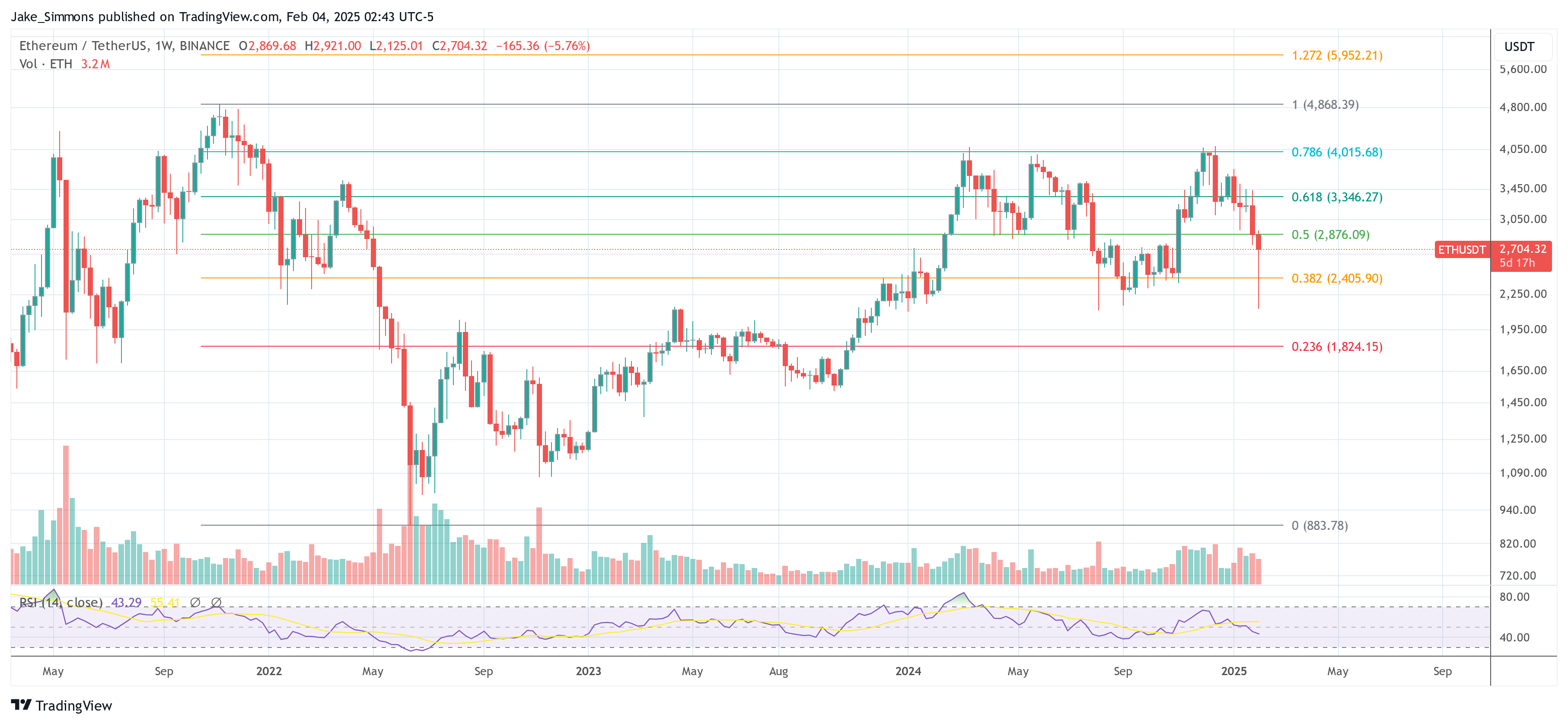

The event had a fever on Monday, February 4th. At that time, ETH price dropped from about $ 2,900 to a low price of $ 2,120, and then rebounded violently. Despite the plunge in the market, Ether finally closed this day, and the green Wick accounted for 26 %, which was a rare price rebound in such a short window.

Ethereum is manipulated by whales?

Analysts attribute dramatic movements to external macroeconomic forces. The most famous is the trade war under President Donald Trump. back Tariffs imposed on Mexico and Canada Earlier that day, the president later made a arrangement that stimulated the global market, including cryptocurrency, to recover rapidly.

Related reading

The turbulence leads to an observer known as the “intern” (@Intern) (@Intern), and published a distinctive emotion on X: “ETH is about to die in front of us. Honestly, I never thought it would happen. “

exist replyEthereum co -founder and consensus chief executive officer Joseph Lubin provides a prospect of composition, emphasizing that these types of price fluctuations are not uncommon for digital assets: “It often occurs. Then it has surged. We have surged. What you see is whale Use economic turmoil and negative emotions to shake hands, stop, and then return when they can run the same script in reverse. “

Lubin’s statement has a cyclical understanding of the fluctuations of cryptocurrencies, which shows that larger participants use market anxiety (usually intensifying macro -development) to sell less elastic investors.

Several famous cryptocurrency traders also comment on these incidents, especially accusing the whale leaders’ allegations.

A famous character HSAKA (@HSAKATRADES) suggested that newcomers do not think that the decline of ETH is purely driven by the organic market emotion: “Dear rookie, Ethereum does not naturally fall. The deceitful selling orders are sold for rookie and risk managers to sell “low repurchase”.

Related reading

The concept of consistent “deception” strategy (a large number of selling orders emit a large number of selling orders in the cryptocurrency community, and then canceled or only partially filled. According to reports, the strategy aims to cause panic selling, so that the so -called whale is more beneficial Price level accumulate positions.

The famous merchant Pentoshi (@Pentosh1) proposed a short but sharp response, emphasizing the ETH method Compared to Bitcoin (BTC), poor performance In the past three years: “So far, three years shake. I hope you are right.”

Community member EVMAVERICK392.ETH (@EVMAverick392) why specially raised the problem of whale: “Maybe I sound naive, but why do whales perform this operation on Ethereum?”

Lubin’s response is to draw similar to traditional bank robbery, and implies that the uneasy wave of uneasiness around the Ethereum ecosystem recently makes the assets the main goal: “Why do bank robber robbers robbery banks or habits? At present, (unreasonable) The FUD of the Ethereum ecosystem is the most obvious. “

At the time of release, ETH’s transaction price was $ 2,704.

Use the characteristic images created by Dall.e, the chart of tradingView.com