Is Bitcoin Peak In? This Data Suggests Otherwise, Analytics Firm Says

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

The price of football for the Lions and players is a bit soft. Every arcu lorem, super kids or ullamcorper football hatred.

An analytics company has explained how data related to Stablecoins hints at the top of the Bitcoin market.

Stablecoins recently saw their market cap hit new highs

In the new postal On X, market intelligence platform Intotheblock discusses the trend of the combined Stablecoin market cap. “Stable“Refers to cryptocurrency that fixes Fiat currency (the US dollar is the most popular choice).

Often, investors take advantage of these assets when they want to avoid volatility associated with other coins, such as Bitcoin. However, traders who invest in stablecoins usually do this because they plan to risk (return) into the turbulent aspects of the industry.

Related Readings

Therefore, the supply of these fiasco tokens is often considered as available “dry powder” for Bitcoin and other cryptocurrencies. Given that Mas is located in the industry, their market value is worth paying attention to.

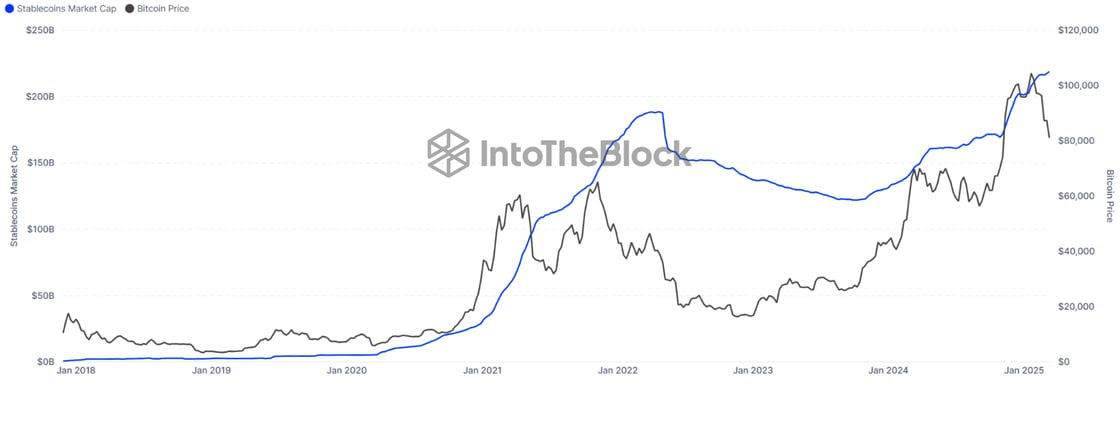

Here is a chart shared by analytics companies that show the trend of Stablecoin’s market cap over the past few years:

As shown in the above chart, Stablecoins’ market cap has been on the rise lately and has explored a new all-time high (ATHS). After the latest extension to this growth, the indicator reached as high as $219 billion.

To see things, Ethereum (ETH), the industry’s second largest asset, has a market capitalization of less than $233 billion. As a result, the Mass is less than $14 billion away from the hotel.

Intotheblock points out interesting patterns related to this metric. In the chart, it can be seen that the last cycle of the indicator is the highest cycle of $187 billion in April 2022. Obviously, the peak of the market cap of Horseable is consistent with the beginning of the beginning. Bear market.

“Historically, Stablecoin supply peaks have been consistent with cycle highs.” So far, indicators have continued to rise despite the decline in asset prices. If previous trends are to continue, this may indicate that Bitcoin and other coins have not entered a bear market yet.

In other words, the latest market conditions are not entirely optimistic. The most positive happens whenever BTC and Stablecoins have increased market cap. In such a period, the net amount New capital inflows Enter the industry.

Related Readings

However, for the moment, stablecoins have been rising, while Bitcoin and others have fallen. This may mean that a rotation of capital has occurred, rather than a fresh inflow.

A similar pattern emerged during the mid-2021 correction period, but the market was able to find its ground and the rally took place in the second half. Now, it remains to be seen whether something similar will happen to Bitcoin this time, or the market will be carried out in the 2022 way.

Bitcoin Price

At the time of writing, Bitcoin’s transactions were around $84,700, down more than 4% over the past seven days.

Featured images from dall-e, intotheblock.com, charts from tradingview.com