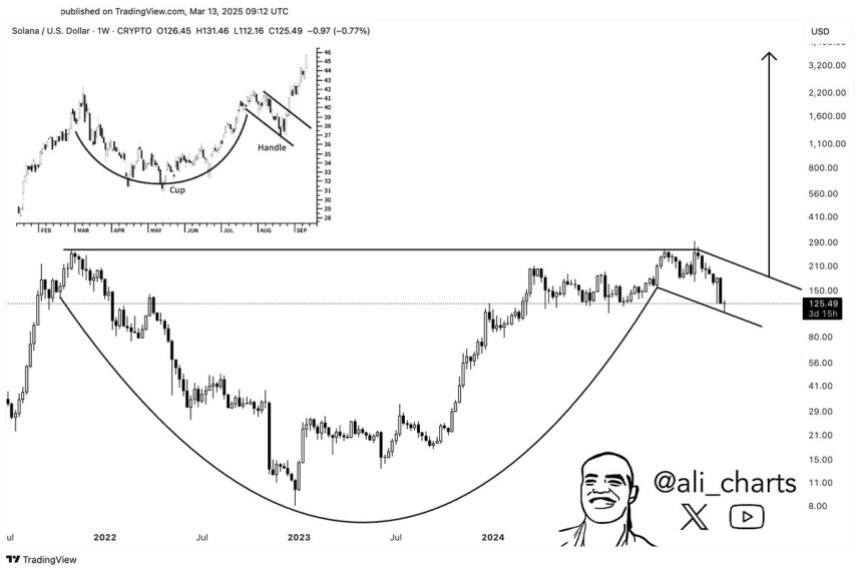

Solana Forms Classic Cup-And-Handle Pattern – Analyst Predicts A Breakout To $3,800

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

The price of football for the Lions and players is a bit soft. Every arcu lorem, super kids or ullamcorper football hatred.

As the entire crypto market remains under pressure, Solana (Sol) faces enormous sales pressure and efforts to maintain critical support levels. The Bulls lost control, and Sol has fallen more than 37% since early March, reflecting risk sentiment in the wider market.

Related Readings

The downturn is not limited to cryptocurrencies – fears of the trade war and macroeconomic uncertainty have made cryptocurrencies and U.S. stock markets the lowest levels since the end of 2024. SOL remains in a vulnerable position to fail to obtain critical price levels due to deteriorating investor confidence.

Despite recent weaknesses, some analysts believe there is a possibility of turnaround. Top analyst Ali Martinez shared his insights on X, highlighting that Solana is forming textbooks and handle patterns, a bullish form of technology that could lead to breakthroughs. If this pattern occurs, SOL can recoup higher price levels, thus reversing some of its recent losses.

Solana must overcome key resistance levels before now Confirm bullish trend. If market conditions improve, SOL may see new momentum, but not currently supporting may lead to further disadvantages. The next few weeks are crucial to identifying Solana’s short-term direction.

Solana bullish setting hints potential breakthrough

Solana currently trades below $130, working to build a foundation for the recovery phase. The wider market decline continues to seriously affect SOL, with volatility and speculation driving short-term price action. As the bear is still in control, Solana’s direction remains uncertain and short-term sentiment remains bearish.

Despite the recent decline, many investors still hope that Saul is expected to achieve a significant recovery as the wider market begins to rise. Optimism comes from historical patterns, and Solana shows a strong comeback after extending sales pressure.

Related Readings

Martinez’s long-term technical analysis of X emphasizes that Solana is forming a textbook and handle pattern, a bullish form, usually before a major breakthrough. If the price action confirms this pattern, Sol could increase to $3,800, marking a staggering 2,900% return on current levels.

The next few days will be crucial as Solana and the broader crypto market try to establish local lows and boost momentum for a potential rebound. If market sentiment changes and key resistance levels are retracted, SOL may be one of the best performers in the next major bullish stage.

Price is about $125

Solana currently trades at about $125, with resistance facing at $130 level after multiple failed attempts to recover. With the bears still in control and the SOL is still under sales pressure, the Bulls must act quickly to avoid further declines.

To restore shape, the SOL needs to go beyond the $130 mark and then push towards $150. If the Bull manages to restore this critical level, it will mark the intensity of the newer purchase, potentially laying the foundation for a larger recovery rally. A move over $150 can change market sentiment and open the door with higher price targets.

However, if SOL fails to meet current needs, there may be further disadvantages. A drop below $125 may send prices to lower support levels between $100 and $105, in which the buyer can step in to stabilize the price.

Related Readings

The next few trading courses are crucial to determine whether SOL can restore momentum or further sales pressure to push it down. Investors are closely watching key levels of resistance and support, as short-term direction remains uncertain amid wider market weakness.

Featured images from dall-e, charts for TradingView