Fund Manager Says Bitcoin Will Crush Gold, Hit $1 Million By 2029

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

The price of football for the Lions and players is a bit soft. Every arcu lorem, super kids or ullamcorper football hatred.

Matt Hougan, chief investment officer (CIO) of Bitwise Asset Management, made amazing long-term predictions about Bitcoin in the latest episode of Coinstories Podcast. In a conversation with host Nathalie Brunell, Hougan outlined why he believes that BTC will not only destroy gold, but will climb to $1 million per coin by 2029. He attributes this bullish forecast to rapid adoption of institutional adoption, the clarity of proposed regulators and ongoing long-term demand beyond new supply.

Why Bitcoin can reach $1 million by 2029

exist interviewHougan pointed out that spot Bitcoin exchange-traded funds (ETFs) are the main factor behind institutional inflows. He described the surge New capital after ETF Launched in January 2024 is longer than most analysts expected. “Before the Bitcoin ETF launched, the most successful ETF ever collected $5 billion in its first year,” he said. “These (bitcoin) ETFs made 37 billion.”

He added that this amazing inflow rate could continue, mainly because “less than half of all financial advisers in the U.S. can proactively engage in active conversations about investing in Bitcoin. Once restrictions are lifted and more advisors are allowed to recommend Bitcoin to their clients, he expects the influx of assets to be larger.

Related Readings

When asked about competition among top ETF providers, Hougan stressed BlackRock’s entry Ultimately, the industry as a whole is benefited by promoting overall participation. He highlights how his company focuses on meeting the needs of institutional investors and crypto experts who want to “encrypt locals” managers.

Although Bitwise’s spot Bitcoin ETF was launched alongside several other well-known players, Hougan said he believes the fierce competition is constructive for investors because it has driven the expenses of “rock”. He noted that his company’s management fees were lower than those of many traditional commodity ETFs and concluded: “This is an incredible deal for investors.”

In addition to the massive shift in financing of these institutions, Hogan also drew attention to the rapid expansion of stablecoins. He called them “killer applications” citing global demand for cheaper, faster transaction tracks and explained that Stablecoins settled on blockchain could improve cross-border capital flows.

He expects a stable market to be measured in trillions of dollars in the coming years, especially in the presence of supportive regulatory frameworks. While he acknowledged that the U.S. could enact legislation to shape whether Stablecoin issuers have short-term or long-term Treasury bonds, he said he hopes that the market will remain free enough to promote sustained competition and innovation.

The conversation also involved growing interest in the company, which Hogan said was a barrier like “weird accounting rules” but still proved strong. He noted how the company “buyed hundreds of thousands of bitcoins last year” and believed these early movers said there would be a bigger wave once accounting, and proposed due diligence considerations.

Related Readings

He said his company’s private survey revealed the gap between advisors’ personal enthusiasm for Bitcoin (“over 50%” of people themselves already hold it – about 15-20% can formally allocate it on behalf of their client portfolio. He predicts that this number will continue to rise with the green light given by the internal committee to advise, and as more agencies realize “if you have zero allocation to cryptocurrencies, you are actually short.”

Regulatory shifts and Washington factors

Throughout the interview, Hogan repeatedly stressed that the market may “underestimate the changes in Washington.” He recalled until recently how banks were reluctant to obtain deposits from cryptocurrency companies, and how multiple subpoenas, lawsuits and the risk of “revoked” had a shocking impact on industry growth.

Hougan believes that “unless you have worked in cryptocurrencies for the past four years, you can’t imagine how challenging it is” and that the government’s gentle stance now removes huge barriers to capital inflows. He also believes that bipartisan support for stability legislation is a strong sign of the clarity of Horizon’s regulation.

In addition to regulations, Hougan suggests that Bitcoin is expected to be Macroeconomic climate Full of uncertainty. He calls out-of-control inflation or sudden ventilation rupture a scenario that people are worried about, and asserts: “If you look at the market, it’s more turbulent, open, or uncertain than in the past.”

From his point of view, even the small allocation of Bitcoin provides a non-supervised hedge against potential monetary or fiscal turbulence. He said many of Bitwise’s big customers are working on ways to produce production for their bitcoin, whether through derivatives or institutional loans, so they can maintain exposure without selling the assets themselves. He believes that this interest reflects a strong level of belief in tending to characterize cryptocurrency communities.

