Bitcoin Profit-Taking Drops 93% From December Peak – What’s Next For BTC?

After testing lows of $90,000 multiple times over the past two months, Bitcoin (BTC) briefly broke out of its tight trading range earlier this week to reach a new all-time high (ATH) of $108,786. However, a recent report from Glassnode suggests that the ongoing consolidation observed in recent months may be coming to an end and the leading cryptocurrency is ready for the next phase. important move.

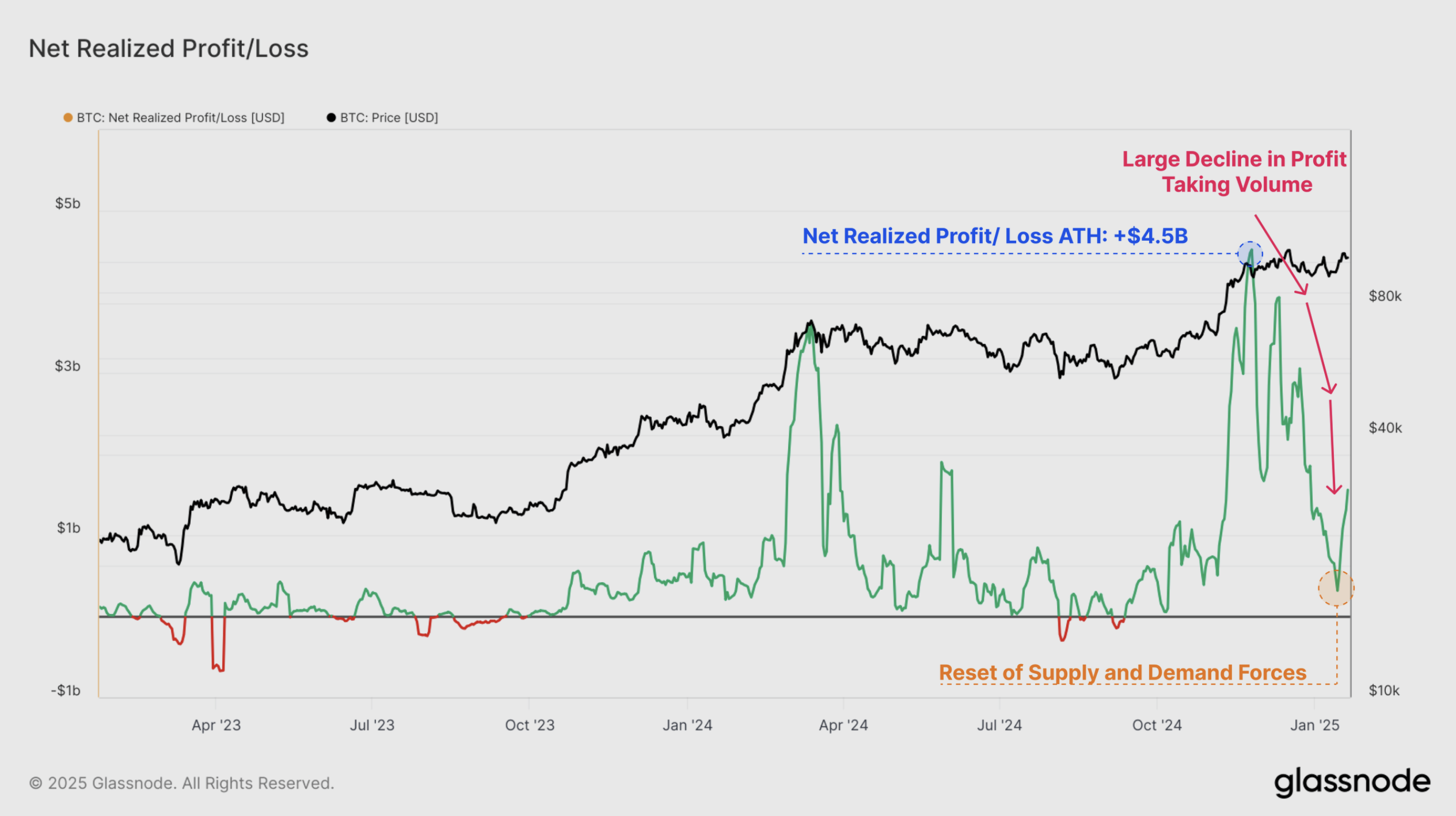

Bitcoin profit-taking drops sharply

According to the latest news version Glassnode’s “On-Chain Report of the Week” shows that BTC profit-taking volume has dropped significantly, from peak It fell from US$4.5 billion to approximately US$316.7 million in December, a significant drop of 93%.

The decline in profit-taking signals a significant reduction in pressure on Bitcoin sellers. Currently, BTC is trading within a narrow 60-day price range, a pattern that often precedes large market moves.

Related reading

When Bitcoin trades within a tight price range, it either signals the beginning of a bull market rally or the final stages of a bear market surrender. A key metric highlighted in the report is realized supply density, which measures Bitcoin’s supply concentration around the current spot price in a 15% range (plus or minus).

Currently, approximately 20% of Bitcoin supply is within this price range, indicating high price sensitivity. Small price changes within this range can severely impact investor profitability, thereby exacerbating market volatility.

