$12k Void Opens Up Possibility Of Crash Toward $75,000

Bitcoin The scope of correction has been expanded It fell below the psychological $100,000 level in the past 24 hours. As of this writing, Bitcoin is struggling to hold on to the $94,000 mark after briefly recovering from its recent plunge to $91,000.

Related reading

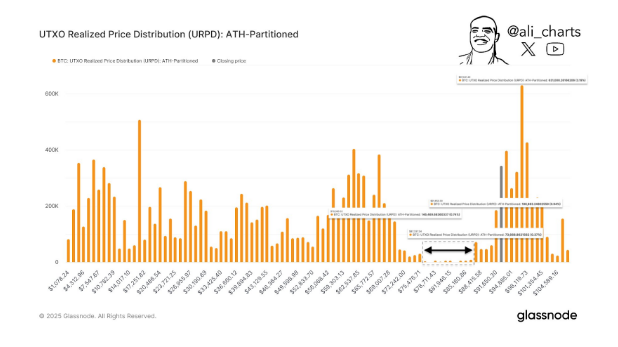

At present, the price outlook for Bitcoin has taken a cautious turn, with cryptocurrency analyst Ali Martinez highlighting a $12,000 gap in Bitcoin prices between $87,000 and $75,000. analyzebased on the Bitcoin UTXO Realized Price Distribution (URPD) ATH zoning, revealed the lack of significant support in the range and raised concerns about a rapid decline towards $75,000.

The $12,000 gap suggests a lack of support between $87,000 and $75,000

Data from the Bitcoin UTXO Realized Price Distribution (URPD) ATH Zoning indicator shows a lack of significant realized price activity in the range between $87,000 and $75,000. UTXO is a relatively quiet but important technical indicator that provides insight into Bitcoin’s distribution at different price levels, with a focus on UTXO (Unspent Transaction Outputs).

Therefore, analyzing UTXO helps determine the price level at which Bitcoin holders have currently realized gains or losses.

As Ali Martinez pointed out, the range between $87,000 and $75,000 opens a $12,000 gap that could easily have a negative impact on Bitcoin. This is because this range represents “little support,” meaning that historical buying activity is not enough to stabilize Bitcoin’s price if it moves into this area. In this way, the gap is increased The risk of a sharp correction Will Bitcoin fall below the cap?

Market Impact of $12,000 Vacancy

As it stands, the $12,000 threat will only be valid if Bitcoin falls below $87,000. Although Bitcoin has largely remained above $90,000 during the correction since November, it recently fell to $91,000 and may eventually fall below $90,000. This concern is amplified Crypto Fear and Greed Index Shifts to Neutral Territory, Accompanied by Surge in Crypto Fear and Greed Index Bearish sentiment abounded on social media.

If Bitcoin falls below $90,000, it may continue to fall to $87,000. This, in turn, is likely to lead to a rapid price drop to $75,000. This situation will undoubtedly test investors’ bullish sentiment and Bitcoin’s ability to sustain Predictions for a long-term bullish trajectory.

Related reading

On the other hand, you could easily argue that continued consolidation provides an opportunity to accumulate more Bitcoins. according to CryptoQuant analysts said that the short-term SOPR indicator is currently below 1, which means that many short-term investors are selling Bitcoin at a loss. However, history shows that this phenomenon often precedes major uptrends, making it Good time to accumulate.

As of this writing, Bitcoin is trading at $94,350.

Featured image via Getty Images, chart via TradingView