Cathie Wood Predicts $1.5 Million

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

The price of football for the Lions and players is a bit soft. Every arcu lorem, super kids or ullamcorper football hatred.

ARK Investment Management founder and CEO Cathie Wood reiterated her ambitious price target for Bitcoin in a brand new interview with Bloomberg, predicting that it could soar to $1.5 million per coin by 2030. Despite recent market volatility and obvious “risk” environment, Wood remains firmly in keeping with the firmness of the legacy, which will continue to move forward with a close track that remains unwavering.

“Yes, that’s our point of view,” Wood answer When asked if she still expects Bitcoin to reach her prescribed price target. “I think now we’re usually in a risky period. If you’re looking at bitcoin all the time, it’s almost a risky, risk-risk leader.”

Cathie Wood still calls $1.5 million in Bitcoin by 2030

According to Wood 4-year cycle. She stressed that “we think we are still in a bull market” and expects the U.S. “deregulation” to play a key role in encouraging more institutions to enter the asset class.

Wood further argued that institutional asset allocators “must have a point of view on this new asset class” and that inclusion of Bitcoin in the portfolio could boost risk-adjusted returns.

Related Readings

In a wider market sell-off, Wood suggests that there may have been a “rolling recession” situation. She noted that the focus on job security and the increasing savings rate as evidence: “We’re seeing a savings rate rise. We’re seeing a drop in the rate of money, and we do think we’re going to see a negative quarter or two.”

She insists that this economic pressure could force the Fed to reverse the process later this year: “We won’t be surprised to see two or three cuts. (…) We think inflation will be surprised to be on the low end of expectations.”

Wood noted that gasoline prices, egg prices and rents fell because it suggests inflation may be faster than many expected, thus granting the Fed “degrees of freedom in the second half of the year.”

After the shift to adjustment, wood appears very optimistic about the “loose regulatory environment” of cryptocurrencies. She stressed U.S. Securities and Exchange Commission (SEC) The regulator’s approach states that by “announcing these meme coins instead of securities”, the regulator says: “Buyers should be careful (…) that we don’t think most of them are very valuable.

However, Wood highlighted Bitcoin, Ethereum and Solana as core assets for “use case (…) breeding” and may remain integral to the crypto ecosystem, in stark contrast to the “millions of meme coins” she believes ultimately lost value.

Related Readings

Wood also discussed her investment paper to value and Common casesreveals that Ark sees both companies as leaders in the battle for digital wallet domination. She compared the digital wallet to the credit card, which shows that “most of us don’t have a lot of credit cards” and, from the expansion, most users don’t have more than a few digital wallets.

Furthermore, she draws attention to the rise of tokenization and points out that BlackRock’s interest in tokenized assets suggests that large players envision a “complex (…) new world” in capital formation. She also believes that emerging markets are a key terrain, where Sabalecoins and Bitcoin have become the backdrop to protect purchasing power from currency devaluation: “If you go to emerging markets (…), they are using Bitcoin (…), but also using stablecoins, but in reality, it’s backing for effective purchasing power and wealth.”

Cathie Wood is still not bound by short-term volatility or market jitters. In reiterating her high-profile bet on disruptive technologies such as Tesla, Bitcoin and artificial intelligence, she reiterated her overview: Innovation and blockchain-based platforms will continue to drive the power of trust and create new opportunities for growth. “We are known for our phone calls from Tesla and Bitcoin calls. (…) I will add an AI platform to a service company like Palantir.”

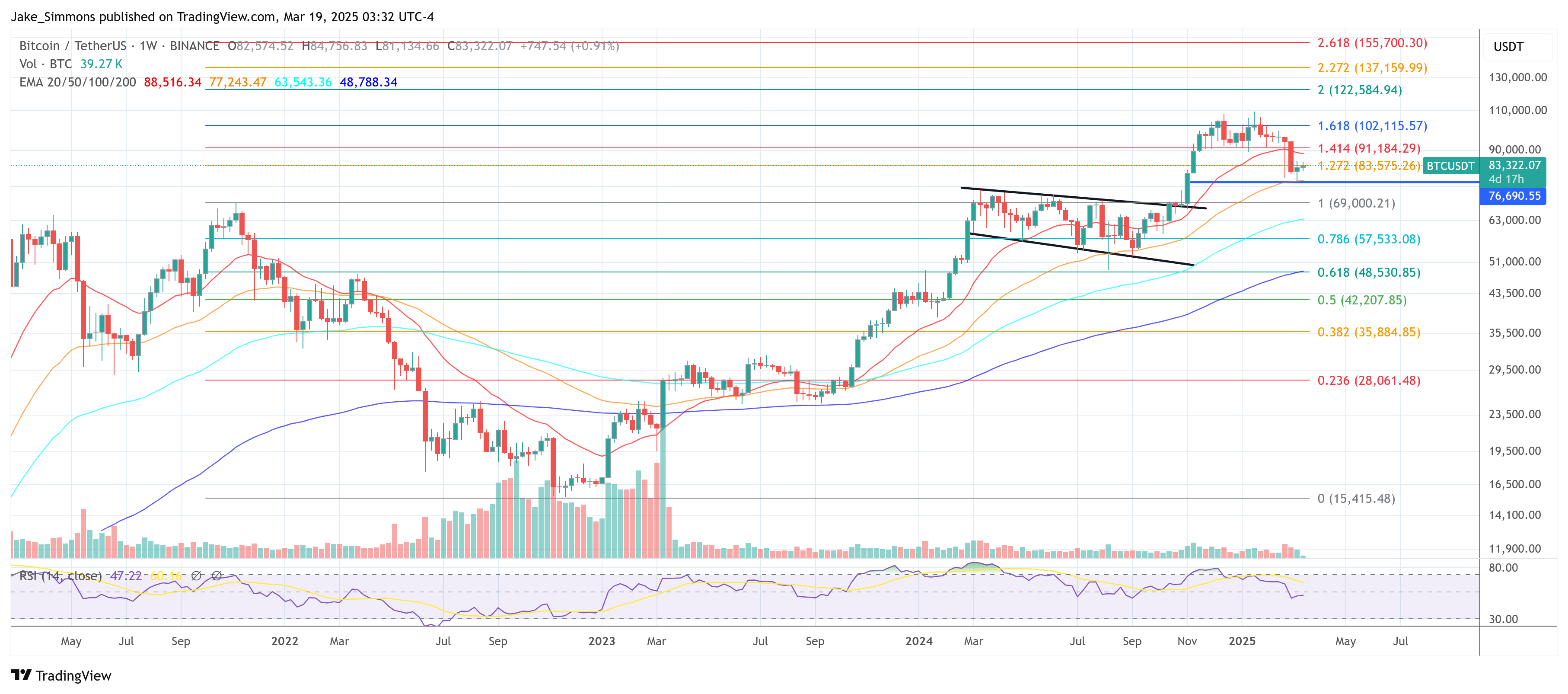

At press time, BTC traded at $83,322.

Featured images from YouTube, charts from TradingView.com