Is Ethereum Breaking Free from the Bear Trap? Analysts Weigh In

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

The price of football for the Lions and players is a bit soft. Every arcu lorem, super kids or ullamcorper football hatred.

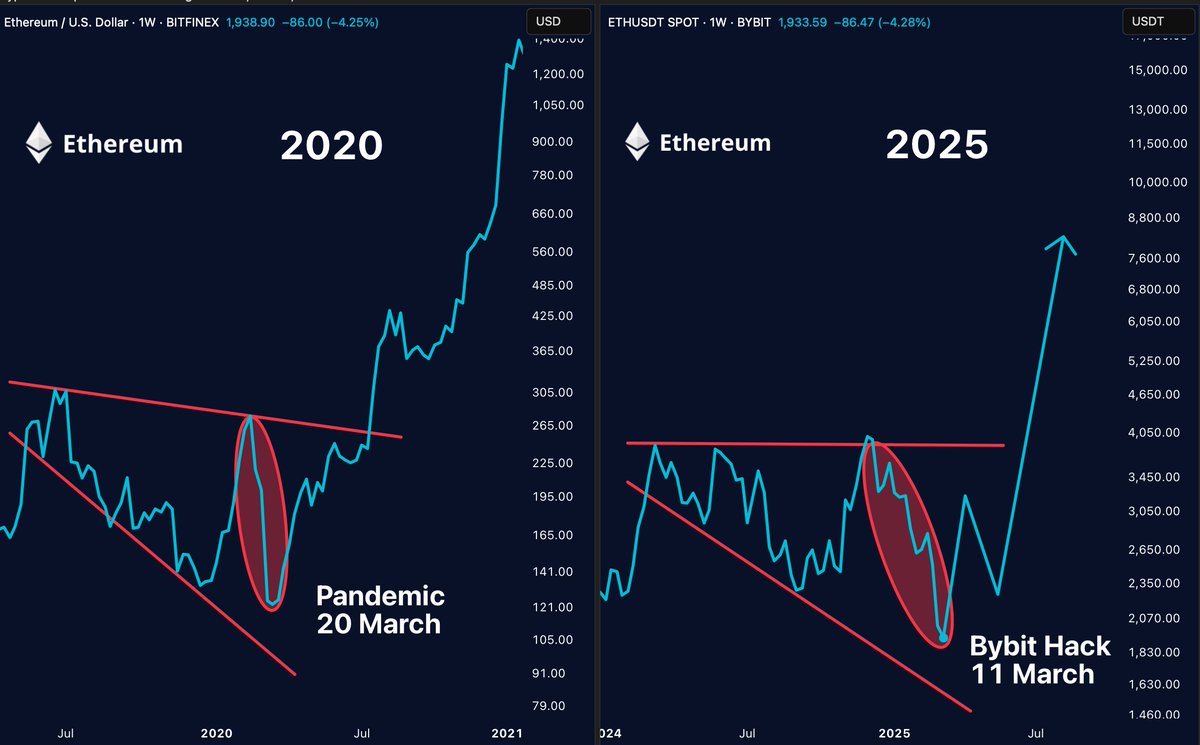

According to an X post by crypto analyst Cryptogoos, Ethereum (ETH) may be close to the end of the bear trap. The analyst predicts that cryptocurrencies could exceed its most recent $4,000 range, which could focus on a new all-time high (ATH) of $10,000.

Ethereum stands out from the bear trap?

Ethereum appears ready to get rid of the potential bear trap as the second-largest cryptocurrency market capitalization continues to trade in the lower $2,000 range after a strong sell-off since December 2024.

Related Readings

For beginners, bear traps are false signals that make the asset’s price seem to be continuing to fall, inducing traders to shorten it – just to suddenly reverse and rise, resulting in these short positions being liquidated.

In a recent X post, Cryptogoos stressed that ETH may be approaching the end of such traps. Analysts share an ETH weekly chart showing how cryptocurrencies are edge After months of ruthless selling, the trend reversed.

Cryptogoos’ sentiment was echoed by cryptogoos, highlighting the similarities between ETH’s current price action and the pattern seen in 2020. He noted that the last appearance of this setup, “the panic turned into a historic rally.”

Crypto investor Rekt Capital also weighed, pointing out that Ethereum is trading within the “historical demand area.” Investors pointed out:

If the price can react strong enough here, #eth Will be able to recover $2196-$3900 in macro range (black). If ETH does this before the monthly shutdown in March, the entire low $2,200 downside will be a downside wick.

ETH is about to exit the accumulation stage

Experienced crypto commentator Ted shared a chart showing that ETH has violated its short-term accumulation phase. He explained that digital assets have been accumulating since they fell from $3,000 to $1,800. TED added that ongoing price action over $2,000 could inspire a large number of price rallies.

Famous analyst Daan Crypto trade shows that he has recently converted some of his long-term Bitcoin (BTC) holdings into “the first time in years.” He lists the current ETH/BTC trading pairs with an attractive risk/reward settings.

Related Readings

In addition to bullish price action, several technical indicators also indicate potential ETH rally in the short term. It is worth noting that ETH’s recent weekly relative strength index (RSI) beat Multi-year lows – This suggests a trend reversal may be coming.

However, rise ETH retains reserves made on crypto exchanges remain a prudent point, as investors may curb bullish momentum if they choose to sell. At press time, ETH traded at $2,029, up 7.8% over the past 24 hours.

Featured images from Unsplash, charts from X and TradingView.com