Bitcoin HODLer Selloff Extends To 1.1 Million BTC As Profit-Taking Continues

Data on the chain show that the long -term holders of Bitcoin have recently exchanged a lot of cryptocurrencies from their holdings.

Long -term holders of Bitcoin have recently realized a significant profit

In its latest weekly report, chain analysis company Glass node It has discussed how the supply between BTC short -term holders and long -term holders has changed.

this”Short -term holder“(STH) and”Long -term holder“(LTHS) This refers to the two major departments of the Bitcoin market based on the holding time. Investors who buy coins in the past 155 days fall in the front queue, while those who hold time longer than this period are Put in the latter.

Statistically speaking, the longer the investor holding a coin, the less likely they will sell coins at any time. Therefore, it can be considered that STH includes the weak hands of the market, and LTHS represents a resolute entity.

Now, this is the supply chart of the two groups shared by the company in the report:

As shown in the figure above, Bitcoin LTHS participated Sell Recently, as their total shareholding has decreased by about 1.1 million BTC. This shows that the price explosion is more than $ 100,000, even if these diamonds cannot sit down.

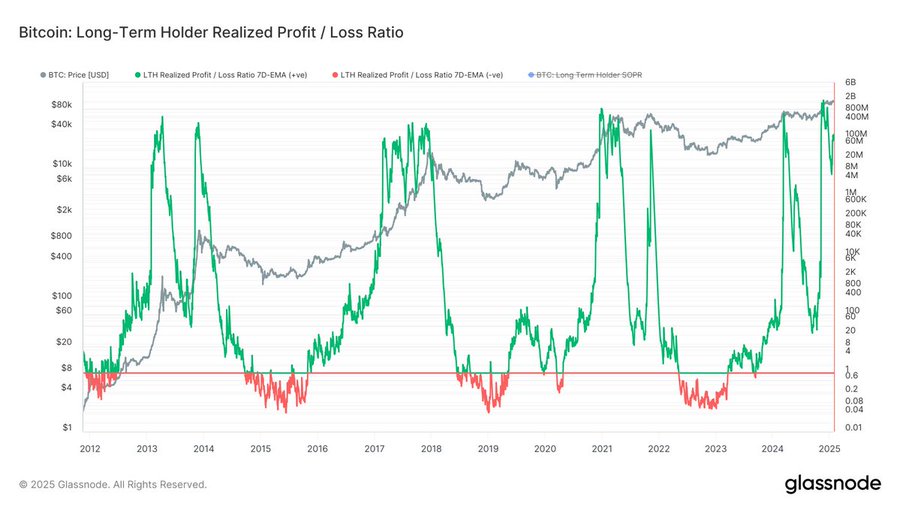

exist postal On X, GlassNode shared the recent data of LTHS’s comparison of profit and loss locking.

From the chart, we can see that the profit margin of Bitcoin LTH is much higher than the recent loss. This trend has also been witnessed on every bull in the past.

This model is not surprising, because LTHS tends to accumulate such a huge income through their patience, so that when the bulls are running, they are ready to gain a lot.

Naturally, with the latest sales of LTS, STH supply increases the same number. Whenever LTHS is sold, some new buyers will get coins.

During the bull market, a large amount of fresh demand often absorbs LTHS’s profit. As long as the market balance is maintained, the rally will continue. However, once the demand is used, the price reaches the highest level.

Now, the Bitcoin market can continue to absorb Hodler’s positive profit frenzy. It remains to be observed.

BTC price

When writing this article, Bitcoin’s transaction was about $ 105,100, an increase of more than 2 % last week.