Dogecoin Faces 1929-Style Reckoning: Bloomberg’s McGlone

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

The price of football for the Lions and players is a bit soft. Every arcu lorem, super kids or ullamcorper football hatred.

Mike McGlone, chief commodity strategist at Bloomberg Intelligence, sent a noticeable caution to Dogecoin holders and the wider cryptocurrency community by comparing the comparison with historical examples of market surplus. In a series of recent posts published on X, McGlone cites the infamous era of stock market crashes and the internet bubble in 1929 and 1999 to highlight the risk of speculative “stupidity” in digital assets.

Dogecoin Mirrors 1929 risk

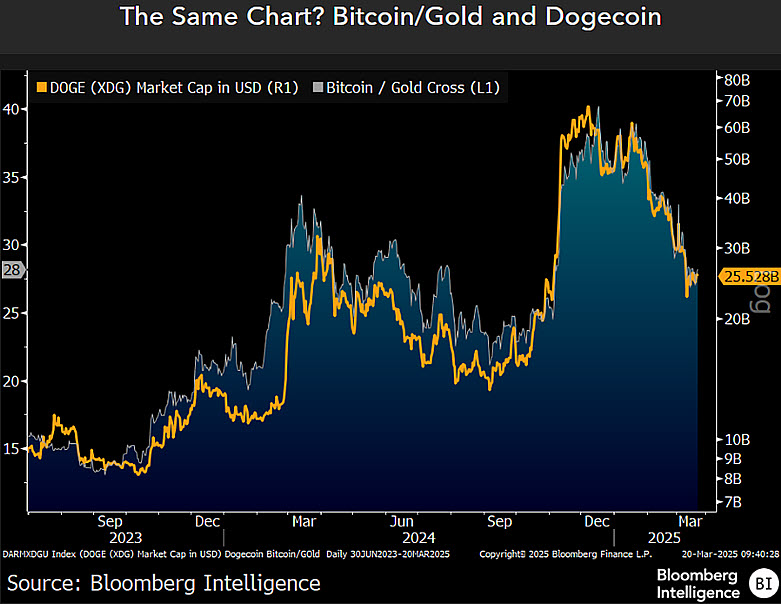

he Pick it out Dogecoin, in particular, highlights its vulnerability to potential market recovery, while also taking gold as a beneficiary if the appetite for risk continues to worsen. “Dogecoin, 1929, 1999 Risk Resources Stupid and Gold – The ratio of gold ounces to Bitcoin traded almost ticked with Dogecoin, which may show the recovery risk of highly speculative digital assets with a sense of deflation that supports metals,” he wrote.

Related Readings

The following diagram shows how the market value of a meme-inspired cryptocurrency reflects the Bitcoin to Gold ratio. Tracking of these two indicators shows that as long as the relative value of Bitcoin is Gold After a transformation, Dogecoin’s trajectory has slid sharply, exposing it to market forces historically challenging highly speculative assets.

McGlone’s broader paper does not end with Dogecoin. In another post, he shifted his attention to the $4,000-per-ounce gold concept, linking that possibility to dynamics Bond Market and potential declines within the risk range, including cryptocurrencies.

“What is gold to $4,000? 2% T-key? Melted cryptocurrency may guide – #gold’s one-ounce $4,000 path may require something that is usually a matter of time: stupid expensive risky assets recovery, especially cryptocurrencies.”

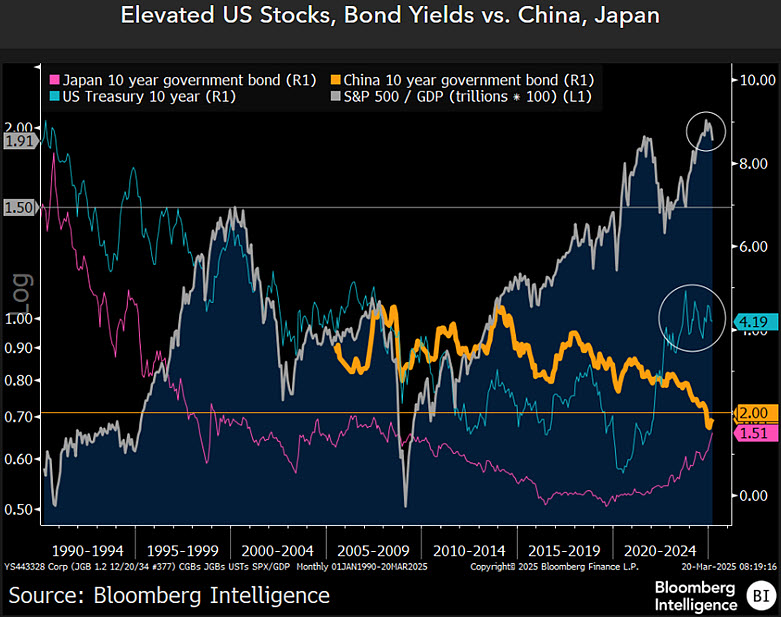

He stressed that if the U.S. stock market maintains pressure, bond yields may end up being lowered by the relatively small 2% or lower yields seen by China and Japan. From McGlone’s perspective, this situation adds to gold’s headwinds, as the shift from relatively high-yield treasury to lower government bonds abroad could turn investors into alternative paradise.

Related Readings

McGlone shared charts reinforce his analysis of the slowdown in demand for risky assets. One visual effect is “U.S. stocks rise, bonds and China, Japan” that shows the ongoing difference between U.S. treasury production, hovering within the trademark range of 4.19%, while the relatively poor ratios of Chinese and Japanese government bonds are close to 2% and 1.51%, respectively.

The graph also depicts the market cap to GDP ratio for the S&P 500, although volatility has remained high recently. McGlone concluded that if investors think the downturn in asset classes that investors consider “expensive”, including risky assets such as DogeCoin, there is continued ongoing pressure on the stock market, coupled with global bond rates that are well below U.S. yields.

The third article introduces the broader Altcoin market, McGlone notes Ethereum as the main indicator Regarding whether the overall trend makes digital assets bearish. He pointed out: “Has the trend been rejected?

At press time, Doge’s trading price was $0.16663.

Featured Images created with dall.e, Charts for TradingView.com