Bitcoin Spot ETF Exodus Continues: $900 Million Outflows Extend Losing Streak

After the last trading window, US Bitcoin live ETFs recorded another week of overwhelming net outflows, with investors making over $900 million from the market. This development marks a fifth straight week of redemption suggests that market confidence is weak among the Prime Minister’s institutional investors.

Bitcoin institutional investors exit for the fifth straight week

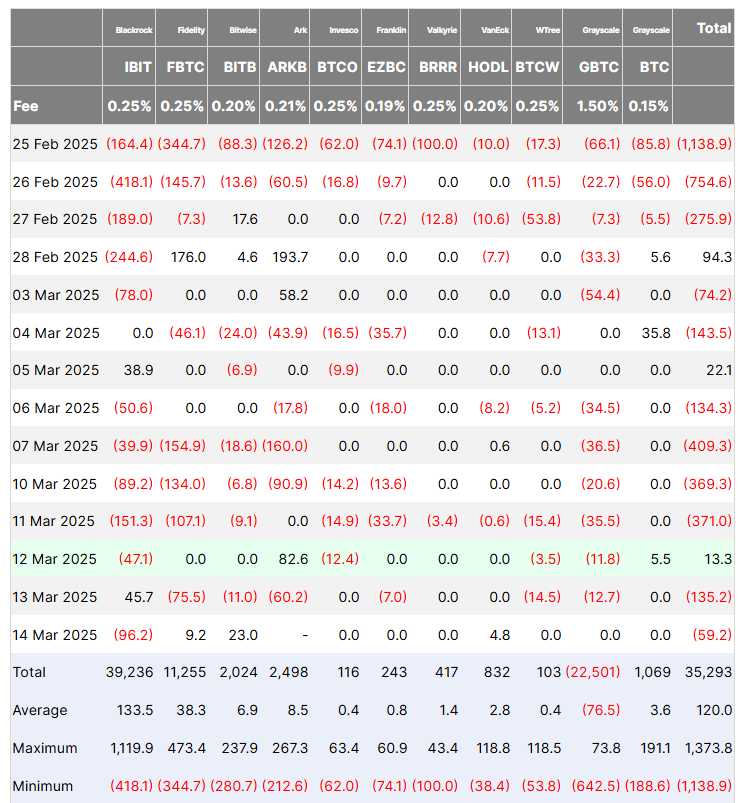

Bitcoin ETFs have attracted more than $5 billion in investment after a strong start to the year, with institutional investors evacuating massive withdrawals in recent weeks. according to Data from Farside InvestorsBitcoin Live ETF has received a net outflow of $921.4 million in the past week, with a final estimated total Over the past five weeks, $5.4 billion.

Most withdrawals from last week were withdrawn from BlackRock’s IBIT, which recorded a net outflow of $338.1 million. Fidelity’s FBTC is closely followed by investors’ redemption of more than $307.4 million. Other Bitcoin ETFs, such as ARK’s ARKB, Invesco’s BTCO, Franklin Templeton’s EZBC, WisdomTree’s BTCW and Grayscale’s GBTC, all saw medium net outflows between $33 million and $81 million.

Meanwhile, Bitwise’s BitB, Valkyrie’s BRRR and Vaneck’s Hodl have all recorded small net outflows of less than $4 million. Grayscale’s BTC became the only fund with a positive performance, with a net inflow of $5.5 million.

Consistently high levels of extraction from Bitcoin ETFs may be related to the recent BTC market price correction. The price of Virgin’s cryptocurrency has fallen 11.95% over the past month, with levels as low as $77,000. Institutional investors were very cautious during this period, according to the Bitcoin on-site ETF, which decreased by 21.70% to $89.89 billion. Data from Sosovalue.

Ethereum ETF lost $190 million in withdrawal

The Ethereum ETFS market has experienced similar investor sentiment amid the struggles of Bitcoin ETFs, as the net outflow of $189.9 million last week. This development marks a third consecutive week of withdrawals, which will bring net outflows to $645.08 million in the period. Similar to its Bitcoin peers, BlackRock’s Etha experienced its biggest withdrawal of the past week, worth $63.3 million. At the time of writing, the total cumulative inflows entering the Ethereum ETF market was US$2.52 billion and the total net assets were US$6.72 billion, or 2.90% of the ETH market capitalization. Meanwhile, Ethereum continues to trade at $1,924, reflecting a 0.73% increase in the past 24 hours. Bitcoin, on the other hand, has a value of $84,009, and its daily chart has not changed significantly.