The Fed Blinked — The Bitcoin Bull Run Return Is Now Inevitable

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

The price of football for the Lions and players is a bit soft. Every arcu lorem, super kids or ullamcorper football hatred.

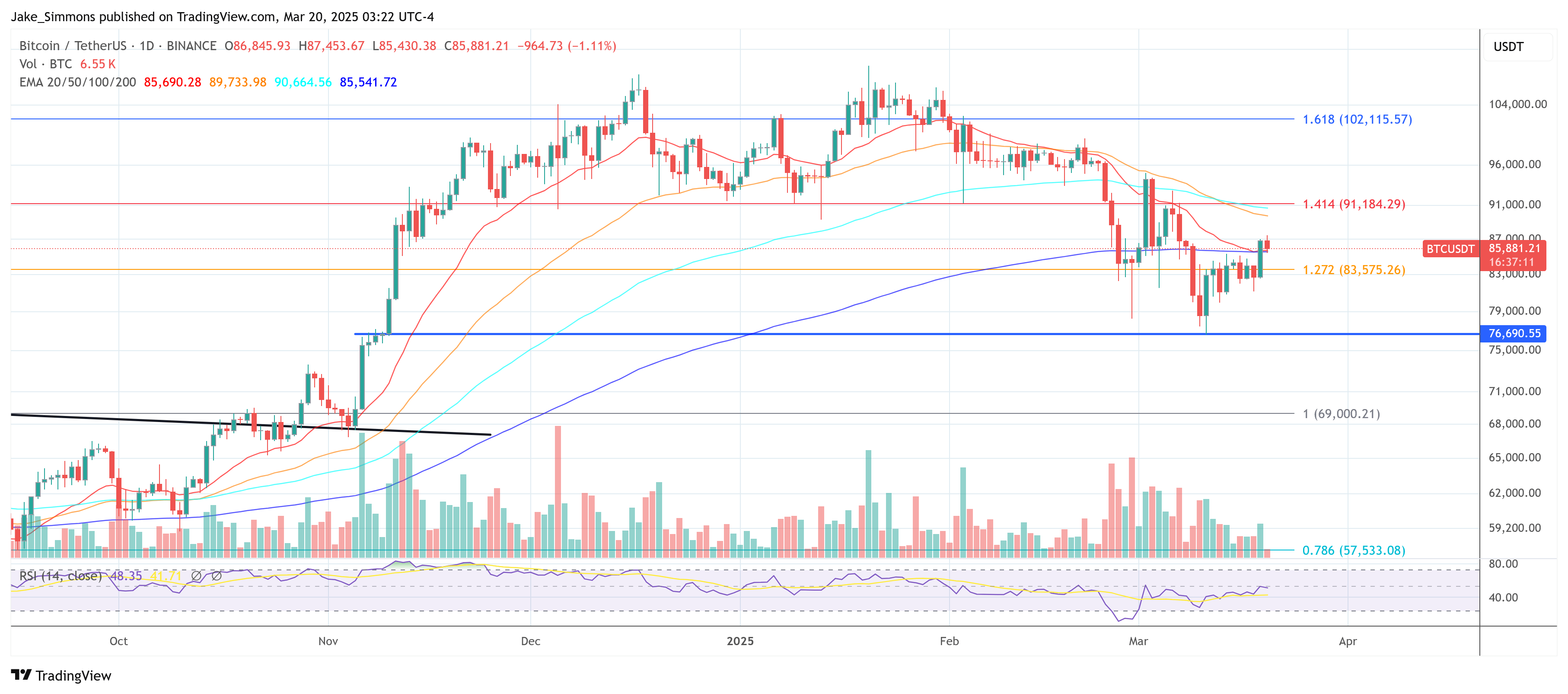

On Wednesday, the U.S. Federal Reserve decided to keep its benchmark interest rate unchanged within the range of 4.25%-4.5% – Bitcoin reacted immediately. The suspension, while well known, comes with a slightly revised prospect, which includes a timeline for lowering tax rates and significantly adjusts the pace of the central bank’s balance sheet reduction.

According to a statement from the Federal Open Market Committee (FOMC), the Fed’s “dot chart” now represents only 25 basic points lower this year, which is more than many market participants expected in December. Policymakers stress that although interest rates are still on restrictive territory, the timing of actual cuts depends on the path of economic indicators, especially inflation and employment.

However, the latest statement no longer asserts inflation Employment and employment are “balances”, reflecting the Commission’s growing concern about economic uncertainty. But perhaps the most important key is that the Fed announced that it will slow down its bond holdings, often called “Quantitative tightening” (QT).

Related Readings

Starting April, the monthly runoff of government bonds will drop from $25 billion to $5 billion, a substantial downshift, with many analysts saying that if economic or market conditions worsen, a prelude to a more tolerant stance.

What does this mean for Bitcoin

Shortly after the Fed announcement, Bitcoin had about 4-5% of votes, briefly surpassing the $86,000 level. Nik Bhatia – The Foundation of the Bitcoin Layer and the Author of the Bitcoin Age – Video update Analyze the meaning of decisions. “Bitcoin has grown 4% news that the Fed slows QT and remains committed to lowering interest rates,” Batia said at the beginning of the analysis. He noted that the market has been focusing on whether central banks will modify their quantitative tightening methods.

Bhatia explains how the monthly runoff cap is reduced from $25 billion to $5 billion to reduce liquidity restrictions throughout the system: “Now, the Fed is still signing up for its balance sheet, but now it’s only $5 billion a month, not $25 billion a month, which is a month change,” he said.

Related Readings

“It’s not some, ‘Hey, we’re at the cusp of QE right now because we’re from 25 to five, but the first step is to stop the balance sheet from shrinking… So if the Fed needs to pivot, it can quickly grow from 5 billion QT per month to some modest expansion.”

Bhatia stressed that such a move could intensify the market’s risk preference: “The market sees the nature of the Fed: It supports the establishment of credit creation, thus expanding the balance sheets around the world, and the prices of these assets end up at the asset price… Some of these assets can be stocks, Bitcoin, Bitcoin, other financial assets.”

Other experts have been more intense in their assessments. Arthur Hayes, co-founder of Bitmex statement By X: “Jaypow has been delivered, basically on QT above April 1. The next thing we need to bully for Realz is a waiver for SLR, or a restart of QE. The bottom of BTC is $77,000, but there is more pain left with Stonks Prob Prob to make Jay completely convert to Trump Trump Trump, so stay agile and cash.”

Realvision Chief Crypto Analyst Jamie Coutts Almost agree: “After last night, QT effectively died (for some time). Treasury volatility has immediately retreated and is now mirroring DXY drops From early this month. These are all very liquid positive. ”

At press time, Bitcoin was trading at $85,881.

Featured Images created with dall.e, Charts for TradingView.com