Ethereum Price Forms Megaphone Bottom Not Seen Since 2020, Here’s What Happened Last Time

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

The price of football for the Lions and players is a bit soft. Every arcu lorem, super kids or ullamcorper football hatred.

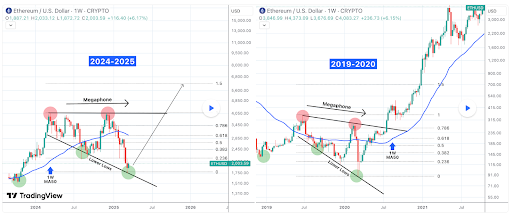

Crypto Analyst Tradingshot It has been revealed that Ethereum price has formed a loudspeaker bottom that has not been seen since 2020. Analysts revealed what happened at the bottom of ETH last time, which provided Altcoin with a bullish outlook.

Ethereum prices form the largest bottom

exist TradingView PostsTradingshot said Ethereum prices have formed the bottom of the loudspeaker for March 2020. He pointed out ETH is currently After three consecutive red weeks recording, the first week of rebounding, it could not exceed a MA50 for 1 week. The analyst further noted that ETH is adopting a lower low-point trend line, technically the bottom of the 1-year megaphone since March 11, 2024.

Related Readings

Tradingshot claims that the market is no stranger to the period of long-term amplifier mergers like this. He said Ethereum Price Finally, it last formed this megaphone between June 2019 and March 2020, which happened after the brutal Covid Crash Crash Bearish leg touched the bottom.

He noted that the March 2020 period is very similar to the current bearish Ethereum price action since late December. The analyst then highlighted the perfect alignment of the Fibonacci retraction levels. Based on this development, he predicts that Ethereum prices can be tested at least 1.5 Fibonacci extension The cycle rose at $6,000 before the end of the year.

Crypto Patel also raises the possibility of Ethereum price rally to $8,000. He suggested that this parabolic move could happen in the E-stage of ETH’s bull run. He noted that ETH could face significant resistance at around $4,050 at this price level.

The basic principles of optimistic about ETH

Despite the underperforming performance, Ethereum’s price still has fundamentals of bullish fundamentals, which could reverse the upside and lead to it reaching new highs. Crypto analysts replace Bulls reveal Exchange reserves of ETH A sharp decline. He noted that this would lead to a limited supply, which is just a matter of time before the ETH parabola parasite. In line with this, analysts affirm that altcoins are still in the early stages of bulls running.

Related Readings

Crypto Analyst Ali Martinez It also reveals that whales are actively accumulating ETH, which is bullish on Ethereum prices. In the X post, he said that 360,000 ETH had been withdrawn from crypto exchanges in the past 48 hours, and this development could cause a supply shock.

It is also worth mentioning that Ethereum prices will soon witness the supply shock through ETH ETFs. Asset managers like Bitwise have submitted funds to the U.S. SEC to include their funds. If approved, this may cause more ETH to be decirculated, as some institutional investors choose to place their ETH for profit.

At the time of writing, Ethereum price trading was around $1,969, down nearly 2% in the past 24 hours. data From CoinMarketCap.

Featured images from Unsplash, charts from TradingView.com