Solana Holds Bullish Pattern – Expert Sets $140 Target

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

The price of football for the Lions and players is a bit soft. Every arcu lorem, super kids or ullamcorper football hatred.

Solana (Sol) has been under enormous sales pressure and after weeks of fear-driven market conditions, prices have been unable to recover from key resistance levels. When Sol fell below $180, the Bulls lost control, a level of firm support they had previously had. Since then, bearish sentiment has dominated, with speculation about potential bear markets in Sol and the broader Altcoin industry increasing.

Related Readings

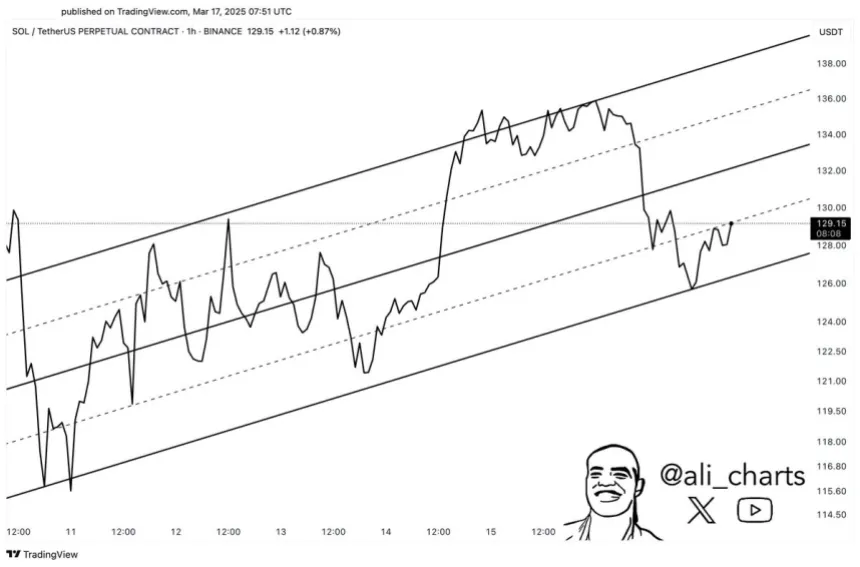

Despite looking at this negative, the Solana Bulls may have a silver lining. Top analyst Ali Martinez shared a technical analysis on X that shows that SOL has formed a bullish channel in the short term. This pattern suggests that if Solana remains in this formation, it may rise to higher price levels.

To make this bullish situation work, SOL must keep the channel’s lower trend line and push towards higher resistance. This model breakthrough It may indicate a strong recovery, potentially reversing the downward trend that dominated the market for weeks. However, if Solana cannot maintain this structure, the risk of further downside remains high. The next few days are crucial to identifying the short-term direction of SOL.

Solana faces risks in fluctuations

Solana has faced ruthless sales pressure since reaching its all-time high of $261 in January and is now down 61% from that peak. As hopes for the big bulls running fade out, speculation surrounding a potential bear market continues to grow. The broader macroeconomic environment remains unfavorable, with fear of the trade war and economic uncertainty driving not only the cryptocurrency market, but also the U.S. stock market.

Investors are now looking for signs of reversal, with technical indicators indicating potential short-term recovery. Martinez’s analysis of X Revealed that Solana is forming a bullish channel and is watching ascending from the channel’s base to the upper limit for a price of $140. If this pattern holds, SOL could push up to $140 or even higher, indicating relief rally.

To achieve this bullish outlook, Solana must keep its current trendline backed and break through key resistance levels. If Sol cannot hold this channel, it may face further shortcomings, which intensifies concerns about a prolonged bear market. The next few days are crucial to determine whether Solana can restore momentum or continue its downward trajectory.

Related Readings

Solana struggles as the bulls fight for recovery momentum

Solana (Sol) is currently trading at $129 and has been consolidated in the following days between $136 and $111. Price action remains uncertain, and the Bulls struggled to restore control after weeks of sales pressure.

To make a potential reversal, the SOL must go above the $140 resistance level and push it to $160, a key level that indicates a change in the market structure. If the Bull successfully recoups these price points, a stronger recovery phase can be initiated, which has the potential to attract new buyers back to the market.

However, if Solana fails to hold $125 support, it could trigger sales pressure, sending prices to low-demand areas. A break below this level could bring SOL down to $110 or even lower, which puts people in fear that the current downtrend is far from over.

Related Readings

The next few trading sessions are crucial to determine whether Solana can recover momentum or if it drops further.

Featured images from DALL-E, charts from TradingView