Bitcoin Long-Term Holder Net Position Turns Green For The First Time In 2025

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

The price of football for the Lions and players is a bit soft. Every arcu lorem, super kids or ullamcorper football hatred.

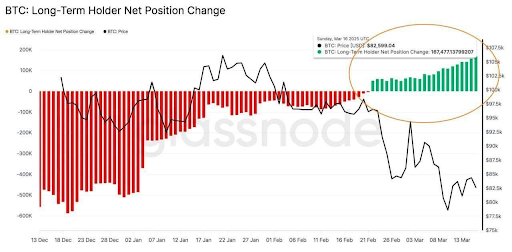

Long-term holders of Bitcoin recovered from a significant shift in investor sentiment Despite the turmoil This has put the market in trouble in recent weeks. In particular, data from the Chain Analytics Platform Glass Section shows that the “BTC: Long-term Holder Net Position Change” metric was positive for the first time this year. This suggests that long-term Bitcoin investors are taking advantage of market conditions to increase their holdings in large quantities of BTC.

Long-term holders add 167,000 BTC in March crash

Earlier this month, Bitcoin’s price dropped from $90,000 to $80,000, during a period of a rapid sell-off. This price shocked many traders and triggered a continuous wave of liquidation among short-term investors. However, despite this steep correction, long-term holders will handle the level below $90,000 As a buying opportunity rather than a reason to surrender.

Related Readings

In other words, coins are entering wallets that haven’t spent BTC for a long time, which is a significant reversal Starting from 2025, negative Net position change. This marks the first net accumulation of these “Hodlers” in 2025. GlassNode’s long-term holder net position change indicator, which flips in a red, “green” way as long-term investors accumulate long-term investors in a downturn.

The data on the chain shows that this flip has been seen Increase in long-term holders Over the past month, their net Bitcoin holdings have exceeded 167,000 BTC. This famous influx is worth nearly $14 billion. In short, experienced holders queues start snapping up cheap BTC while short-term sentiment The bleakest.

Is Bitcoin price restored to brewing?

This reversal time from red sell-off to green accumulation is shocking given what has been going through in the past two weeks. The data shows that a large part of the Bitcoin crash is caused by Short-term holders’ panic. This behavior is consistent with the past market cycle between August and September 2024, where long-term holders are actively accumulating during price declines.

Related Readings

Interestingly, GlassNode’s long-term holder metric is not the only indicator of positive coin sentiment in large holders. After weeks of uncertainty, Bitcoin Exchange Trading Funds (ETFs) begin to see Net inflow. On March 17, spot Bitcoin ETFs attracted approximately US$274.6 million, the largest single-day inflow in 28 days and clearly sent new investor interest signals.

The next day, a new wave of capital poured into Bitcoin funds on March 18, with about $209 million. In fact, the three-day streak represents the first continuous positive inflow since February 18, during which time Bitcoin funds experienced several consecutive days of outflows.

At the time of writing, Bitcoin trades for $83,500.

Featured images from Unsplash, charts from TradingView.com