Bitcoin Trades At Discount For The Past Month Signaling Selling Pressure – What This Means

The volatility is still the normal state of the Bitcoin market, and its positive price fluctuations have defined the past few days. On Monday, BTC fell to $ 97,000, soaring yesterday to $ 106,000. However, the price has been reviewed since then, and now it has consolidated the $ 102K mark, so that investors are in a marginal state in the next step.

Related reading

Top analyst DAAN shared the key insights of Coinglass, indicating that Bitcoin traded most of the COINBASE Premium index in the past month with the coinbase discount. This means that the price of other spot exchange is higher than the Coinbase, which shows that the sales pressure of American investors has increased. Coinbase Premium usually shows that the demand for institutions and ETF buyers is strong, thereby enhancing the mood of watching bullish. However, due to the current index, the US market seems to be indecisive.

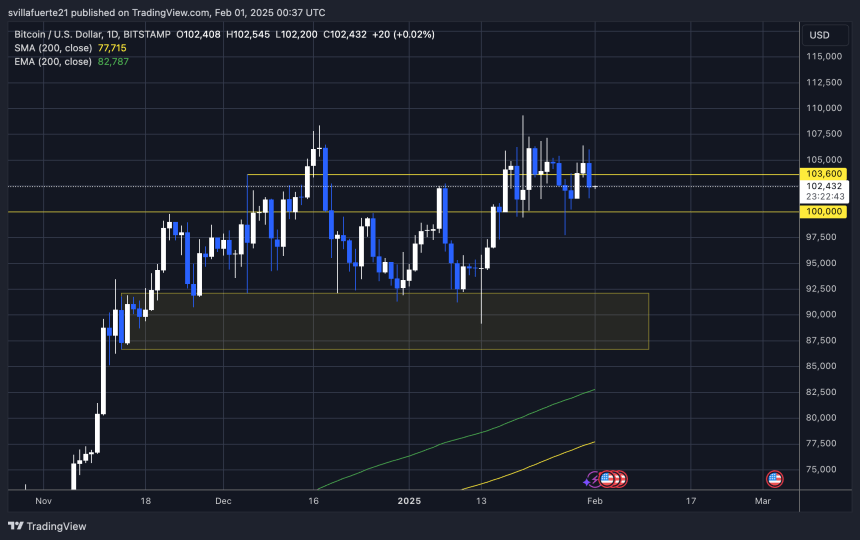

With the merger level of Bitcoin lower than the highest point in historyTraders are paying close attention to whether it can recover the key resistance level or face another wave of sales pressure. If the BTC breaks through $ 106K again, it may test the highest test. However, losing a $ 100,000 support level may lead to further shortcomings and expansion mergers. In the next few days, it is essential to determine the next stage of Bitcoin.

As the market waits for the next step, Bitcoin is at a critical level

Bitcoin failed to re -test its highest history (ATH), and now seeking support to strengthen the next leg is a key moment. The level of $ 110,000 is still a key psychological goal that is higher than ATH. Once the BTC breaks through and occupies it above it, the entire market may enter a new bullish stage.

Related reading

Despite the recent rise, BTC is still trying to obtain a clear breakthrough, leading to uncertainty of investors. Analysts are still split-some people regard it as a natural consolidation before Bitcoin adopt the next major measure, while others are worried that if BTC cannot maintain a key support level, it will be more correct.

Top analyst DAAN sharing COINGLASS key insightsIt revealed that most of Bitcoin traded with common discounts in the past month. This means that the price of BTC’s coinbase is low compared to other spot exchanges, which indicates that sales pressure mainly comes from investors in the United States.

Historically, Coinbase Premium marks strong demand for institutions, especially from ETF and major financial participants. However, as the current index is flat, the US market seems to be cautious. For BTC’s breakthroughs in viewing bullish, it is important to hold more than $ 102K and recover 106K. If Bitcoin loses these levels, it may receive support of $ 100,000 again, which will be discovered by breakthrough to prices.

Bitcoin price consolidation is lower than the key level

The current transaction price of Bitcoin is $ 102,400, showing signs of merger, because the price remains between $ 106,000 and the support level of $ 100,000. This series defines the short -term exercise of Bitcoin, and the breakthrough in any direction may determine the next trend.

The subdivision of less than $ 100,000 may lead to further mergers and even deeper corrections, thereby delaying Bitcoin’s bullish breakthrough. If the BTC cannot maintain this psychological level, the sales pressure may increase, and the price increases the price before trying to restore the attempt.

On the other hand, recovering and holding more than $ 106K will be a major bullish signal, which indicates that the price discovery is coming. This will remove Bitcoin to test its historical highest (ATH) and marked the path of $ 110K, which may trigger a new rally.

Related reading

At present, with the change of market waiting to confirm the short -term direction, uncertainty is still the main theme. With the increase of volatility, traders are closely monitoring these key levels, because they know that clean breakthroughs or decomposition will set the tone for the next major measures of Bitcoin.

Featured images from Dall-E, chart of tradingView