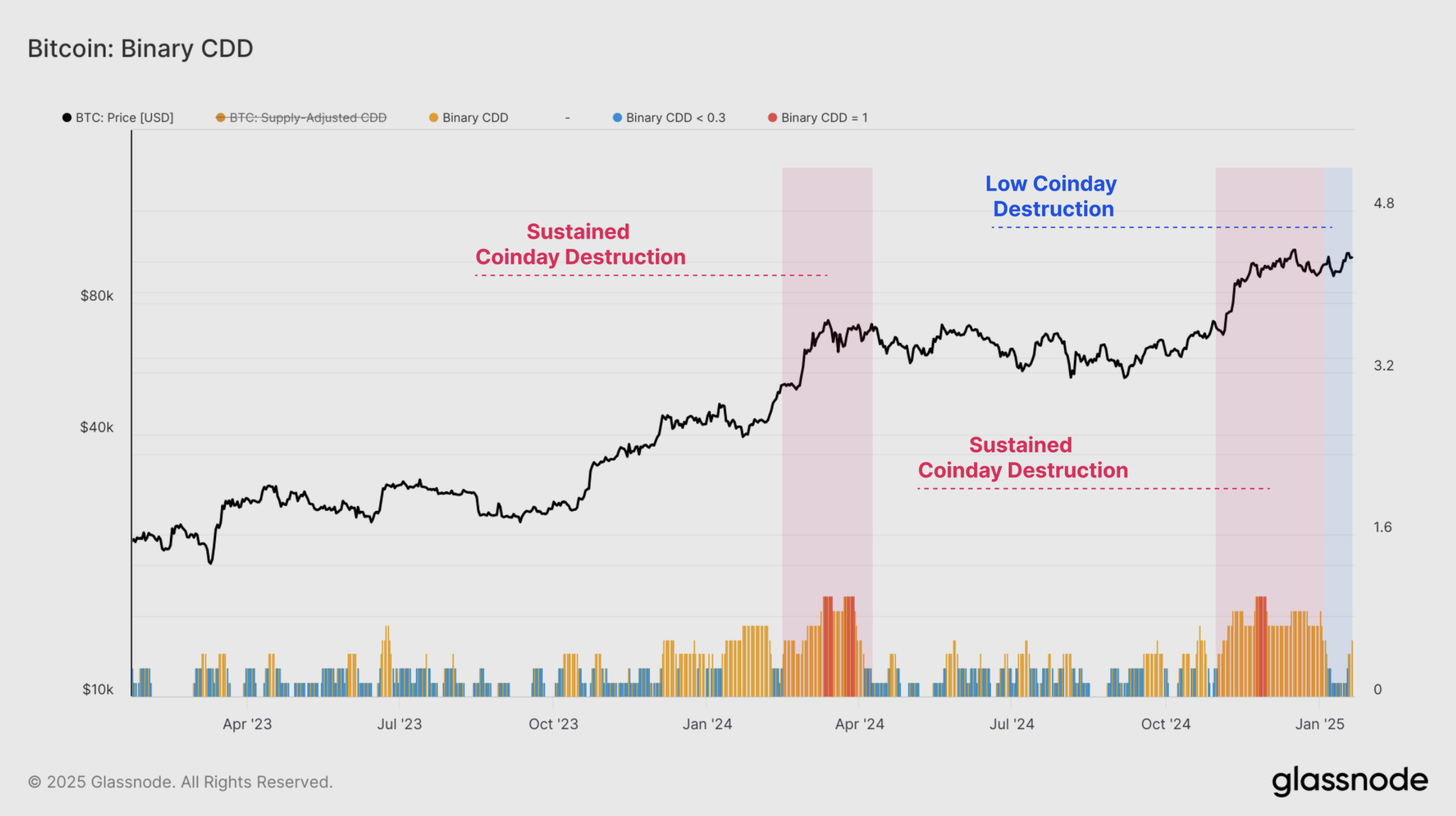

The report also pointed to a key indicator, CoinDay Destruction (CDD), as further evidence of declining seller pressure. CDD values were significantly higher in late December and early January, reflecting increased activity from long-term holders. However, the indicator has cooled in recent weeks.

For the uninitiated, CDD measures economic activity in spent BTC by tracking how long coins are held before being transferred. It multiplies the number of tokens by the number of days of inactivity, highlighting whether long-term holders are spending their tokens.

The recent decline in CDD suggests that many BTC investors planning to take profits have already taken profits within the current price range. Therefore, the market may enter a new price range to unlock the next wave of supply and liquidity.

Long-term investors return to accumulation mode

The report also highlights the Long-term Holder (LTH) binary spending indicator, a key metric tracking Bitcoin holdings by long-term investors. The report states:

Consistent with the previous heavy profit-taking volume, we can see a significant decrease in total LTH supply as the market reached $100,000 in December. The rate of LTH supply decline has since stalled, suggesting allocation pressure has eased in recent weeks.

Additionally, LTH inflows to cryptocurrency exchanges dropped significantly, falling to just $92.3 million from $526.9 million in December. That said, total LTH BTC supply is showing signs of growth, indicating that long-term investors return to accumulation mode.

Related reading

Meanwhile, retail demand for Bitcoin remains Strong. Investors holding less than 10 BTC have purchased a total of approximately 25,600 BTC in the past month. In comparison, Bitcoin miners minted only 13,600 BTC during the same period. At press time, BTC was trading at $104,207, up 0.5% in the past 24 hours.

Featured images from Unsplash, charts from Glassnode and TradingView.com