Is $86,800 The Level To Watch?

On-chain data shows that the actual price of Bitcoin for short-term holders is currently $86,800, a level worthy of attention.

There remains a significant gap between Bitcoin and short-term holder cost base

in a new postal On X, on-chain analysis company Glassnode discussed the trend of short-term profit and loss status of Bitcoin holders. The correlation metric here is “Market Value to Realized Value (MVRV) Ratio”, which tracks the ratio between BTC market cap and its realized market cap.

Related reading

this”Cap achievedThis refers to the on-chain capitalization model of cryptocurrencies, which assumes that the “real” value of each token in circulation is the price of its last transaction on the blockchain.

Since the last transfer of any token likely corresponds to the last time it changed hands, the price at that time can be considered its current cost basis. Therefore, the realized cap is nothing but the sum of capital that investors as a group have used to purchase cryptocurrencies.

In contrast, market capitalization represents the value of what holders currently hold. When the MVRV ratio compares these two models, its value tells us the profit and loss of the network.

The traditional MVRV ratio is measured for the entire market, but the version of the indicator of interest to the current topic is specifically for Short Term Holders (STH)investors who purchased the token within the past 155 days.

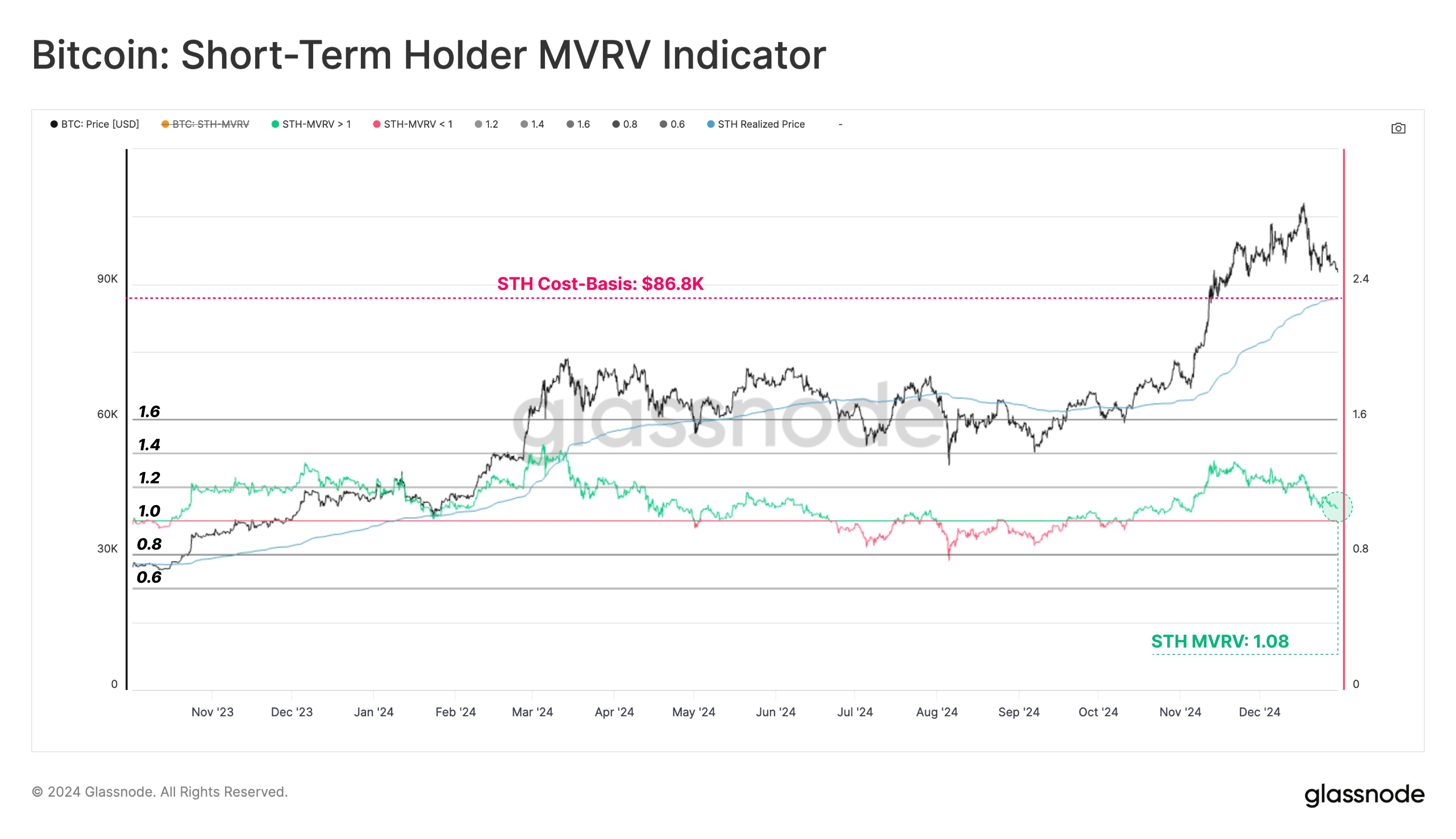

Below is a chart shared by the analyst firm showing the trend of Bitcoin’s STH MVRV ratio over the past year or so:

As shown in the chart, when BTC rallied recently, the Bitcoin STH MVRV ratio surged to significant levels above 1. An indicator above this value means that the group’s market capitalization is greater than its realized market capitalization and, therefore, the average member is profitable.

Recently, as cryptocurrency prices have fallen, this indicator has naturally declined as well. However, its value remains above the 1 level, indicating that the group is still holding more profits than losses.

Currently, the STH MVRV ratio is 1.08, which equates to the group holding about 8% of unrealized gains. Historically, STH has proven to represent a volatile side of the market that can easily engage in sell-offs, so their large profits are often a red flag for price.

After divestment, the group no longer earns significant profits, but perhaps cooling may be necessary if the risk of profit taking must be eliminated. One metric that can be handy for tracking when this happens is the “realized price,” which is calculated by dividing the realized cap by the total number of coins in circulation.

Related reading

As you can see from the chart, STH’s current real price is $86,800, which means that if Bitcoin fell to this level, the group’s investment would just break even.

bitcoin price

Yesterday, Bitcoin briefly fell below the $92,000 level, but Bitcoin has rebounded slightly and is currently priced around $94,500.

Featured images from Dall-E, Glassnode.com, charts from TradingView.com