Analyst Explains Bitcoin’s Path To $150,000 – Details

In the past week, the Bitcoin (BTC) market has less losses than returns, resulting in a net price of 2.37 %. Nevertheless, investors and market experts still have highly increased the potential of high -level cryptocurrencies in the current bull running.

Bitcoin preparation for $ 150,000 price target-analysts

exist Quicktake post On Cryptoquant, analysts of the username Percival touted Bitcoin, reaching a price of $ 150,000 in the current bull cycle. Percival commented on the current market status, which may make some investors feel disturbed, and pointed out that the price trajectory of Bitcoin is characterized by sharp upward peaks and mergers, similar to the structural dynamics of any mature financial assets.

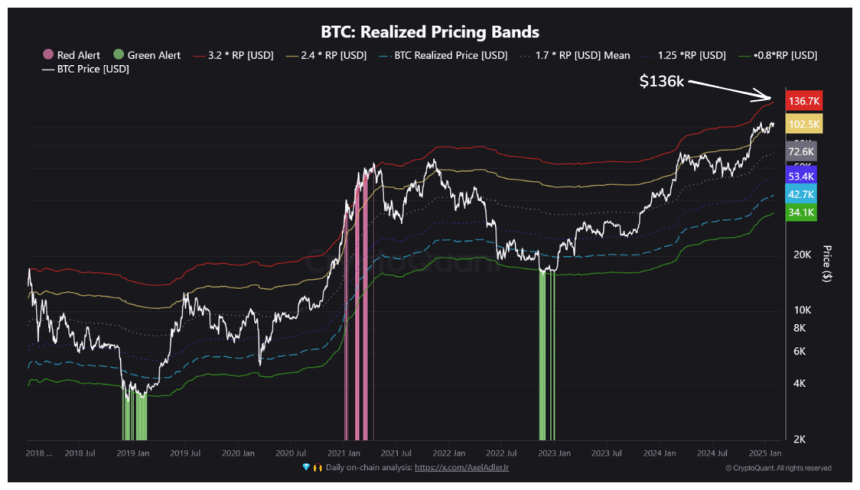

Regarding future price changes, analysts refer to the Fibonacci expand from the Bitcoin cycle as low as $ 15,450 in November 2022, and the merger of 2024 will be $ 48,934. The data of the price board implemented by Bitcoin further supports that this is a market indicator. The market indicators analyze the supply based on different purchases.

However, to trade Bitcoin at a price of $ 150,000, the assets must reach a total market value of $ 3 trillion. At present, strong historical data supports this assumption. As far as the context is concerned, Percival explains that Bitcoin has achieved CAP increased by 470 % in the 2021 view of the 2021. At present, the implementation of CAP has only increased by 111 %, which shows that the potential for market growth is greater.

In addition, analysts have determined the possible source of demand for the expected US $ 3 trillion market expansion, one of which is American Bitcoin Live ETFEssence

It is worth noting that these investment funds received nearly $ 40 billion in the first trading year in 2024. Donald Trump administrationThrough these ETFs, institutional demand may be stronger. In addition, Percival also includes the Bitcoin futures market, which is currently worth $ 95 billion. As another potential bullish driver for market expansion

BTC price overview

During writing, the transaction price of Bitcoin was 102,334, which reflected a decrease of 1.66 % on the last day. However, after the outstanding performance in January, the moon table of flagship cryptocurrencies rose by 7.93 %.

According to data from the forecast website CoinCodexThe fear and greed index is 76, which indicates that investors are extremely greedy. Looking forward to the future, the analysts of Conincodex predict that Bitcoin’s transactions are $ 113, 658 and $ 132,823, respectively, $ 132,823, respectively. In particular, they have predicted that digital assets will cross $ 150,000 in the next three months.