Dogecoin Hodlers Surge In 2025: Will Price Skyrocket Next?

Dogecoin (DOGE) has added more than 29,000 new wallets since January 1, according to on-chain analytics firm Santiment. The company shared its findings earlier today (January 10) via Chainlink (LINK)) data. New wallets grow.

Dogecoin holders continue to increase

“As the roller coaster ride for crypto’s top asset prices kicks off in 2025, the number of holders has fluctuated significantly since the new year,” Santiment said. Write via reverse operation).

Related reading

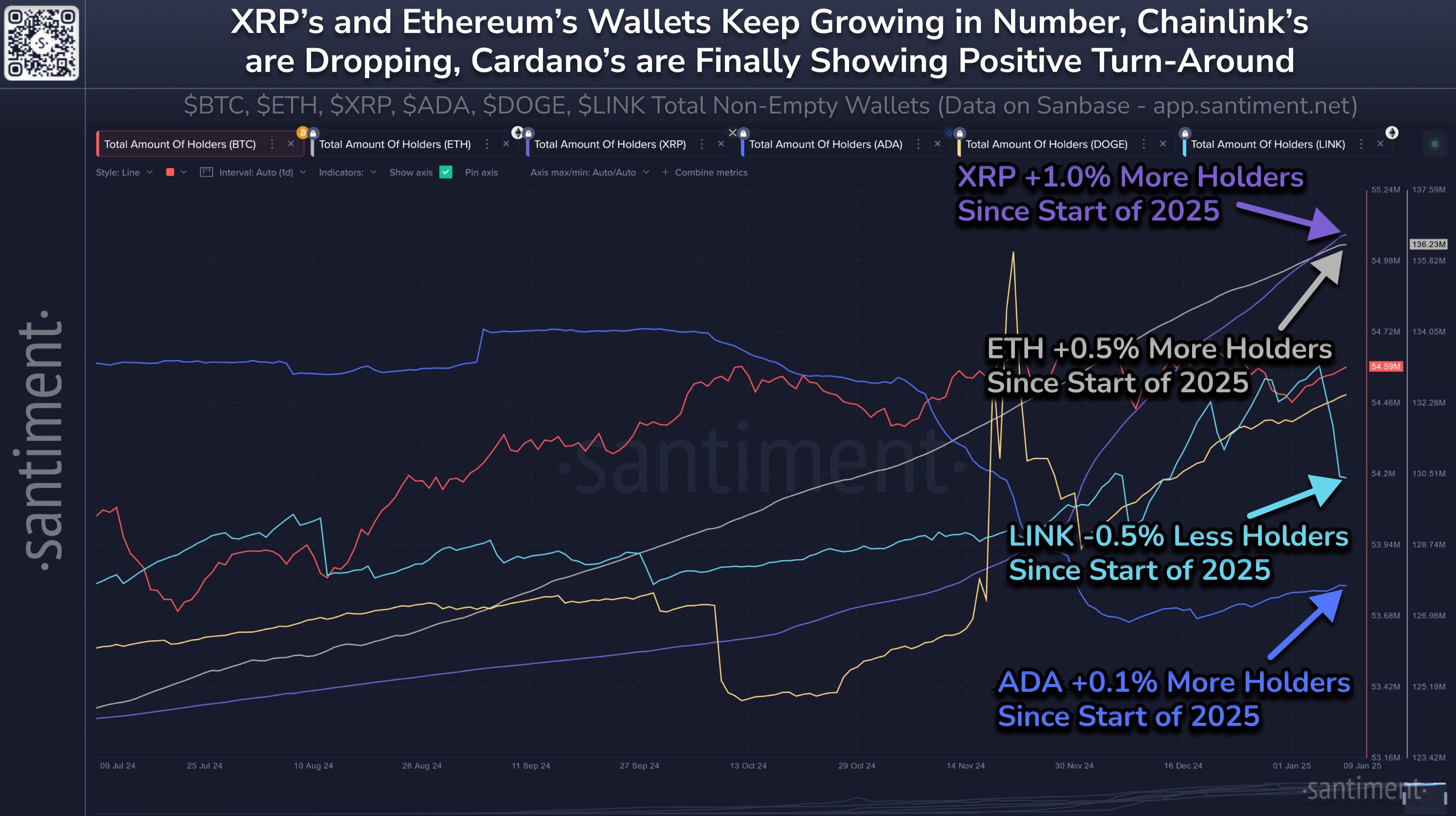

Santiment’s chart shows that both Ethereum and XRP holders will see significant growth starting in 2025. The company observed the number of Ethereum wallets growing by +645K, while XRP grew by +58K. Meanwhile, Bitcoin maintains a +102K gain and Cardano is up +2.8K. Notably, the number of Chainlink holders fell by 33,000 during the same time period.

The on-chain analytics firm noted: “XRP and Ethereum wallet numbers are growing, Chainlink wallet numbers are declining, and Cardano wallets are finally seeing a positive turn.” Trendline annotation shows that since the beginning of 2025, XRP Holders increased by 1.0%, Ethereum holders increased by 0.5%, and Cardano holders increased by 0.1%. In comparison, Chainlink fell 0.5%. While the chart doesn’t show specific numbers for Dogecoin, there is a clear and strong upward trend.

However, Santiment’s in-depth analysis noted that overall trading volume across the cryptocurrency space has dropped significantly since mid-December 2024. Meme coins like Dogecoin were particularly affected, with speculation-driven transactions declining significantly. “Despite some bullish developments, overall trading volumes across the cryptocurrency market have been declining since mid-December 2024,” Santiment explained.

The company reported that daily trading volumes for the top ten cryptocurrencies have fallen by an average of 13% over the past two weeks, with Ethereum suffering the largest decline of 17%. Exchanges like Binance Coin library Spot volumes showed declines of 15% and 12%, respectively, which analysts attributed to seasonal factors, reduced whale activity and uncertainty about impending regulatory changes.

Related reading

Another key metric that Santiment highlights is MVRV (Mean Value to Realized Value), which tracks average trader returns. The 30-day returns for the most active wallets among the top assets are currently in negative territory, indicating potential opportunities for contrarian buyers. As reported yesterday, Dogecoin’s MVRV is -8.89%, showing ‘Bloody in the streets’ moment.

“Across the top market caps and the vast majority of altcoins, the average trader’s portfolio active over the past 30 days has declined by a sizable amount…which means that mathematically speaking, adding to a position or opening a new one is riskier than usual Be low, Santiment points out.

Looking ahead, Santiment highlights the multifaceted market environment affected by regulatory changes, institutional strategies and varying degrees of risk appetite. Firm calls attention to upcoming cryptocurrency sentiment Trump administrationtighter regulation of global markets and the changing role of large investors (“whales”) in influencing price dynamics.

“We recommend taking a closer look at how the whales behave and how much blood there is in the streets,” Santiment said. “Cryptocurrency is a zero-sum game, although it often feels like most bullish communities are making money together and losing money together.”

Technical diagram of DOGE

From a technical perspective, Dogecoin mirrors Bitcoin’s recent moves, breaking below key Fibonacci levels on the 4-hour chart. DOGE fell below the $0.373 handle (0.5 Fib level), which is seen as the main support on the lower time frames, before testing the $0.346 threshold (0.382 Fib level).

Price action eventually eased briefly near the 0.236 Fib line at $0.314, where DOGE bounced back, once again tracking Bitcoin’s rally. Recovering the $0.382 Fib (~$0.346) is critical to regaining bullish momentum; failure to do so could open the door to further declines to $0.26 – last seen on December 20, 2024.

Featured image created using DALL.E, chart from TradingView.com