Investors Withdraw 360,000 Ethereum From Exchanges In Just 48 Hours – Accumulation Trend?

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

The price of football for the Lions and players is a bit soft. Every arcu lorem, super kids or ullamcorper football hatred.

Ethereum has experienced a much-needed surge above the $2,000 level, a key psychological and technical marker that the Bulls have been working on recycling since March 10. This breakthrough sparked optimism in the market, but the momentum was short-lived as ETH quickly retreated to levels and could not confirm a solid holding. Analysts generally agree that it is crucial for Ethereum to conduct a wider recovery rally.

Related Readings

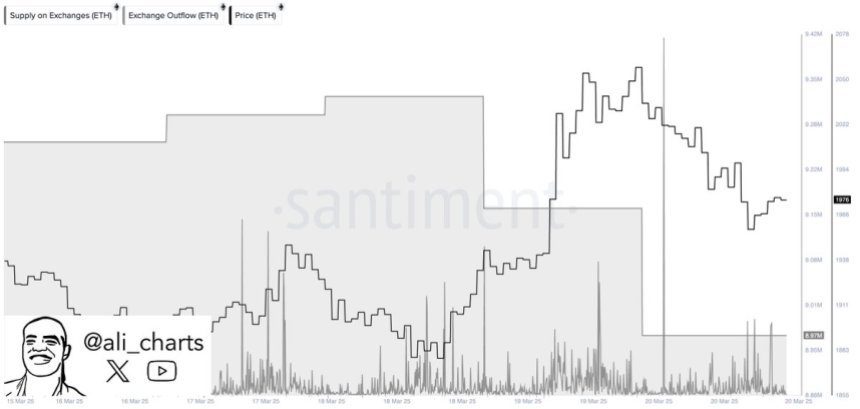

Despite resistance hesitation, the data on the chain shows signs of growing investor confidence. According to Santiment, investors have withdrawn more than 360,000 of ETH from centralized communications over the past 48 hours. This shift is often interpreted as a bullish signal that large holders are transferring their assets to private wallets, which may be due to higher prices expected.

Meanwhile, the broader macroeconomic landscape continues to exert pressure. The U.S. government’s trade war tensions and unpredictable policy decisions have severely impacted cryptocurrencies and traditional markets, exacerbating volatility and Investor uncertainty. Nevertheless, Ethereum’s latest exchange flows out a potential trend shift that could help build up and lay the groundwork for the next major move, provided the Bulls can recoup and keep over the $2K threshold.

Ethereum’s key tests on exchange outflows

Ethereum has lost more than 57% of its value since mid-December, falling from a high of about $4,100 to its most recent low of $1,750. This keen correction creates a challenging environment for the Bulls who have repeatedly failed to recover and maintain higher price levels.

Now, the $2,000 trademark is a psychological and technical battlefield. If Ethereum can firmly build support above this level, it can provide a basis for restoring the assembly. However, failure to do so may lead to further disadvantages and strengthen the bearish trend.

Related Readings

The current market landscape struggles with uncertainty. On the one hand, macroeconomic headwinds – exacerbating trade tensions, inflation issues and policy shifts from the U.S. government – weaken investor confidence and drive volatility across risky assets. On the other hand, there are potential signs of recovery and accumulation.

Share by Ali Martinez, top crypto analyst Data from Santimentreveals the withdrawal of more than 360,000 ETH from centralized communications in the past 48 hours. Historically, large withdrawals have been seen as bullish signals because they believe investors are transferring assets to cold storage for long-term holdings rather than preparing for sale.

The move could indicate growing confidence among large holders and indicate an early stage of the new accumulation phase – pre-listed Ethereum can hold more than $2,000 in stakes.

Prices are stable below $2,000

Ethereum has now traded at $1,960 after briefly attempting to recover $2,000 at yesterday’s meeting. The $2,000 psychological and technical resistance remains a key obstacle that the Bulls must overcome to change the market momentum. Despite a small bounce in recent lows, Ethereum is struggling to gain appeal amidst ongoing market uncertainty.

The Bulls need to increase ETH above $2,000 and get higher levels, such as $2,150 and $2,300, to confirm the start of the recovery phase. Continuous movement beyond these levels not only indicates a potential trend reversal, but also may also attract a small number of investors to return to the market. Until then, Ethereum was still vulnerable to continued downward pressure.

Related Readings

If the Bulls fail to exceed $2,000 in resistance at the upcoming meeting, Ethereum may lose support at the current level and revisit the lower demand zones left and right, about $1,850 or even $1,750. As the broader crypto market remains affected by macroeconomic volatility and low sentiment, the days to come may be crucial to the short-term direction of ETH. Decisive moves above or below this critical range may set the tone for the next major price action.

Featured images from DALL-E, charts from TradingView