Hougan’s conclusions return to the power of Bitcoin to limit supply and deepen institutional demand. He said that the limited issuance schedule of Bitcoin, coupled with the number of new buyers exceeding the number of new Bitcoin mined, may continue to increase prices over time. “I think Bitcoin is on the way to destroy gold,” he said. “We think it will reach a million dollars by 2029.” Although he stressed that daily price volatility may be dramatic, he firmly believes that long-term fundamentals are still impeccable.

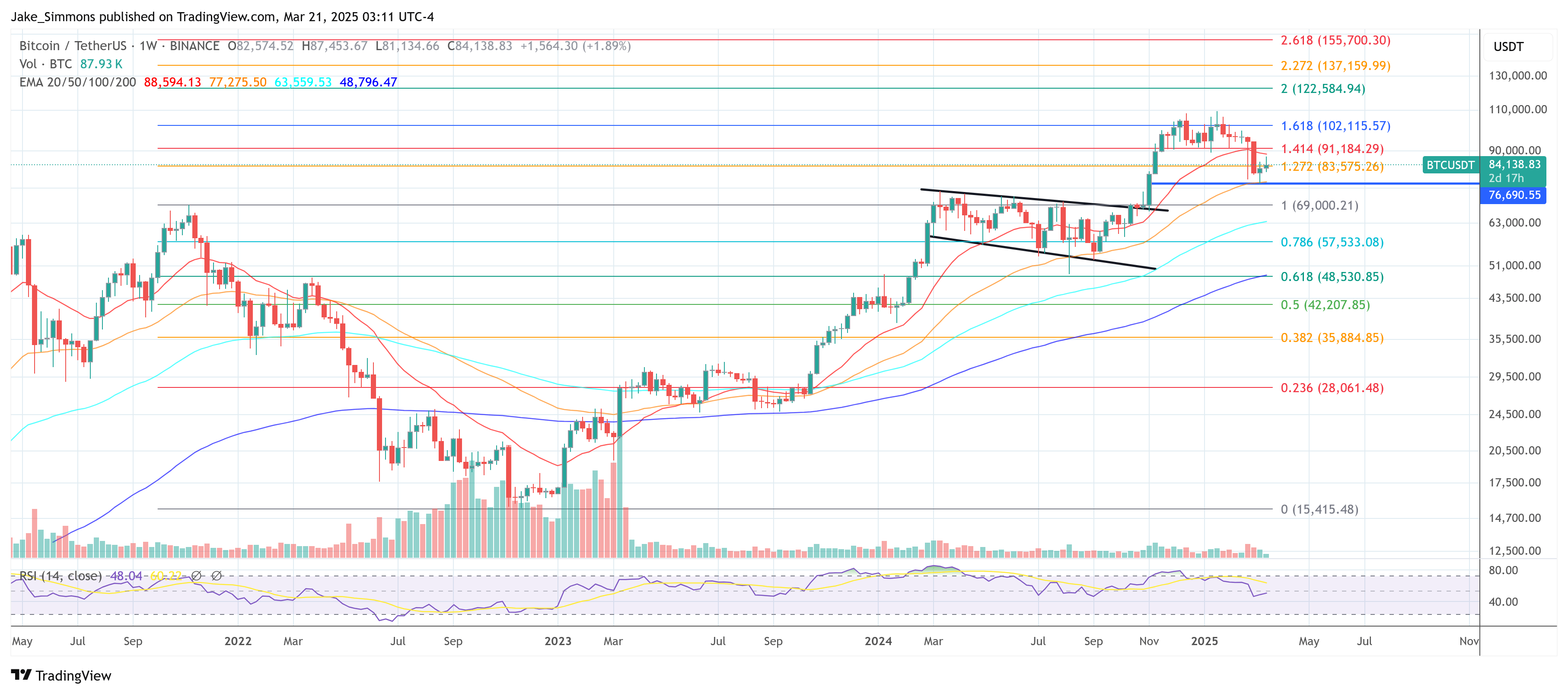

At press time, BTC traded at $84,138.

Featured Images created with dall.e, Charts for TradingView.com