Metaplanet Bitcoin Reserves Grow With Fresh $61 Million Purchase

Japan-based early-stage investment firm Metaplanet continues its Bitcoin (BTC) buying spree. company Announce Today, it purchased 619.7 BTC for $61 million (including fees and other charges), making it the company’s largest Bitcoin acquisition to date.

Metaplanet increases BTC holdings to 1,762

The recent downturn in the cryptocurrency market from all-time highs (ATH) does not seem to be bothering Metaplanet as the Tokyo-listed company made its largest BTC purchase to date, purchasing 619.7 BTC at an average price of around $96,000 , worth $61 million.

Related reading

Recall that Metaplanet started buying BTC at the beginning of May this year, with a purchase volume of 97.9 BTC. Since then, the company has purchased Bitcoin every month (except September), and cross The 1,000 BTC milestone was exceeded in November. The latest acquisition brings Metaplanet’s total Bitcoin holdings to 1,762 coins, with an average price of $75,600 per coin.

Notably, the $61 million acquisition is nearly double the value of Metaplanet’s previous largest acquisition, which took place last November and was valued at nearly $30 million. The company’s continued accumulation of Bitcoin has earned it the nickname “MicroStrategy Asia,” referring to the U.S. business intelligence firm known for its aggressive Bitcoin buying strategy.

It’s worth highlighting that today’s BTC purchases come a week after Metaplanet raised $60.6 million in two tranches of bond offerings in an effort to “accelerate BTC purchases.” Metaplanet’s latest acquisition also places its BTC reserves at 12th among listed companies globally.

According to Metaplanet’s official announcement, from October 1 to December 23, its BTC return rate (a proprietary metric used to measure the performance of its Bitcoin acquisition strategy) was 310%. The company emphasized that the strategy is designed to “add value to shareholders.” “

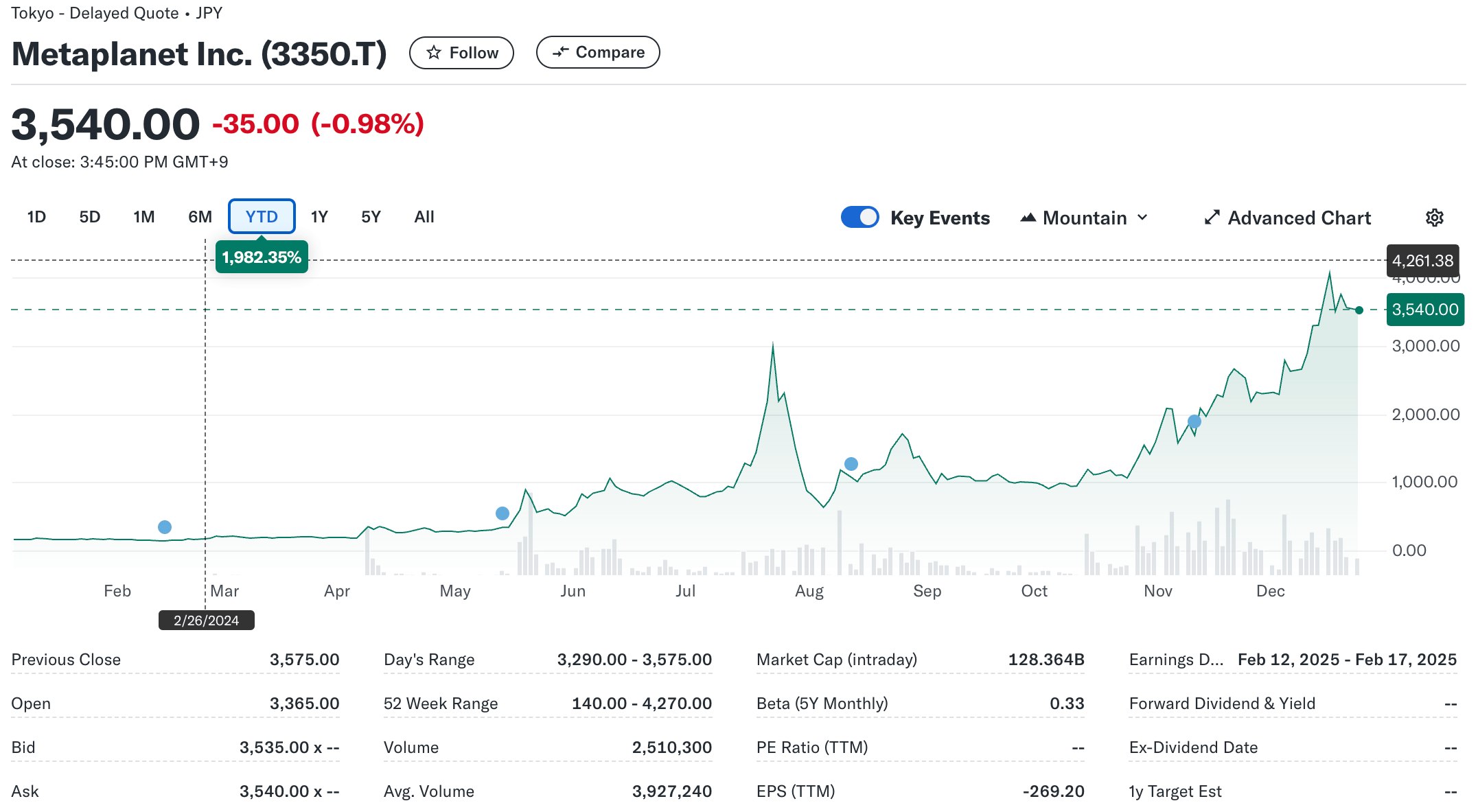

Despite heavy BTC buying today, Metaplanet shares were little changed, closing at $22.5, down 0.98% on the day. Year-to-date, however, the company’s shares have soared a staggering 1,982%, reflecting the long-term benefits of its Bitcoin-centric strategy.

Will Bitcoin supply tightening accelerate adoption?

With the total supply of Bitcoin capped at 21 million coins, the digital asset has solidified its reputation as an inflation-proof store of value. the latest one Report Highlights: BTC supply on cryptocurrency exchanges has hit multi-year lows, suggesting holders are increasingly withdrawing BTC from exchanges, reducing circulating supply and potentially pushing prices higher.

Related reading

The scarcity of Bitcoin has sparked informal competition between businesses and even governments. For example, Bitcoin mining company Hut 8 recently Purchased Purchased 990 BTC for $100 million, increasing its total holdings to over 10,000 BTC. Likewise, MARA, another Bitcoin mining company, obtained Earlier this month, its holdings reached 703 BTC, bringing its total holdings to 34,794 BTC.

Speculation surrounding potential U.S. strategic Bitcoin reserve intensifies further strengthen Bitcoin’s supply crunch story could accelerate its adoption. As of press time, BTC was trading at $94,003, down 1.5% in the past 24 hours.

Featured image from Unsplash, chart from Yahoo! Finance and Tradingview.com