Here’s Where Support & Resistance Lies For Solana, Based On On-Chain Data

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

The price of football for the Lions and players is a bit soft. Every arcu lorem, super kids or ullamcorper football hatred.

Analytics’ glass festival reveals that based on the data accumulated in chains, the price level of Solana may be important.

Solana cost basic distribution reveals the location of supply that is most concentrated

In a new post on X, Glass node Already discussed UTXO implements price distribution (URPD) Solana. URPD is an indicator that basically tells us how much sol supply price level we purchased. Naturally, the indicator takes the last trading price of any token in circulation as its cycle Cost basis.

Related Readings

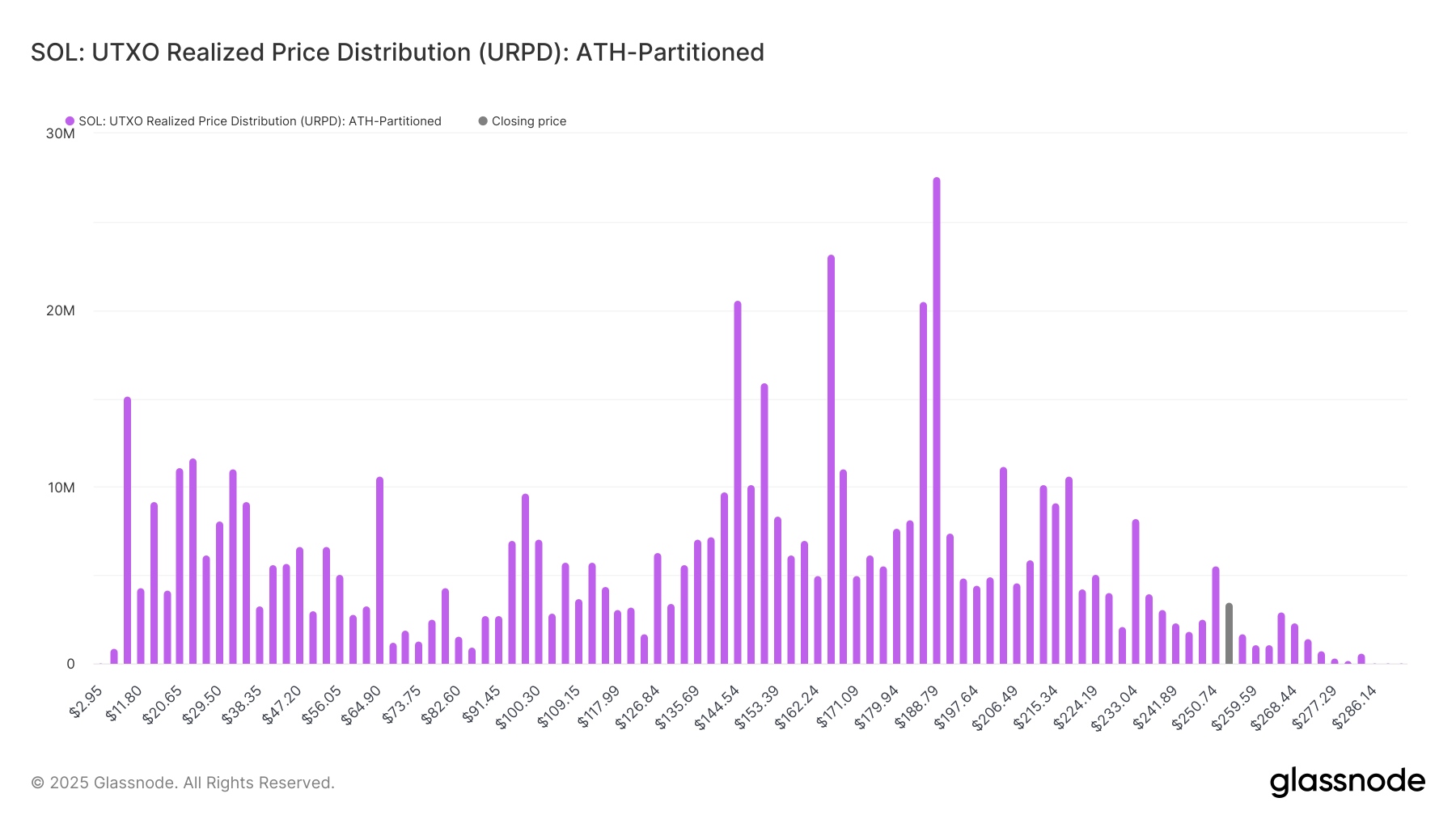

First, this is what URPD looks like when cryptocurrencies set a new all-time high (ATH) in January:

From the chart, it is obvious that some price levels stand out as much as $144 in terms of the supply they host. However, at price levels close to the new ATH, the supply is very thin, which means that not many coins change hands.

In chain analysis, the potential of any level as support or resistance is measured based on the supply it hosts. This means that the level of clusters surrounding them on URPD is very important to assets.

As for the reason, the answer lies in investor psychology: holders are sensitive to retesting the cost basis. Whenever the price hits a large cost-based cluster, investors holding these coins can respond by making some panic actions.

