Bitcoin Whale Moves 8,000 BTC Aged 5-7 Years – What Happened Last Time

Bitcoin continues to struggle to conquer the psychological milestone of $100,000, but failed to break above this key resistance level after retracing from its all-time highs. This prolonged stagnation has sparked talk of a potential correction or deeper pullback as the market awaits confirmation of Bitcoin’s next big move. Analysts and investors are watching developments closely, eager to learn whether the cryptocurrency will rally to new heights or succumb to selling pressure.

Related reading

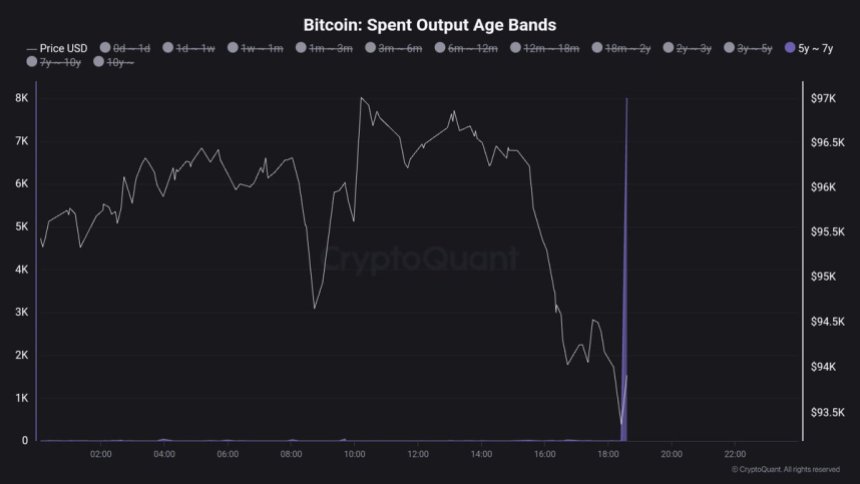

Prominent analyst Maartunn recently highlighted worrisome on-chain activity, exacerbating these concerns. Over 8,000 BTC (aged between 5 and 7 years old) have been moved on-chain, raising questions about the intentions of long-term holders. Historically, such moves tend to precede market changes, with increased selling pressure signaling underlying weakness.

Activity from these experienced wallets may reflect weakening confidence or profit-taking, Keep Bitcoin under $100,000. While bulls and bears are still vying for dominance, this important indicator highlights the growing uncertainty. With Bitcoin’s direction hanging in the balance, market participants need clarity on whether this key level will eventually turn into solid support or mark the beginning of a downward correction.

Smart Money Transfer Bitcoin

Since early December, Bitcoin has entered a lengthy consolidation phase, struggling to build significant momentum in either direction. Recent on-chain data suggests that whale activity plays a key role in suppressing prices. According to top analyst MaartunnA familiar entity – an ancient Bitcoin whale – has resurfaced to make major moves that could impact the market’s trajectory.

Maartunn highlighted that the move above 8,000 BTC echoes a pattern from 10 days ago. According to reports, the same whale has moved a total of over 72,000 BTC since the beginning of the consolidation phase. The whale, often referred to as “smart money,” has been more active than ever, suggesting strategic positioning rather than impulsive selling.

The impact of this activity is far-reaching. As long as this whale continues to dump Bitcoin, the selling pressure could push Bitcoin below key psychological levels, extending the current consolidation period for a few more weeks. However, this accumulation and redistribution phase could set the stage for a massive rebound once activity subsides.

Related reading

Analysts interpreted this as a period of preparation by seasoned market players, suggesting that Bitcoin could experience a strong upward breakout when the dust settles.

Bitcoin trades above key demand levels

Bitcoin is currently trading at $95,000 after managing to stay above the key support level of $92,000. Although the bears have maintained control of the market in recent weeks, they have failed to break through the key demand areas of $92,000 and $90,000. These levels act as a solid base, preventing further declines and signaling buyer resilience.

If Bitcoin continues to hold these key levels, it could pave the way for a swift challenge to its all-time high (ATH). Staying above $92,000 will reinforce bullish sentiment and attract renewed interest from traders and institutional investors to the psychological milestone of $100,000.

However, the path forward is far from certain. A failed attempt to recoup $100,000 could be a sign of buyer exhaustion, which could trigger a deeper correction. In this case, Bitcoin could revisit lower support areas as market participants re-evaluate their strategies.

Related reading

The next few weeks will be crucial for Bitcoin’s trajectory. Whether it rebounds to new heights or faces a sharp correction will depend on whether it can hold key levels and overcome the psychological hurdle that keeps it below $100,000. Investors are watching closely, anticipating Bitcoin’s next decisive move.

Featured image from Dall-E, chart from TradingView