Impact On Bitcoin Price Unveiled

Bitcoin price is inching closer to the coveted $100,000 mark, a promising development, surpassing $98,000 for the first time since late December.

Cryptocurrency analyst Ari Martinez highlights several key indicators that could signal further bullish momentum for the leading currency cryptocurrency As the market begins to recover.

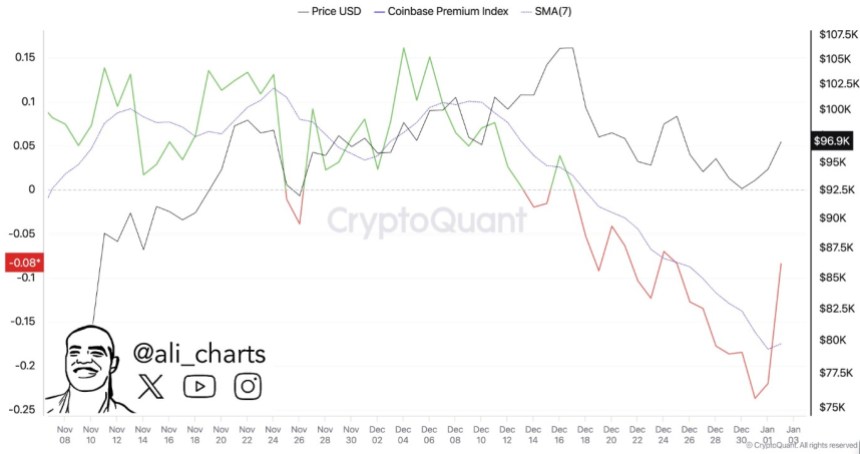

Coinbase Premium Index Heads Lower, Bitcoin Price Surges

One of the important indicators discussed Martinez’s Coinbase Premium Index recently hit -0.23%, its lowest point in two years. The index measures the difference in Bitcoin prices on Coinbase and other exchanges.

The negative premium suggests that U.S. investors may be less willing to pay a premium for Bitcoin, but the current rally may indicate that institutional interest in the asset is shifting toward growth.

Related reading

Martinez also famous The recent rise in Bitcoin prices comes against the backdrop of a clear trend of withdrawals, with more than 48,000 Bitcoins (valued at more than $4.5 billion) withdrawn from exchanges in the past week. Despite a brief price correction late last year, this trend points to bullish investor sentiment.

Despite these positive signs, Martinez warned that Bitcoin is at a critical juncture. he emphasize The importance of maintaining a close above the 50-day moving average (MA), which is currently just above $96,000.

Failure to maintain this level could lead to a potential downward correction. On the contrary, the closing price continues to be higher than 50 day moving average Could signal the end of the recent correction and confirm a stronger bullish trend.

Strong gains expected after third wave breakout

In addition to Martinez’s insights, the Elliott Wave Academy offers technical analysis Recent Bitcoin price action suggests that the cryptocurrency is currently in the fourth wave of a larger bullish cycle.

The academy’s analysis shows that Bitcoin has managed to surpass the ideal levels of the third wave after a strong breakout of the price channel, which may indicate a strong upward trend. this fourth waveAccording to their analysis, it is characterized by a sideways pattern after a sharp rise in the third wave.

Potential correction areas for this wave have been identified, and if these levels are exceeded, the next leg up could target the Bitcoin price range between $117,475.70 and $138,058.37. These numbers represent major bullish targets that could attract more investment and push Bitcoin prices higher.

Related reading

Overall, a combination of massive capital withdrawals as Bitcoin prices continue to rise comminicatelower Coinbase Premium Index and positive Elliott Wave analysis paint a compelling picture for the future of cryptocurrencies.

However, investors should remain vigilant and keep a close eye on key price levels that could determine where the market moves next.

As of this writing, the market-leading cryptocurrency is trading at $98,320.

Featured images from DALL-E, charts from TradingView.com