Bitcoin Could Hit $112,000, But Only If It Holds Above This Key Level

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

The price of football for the Lions and players is a bit soft. Every arcu lorem, super kids or ullamcorper football hatred.

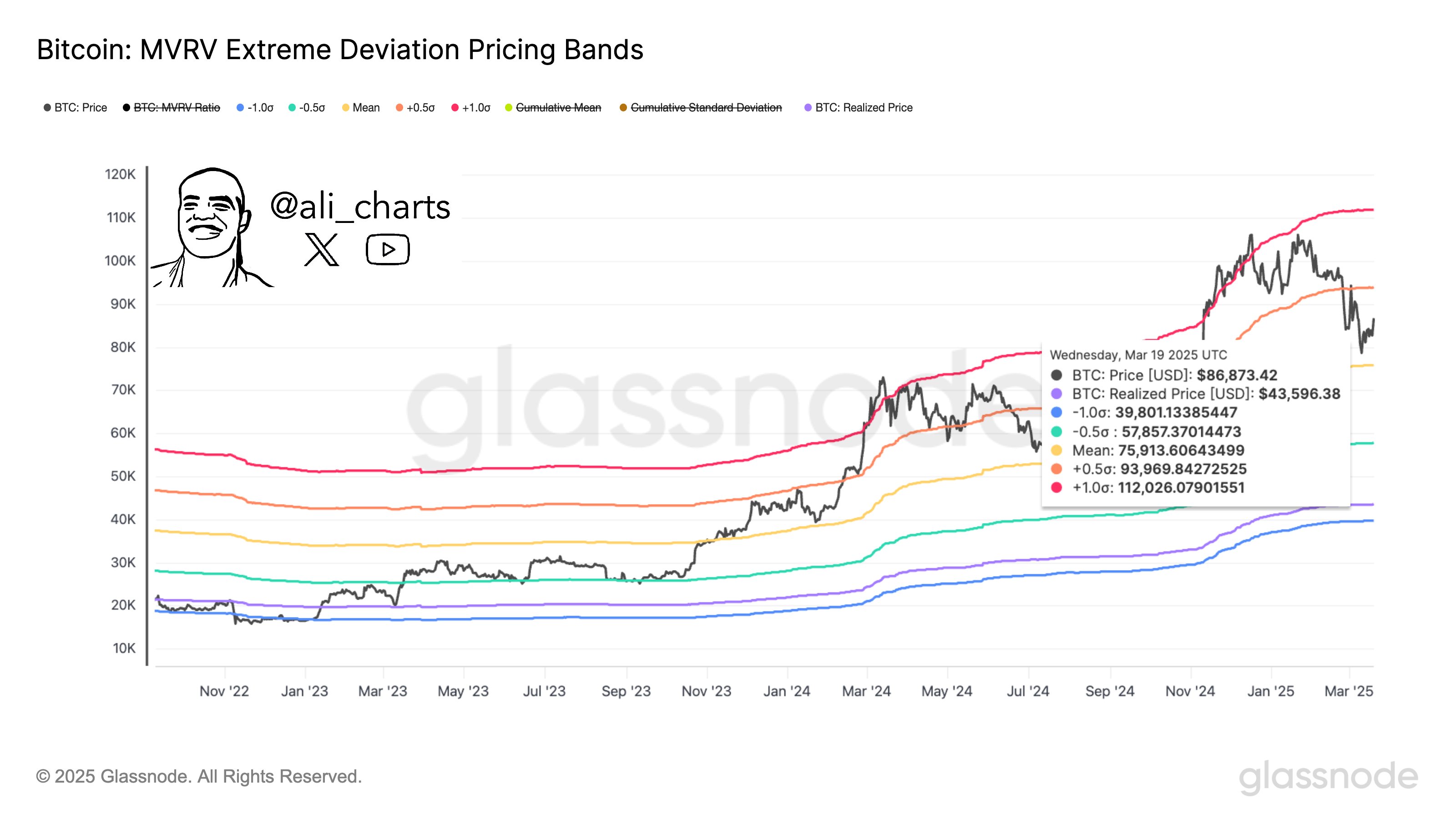

In X postal Experienced crypto analyst Ali Martinez posted yesterday that Bitcoin (BTC) could soar to $112,000 if it breaks and exceeds the key level, according to price rate analysis.

Analysts outline key bitcoin levels

Bitcoin is currently trading in a price range of just $80,000 after the U.S. Federal Reserve announced a slowdown in its balance sheet. However, according to Martinez, the leading cryptocurrency may reach a new all-time high (ATH), but certain conditions are subject to compliance.

Related Readings

Martinez uses market value to achieve extreme deviations in value (MVRV) pricing bands, pointing to two crucial price levels that can determine the next major move for Bitcoin. According to analysts, if BTC goes bankrupt and holds more than $94,000, it has a “high probability” of $112,000.

On the other side, if BTC Fall Below $76,000, it could fall to $58,000 or even $44,000 if the market conditions turn bearish. It is worth noting that BTC had previously reached $76,606 on March 10 before rebounding to its current $80,000.

For uninspired MVRV extreme deviation pricing bands, assets (like Bitcoin) are too high or too low compared to past averages. It helps spot when the market may be too high (potential market top) or oversell potential buying opportunities.

According to Martinez’s chart, BTC is currently trading between averages – Yellow Band – +0.5 Standard Deviation – Orange Band. Continuous breakthroughs above or below these bands may indicate the next important price direction for Bitcoin.

Crypto analyst Rekt Capital noted that Bitcoin is retesting the critical $84,000 support level. Holding successfully at this price, BTC could challenge $94,000 resistance, which could pave the way for new ATH. Analysts noted:

BTC produces long wicks below this level, which is why turning off $8.4K per day is crucial for retesting.

Will BTC witness a brief squeeze?

In separate X posts, crypto trader Merlijn trader suggests Widespread pessimism Recent price action around BTC could cause a strong brief squeeze. According to analysts, a short position worth about $2 billion may be Clearing If BTC reaches $87,000 – it may make the price higher.

Related Readings

Crypto entrepreneur Arthur Hayes adds bullish outlook suggestion BTC’s drop to $77,000 on March 10 may mark the bottom of the market cycle. At the time of writing, BTC is trading at $84,043, down 2% in the past 24 hours.

Featured images from Unsplash, charts from X and TradingView.com