These moves may tend to buy if investors may wish to defend the boundaries of their profit loss. However, in the retest that occurs from below, traders can react by selling as they may try to exit their breakeven.

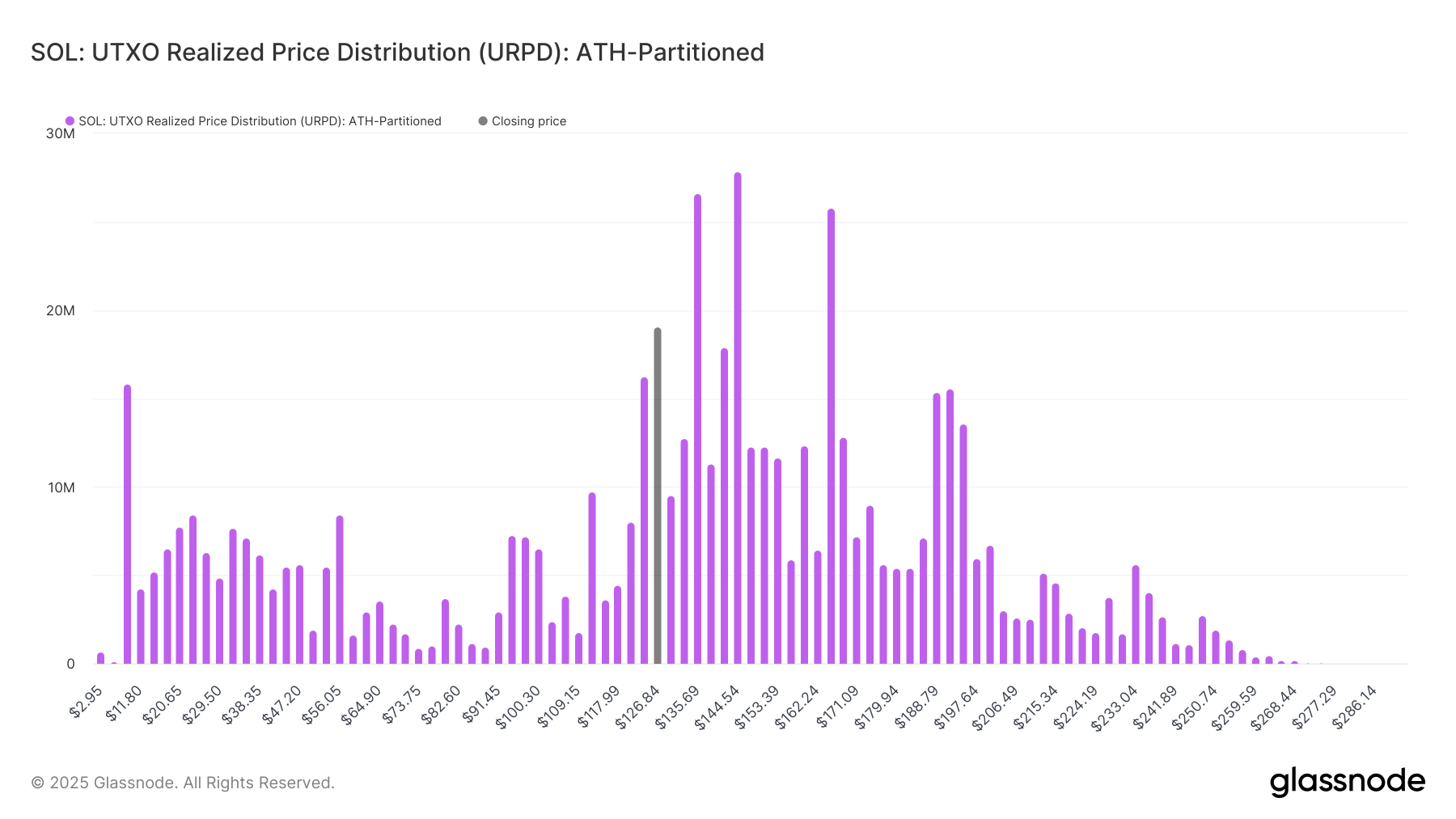

When Sol reaches ATH, there is a lack of support nearby. This may be why assets end up falling into clusters that do carry large supplies. The following chart shows how URPD changes by price decline.

As can be seen from the graph, if SOL continues to trend downward, it may have to eventually rely on the fresh $112 level. In January, the cost base of that level was 4 million tokens, but today, that number has grown to 9.7 million, equivalent to 1.67% of the overall supply.

The Glass Festival points out that outside this level,”$94, $97 and $100, with nearly 21 million SOL (3.5% of the supply). “Solana may be in trouble in case of these support levels failing, as there will be no major supply cluster until $53.

Related Readings

As for the above levels, the $135 and $144 levels stand out as their acquisition levels are 26.6 million and 27 million coins, respectively. These levels may be the main obstacle to SOL recovery.

Sol Price

Solana has jumped more than 5% in the past 24 hours to recover to $130.

Featured images from Shutterstock.com, charts from GlassNode.com, TradingView.com